# Path-dependence problem with EIP-1559 and a possible solution to this problem

[](https://hackmd.io/c6kyRNMuTnKf_SlolmevRg)

[](https://github.com/mtefagh/fee/blob/master/LICENSE)

alidarvishi14@gmail.com

with help from https://github.com/barnabemonnot/abm1559

## Introduction

[EIP 1559](https://eips.ethereum.org/EIPS/eip-1559) is an upgrade to the economic model of Ethereum gas fee. Proposed by Vitalik Buterin in his [Blockchain Resource Pricing](https://github.com/ethereum/research/blob/master/papers/pricing/ethpricing.pdf) paper, this mechanism is going to replace the first-price auction model governing the current fee market for transaction inclusion.

## The basefee and EIP-1559

As discussed in EIP-1559, users have to pay a basefee that will be burned for each transaction. Basefee is updated with a multiplicative rule derived from the size of the last block. If the last block size is more than the target size, basefee will increase, and if the last block is not full enough, basefee will decrease.

In this proposal basefee is updated according to the following formula:

$$delta=gas\ used-target\ gas\ used$$

$$new\ basefee=basefee+basefee\times\ \frac{delta}{target\ gas\ used}\times\frac{1}{basefee\ max\ change\ denominator}$$

Here we declare and proof a statement:

So assuming that the cumulative deviation of the sum of gas cost from the sum of target gas cost is bounded (has a finite upper bound which can be arbitrary large enough), then gas price converges to zero unless the gas used in each block converges to the constant function equal to the target gas (which will never happen in reality). Therefore for a large enough sequence of blocks, we would expect that difference between the sum of gas used and the sum of the gas target is going to grow.

In this part we are gathering data to show that this has happened after the London upgrade.

``` python

# importing required libraries

from bs4 import BeautifulSoup

import cloudscraper

import time

import pandas as pd

from matplotlib import pyplot as plt

# declaring parameters

scraper = cloudscraper.create_scraper()

url= "https://etherscan.io/blocks?ps=100&p="

first_block = 12_965_000

```

``` python

# getting data

df = pd.DataFrame()

for i in range(100):

r = scraper.get(url+str(i+1))

soup = BeautifulSoup(r.content, 'html.parser')

new_table = soup.select('td:nth-child(1) , td:nth-child(7) , td:nth-child(8)')

new_blocks = [int(new_table[3*i].text) for i in range(100)]

new_gasused = [int(new_table[3*i+1].text.split()[0].replace(',','')) for i in range(100)]

new_gaslimit = [int(new_table[3*i+2].text.replace(',','')) for i in range(100)]

new_dict = {'block':new_blocks,'gas_used':new_gasused,'gas_limit':new_gaslimit}

df=df.append(pd.DataFrame(new_dict), ignore_index=True)

if(df.block.min()<first_block):

break

time.sleep(0.1)

# data cleaning

df = df[df.block>=first_block].sort_values('block').set_index('block')

new_df = df.cumsum()

new_df['target_gas'] = new_df.gas_limit/2

```

``` python

plt.figure(figsize=(12,8))

new_df.gas_used.plot(label='cumulative gas used');

new_df.target_gas.plot(label='cumulative target gas');

plt.legend();

plt.figure(figsize=(12,8))

(new_df.gas_used-new_df.target_gas).plot(label='cumulative difference of gas used and target gas');

plt.legend();

```

Finally, we compare the histogram of gas used in each block before and after the London hard fork. As one can see, the target which is the full block size is achieved most of the time pre-fork. However as a result of the predicted oscillations, we observe a bimodal density post-fork where the target which is the half block size is rarely achieved.

## The simulation of permanent loss

We will simulate the basefee parameter in EIP-1559 and show in a world where only 5% of users are rational enough to optimize for paying less fee if possible, the basefee will eventually decrease to 0.

Later, we are going to show that an additive equation for updating basefee would solve this problem.

First, we implement a class for transactions. In this class we store important data. Users specify these parameters:

* The *gas premium*, i.e., the "tip" to the block producers.

* The *fee cap*, i.e., the highest gas price they are willing to pay.

* The *waiting limit*, i.e., the maximum number of blocks they are willing to wait to get a lower basefee.

``` python

import secrets

%config InlineBackend.figure_format = 'svg'

class Transaction:

def __init__(self, gas_premium, fee_cap, gas_used,waiting_limit):

self.gas_premium = gas_premium

self.fee_cap = fee_cap

self.gas_used = gas_used

self.tx_hash = secrets.token_bytes(8)

self.waiting_limit = waiting_limit

self.sent_to_memepool = False

def __lt__(self, other):

return self.gas_premium < other.gas_premium

```

Then, we import some libraries.

``` python

import pandas as pd

# cadCAD configuration modules

from cadCAD.configuration.utils import config_sim

from cadCAD.configuration import Experiment

# cadCAD simulation engine modules

from cadCAD.engine import ExecutionMode, ExecutionContext

from cadCAD.engine import Executor

```

We declare some constants.

``` python

constants = {

"BASEFEE_MAX_CHANGE_DENOMINATOR": 8,

"TARGET_GAS_USED": 12500000,

"MAX_GAS_EIP1559": 25000000,

"INITIAL_BASEFEE": 1 * (10 ** 9),

}

```

Here, we declare a demand function that generates new transactions for each block. Gas premium and fee cap are generated randomly.

In this simulation, we assume that only 5% of the transactions are not an emergency and can wait for at most 10 blocks, and the other transactions will be sent immediately after creation.

We can simply see that a rational choice for a user is that if the user thinks basefee will increase, he should send the transaction immediately, and if basefee is going to decrease, he should wait for at least one block. If sent orders fill 50% or more of the block, patient users will wait.

``` python

from random import randint

def update_demand_variable(params, step, sL, s, _input):

# dict of transactions as a demand

demand = s["demand"]

latest_block = s["latest_block"]

# adding new transactions

for i in range(500):

gas_premium = randint(1, 10) * (10 ** 8)

fee_cap = gas_premium + randint(1, 10) * (10 ** 9)

waiting_limit = 10*(randint(1, 100)<=5)

tx = Transaction(

gas_premium = gas_premium,

gas_used = 25000,

fee_cap = fee_cap,

waiting_limit = waiting_limit

)

demand[tx.tx_hash] = tx

for tx in latest_block.txs:

demand.pop(tx.tx_hash)

# estimation of next block size

basefee = s["basefee"]

miner_gains = 0

txs_included = []

for tx_hash, tx in demand.items():

if not is_valid(tx, basefee):

continue

if not tx.sent_to_memepool:

continue

gas_price = min([basefee + tx.gas_premium, tx.fee_cap])

miner_gains += (gas_price - basefee) * tx.gas_used

txs_included += [tx]

gas_used = sum([tx.gas_used for tx in txs_included])

is_full = gas_used > 0.5*constants["TARGET_GAS_USED"]

# send transactions and update waiting limit

for tx_hash, tx in demand.items():

if tx.waiting_limit == 0 or is_full:

tx.sent_to_memepool = True

if tx.waiting_limit>0:

tx.waiting_limit = tx.waiting_limit-1

return ("demand", demand)

```

Declaring a block and a function to check the validity of transactions.

``` python

class Block():

def __init__(self, txs):

self.txs = txs

def is_valid(tx, basefee):

return tx.fee_cap >= basefee

```

This function is going to include valid transactions in the next block.

``` python

def include_valid_txs(params, step, sL, s):

demand = s["demand"]

basefee = s["basefee"]

miner_gains = 0

txs_included = []

for tx_hash, tx in demand.items():

# include valid transactions

if not is_valid(tx, basefee):

continue

# include sent transactions

if not tx.sent_to_memepool:

continue

gas_price = min([basefee + tx.gas_premium, tx.fee_cap])

miner_gains += (gas_price - basefee) * tx.gas_used

txs_included += [tx]

assert miner_gains >= 0

return ({ "block": Block(txs = txs_included) })

```

Update basefee after each block as mentioned in EIP-1559.

``` python

def update_basefee(params, step, sL, s, _input):

block = _input["block"]

basefee = s["basefee"]

gas_used = sum([tx.gas_used for tx in block.txs])

delta = gas_used - constants["TARGET_GAS_USED"]

new_basefee = basefee + basefee * delta / constants["TARGET_GAS_USED"] / constants["BASEFEE_MAX_CHANGE_DENOMINATOR"]

return ("basefee", new_basefee)

```

Save last block in results.

``` python

def record_latest_block(params, step, sL, s, _input):

block = _input["block"]

return ("latest_block", block)

```

Run simulation and save the results in a data frame.

``` python

%%capture

from cadCAD import configs

psub = [{

"policies": {},

"variables": {

"demand": update_demand_variable # step 1

}

}, {

"policies": {

"action": include_valid_txs # step 2

},

"variables": {

"basefee": update_basefee, # step 3

"latest_block": record_latest_block

}

}]

initial_conditions = {

"basefee": constants['INITIAL_BASEFEE'],

"demand": {},

"latest_block": Block(txs=[])

}

del configs[:]

simulation_parameters = config_sim({

'T': range(10000),

'N': 1

})

experiment = Experiment()

experiment.append_configs(

initial_state = initial_conditions,

partial_state_update_blocks = psub,

sim_configs = simulation_parameters

)

exec_context = ExecutionContext()

simulation = Executor(exec_context=exec_context, configs=configs)

raw_result, tensor, sessions = simulation.execute()

df = pd.DataFrame(raw_result)

```

In this plot we show basefee as time passes. We can see basefee is not stable and decreases with time.

``` python

import seaborn as sns

import matplotlib.pyplot as plt

sns.set(style="whitegrid")

df[50:][df.substep == 1].plot('timestep', ['basefee'])

```

<img src='https://raw.githubusercontent.com/mtefagh/fee/master/README_files/figure-markdown_github/basefee-1559.svg'>

## An unintentional uncoordinated attack

Now assume a percentage of users with a considerable number of transactions (like the users of a wallet client designed to have this optimization as a built-in feature) want to pay less basefee, even though, they do not intend to manipulate it. They can simply do so by sending all of their transactions in a more-than-target full block and not sending any transactions in blocks with a size considerably below the target size. This action would make basefee decrease over time and eventually converge to zero. We have to incentivize such honest but rational users to smoothly send their transactions instead of sending them in bulk.

## A possible solution to this attack

The problem of sending a large number of transactions is equivalent to the problem of liquidating a large portfolio as discussed in ["Optimal Execution of Portfolio Transactions"](https://pdfs.semanticscholar.org/3d2d/773983c5201b58586af463f045befae5bbf2.pdf). It is shown in this paper that with an additive cost function, the trader's optimal execution of transaction strategy is to distribute the transactions across time. Therefore, if we update basefee with an additive rule, users are incentivised to gradually send transactions during a long period of time and spread them across different blocks which in turn helps to avoid network congestion.

In this section, we change `update_basefee` function with an additive fucntion which is convex in basefee and gas_used jointly.

``` python

def update_basefee(params, step, sL, s, _input):

block = _input["block"]

basefee = s["basefee"]

gas_used = sum([tx.gas_used for tx in block.txs])

delta = gas_used - constants["TARGET_GAS_USED"]

new_basefee = basefee + delta / constants["TARGET_GAS_USED"] / constants["BASEFEE_MAX_CHANGE_DENOMINATOR"]

return ("basefee", new_basefee)

```

Run simulation with the new update rule.

``` python

%%capture

from cadCAD import configs

psub = [{

"policies": {},

"variables": {

"demand": update_demand_variable # step 1

}

}, {

"policies": {

"action": include_valid_txs # step 2

},

"variables": {

"basefee": update_basefee, # step 3

"latest_block": record_latest_block

}

}]

initial_conditions = {

"basefee": constants['INITIAL_BASEFEE'],

"demand": {},

"latest_block": Block(txs=[])

}

del configs[:]

simulation_parameters = config_sim({

'T': range(10000),

'N': 1

})

experiment = Experiment()

experiment.append_configs(

initial_state = initial_conditions,

partial_state_update_blocks = psub,

sim_configs = simulation_parameters

)

exec_context = ExecutionContext()

simulation = Executor(exec_context=exec_context, configs=configs)

raw_result, tensor, sessions = simulation.execute();

df2 = pd.DataFrame(raw_result)

```

And finally plot the two plots together.

``` python

df.merge(df2,on=['timestep','subset','simulation','run','substep'],suffixes=('_multiplicative','_additive'))[df.substep == 1][50:].plot('timestep', ['basefee_multiplicative','basefee_additive'])

```

<img src="https://raw.githubusercontent.com/mtefagh/fee/master/README_files/figure-markdown_github/basefee-3416.svg">

## Relation to constant function market makers

This is interestingly related to the concept of path independence in automated market makers (see section 2.3 in [here](https://arxiv.org/abs/2003.10001)). Consider a hypothetical automated market maker as a protocol-level price oracle for the trading pair GAS/ETH whose reserve of gas and ether after the n-th trade are $g_n$ and $f_n \times g_n$, respectively. Moreover, let $g_{n+1} = g_n + M/2 - w_n$, that is, $g +=$ excess. It can be proved that, the limit of $f_n$ as the initial reserve $g_0$ goes to infinity is given by:

- the Almgren-Chriss [additive](https://ethresear.ch/t/draft-position-paper-on-resource-pricing/2838/24) formula in the case of constant sum market maker,

- and Bertsimas-Lo [exponential](https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2034178) formula in the case of constant product market maker.

This observation immediately implies that both of these update rules (and any other one based on another constant function market maker) are path-independent. Ironically, this is exactly why we have arrived at these formulas in the first place when attempting to solve a simple instance of path dependence attacks.

## An improvement for the premium

Even with EIP-1559, the problem of overpayment in the first price auction (winner's curse) remains relevant for the premium. A very simple solution, in terms of [Kolmogorov complexity](https://github.com/ethereum/research/blob/master/papers/pricing/ethpricing.pdf), is to use a sliding median which is more stable and predictable than the first price auction.

It is well-known that median is a robust statistic but to show this in practice, we first download the gas fee data from the Ethereum blockchain.

``` python

import pandas as pd

import numpy as np

from web3 import Web3, HTTPProvider

web3 = Web3(HTTPProvider('http://localhost:8545'))

class CleanTx():

"""transaction object / methods for pandas"""

def __init__(self, tx_obj):

self.hash = tx_obj.hash

self.block_mined = tx_obj.blockNumber

self.gas_price = tx_obj['gasPrice']

self.round_gp_10gwei()

def to_dataframe(self):

data = {self.hash: {'block_mined':self.block_mined, 'gas_price':self.gas_price, 'round_gp_10gwei':self.gp_10gwei}}

return pd.DataFrame.from_dict(data, orient='index')

def round_gp_10gwei(self):

"""Rounds the gas price to gwei"""

gp = self.gas_price/1e8

if gp >= 1 and gp < 10:

gp = np.floor(gp)

elif gp >= 10:

gp = gp/10

gp = np.floor(gp)

gp = gp*10

else:

gp = 0

self.gp_10gwei = gp

block_df = pd.DataFrame()

for block in range(5000000, 5000100, 1):

block_obj = web3.eth.getBlock(block, True)

for transaction in block_obj.transactions:

clean_tx = CleanTx(transaction)

block_df = block_df.append(clean_tx.to_dataframe(), ignore_index = False)

block_df.to_csv('tx.csv', sep='\t', index=False)

```

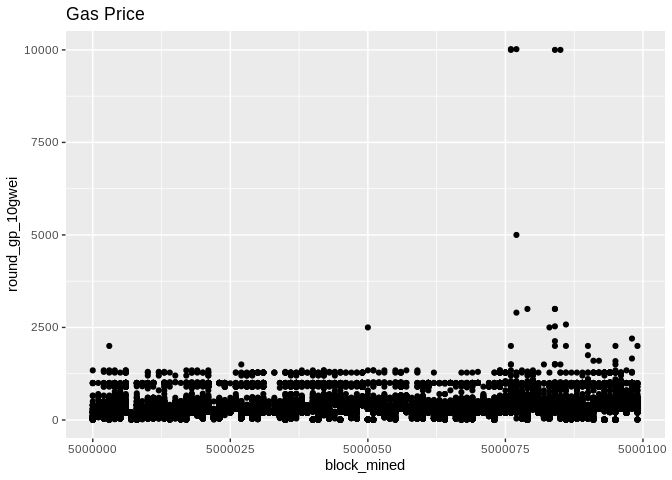

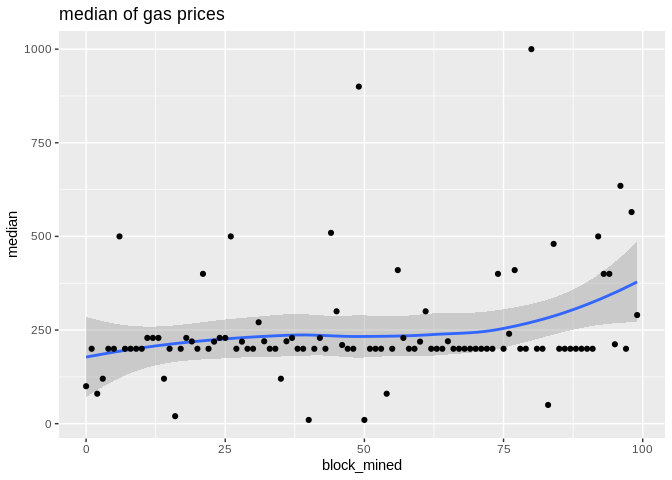

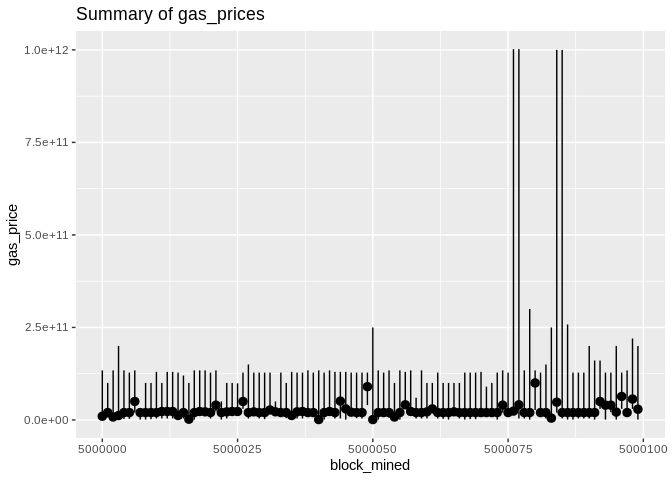

Before we begin, some plots from the raw data (gas price will be normalized later):

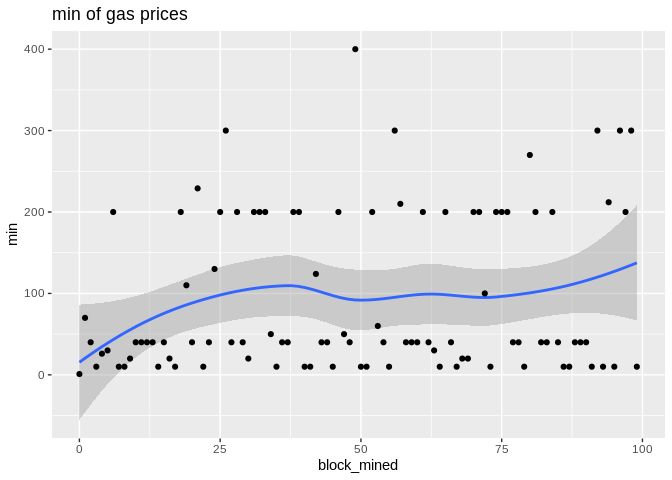

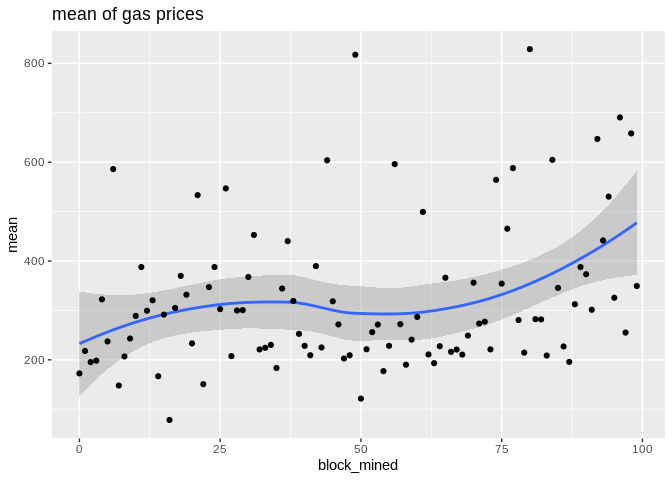

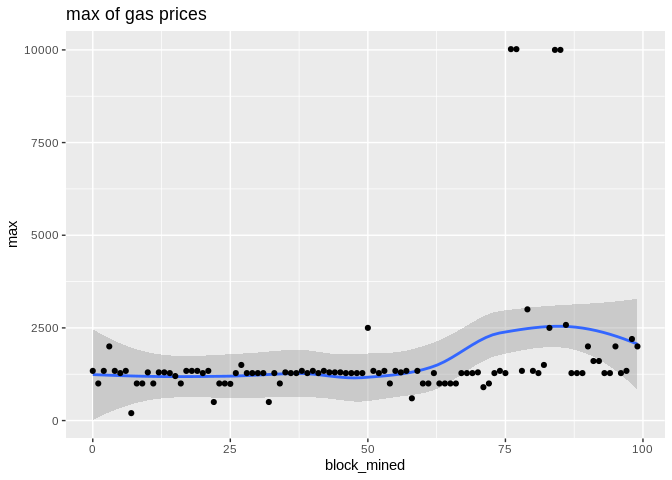

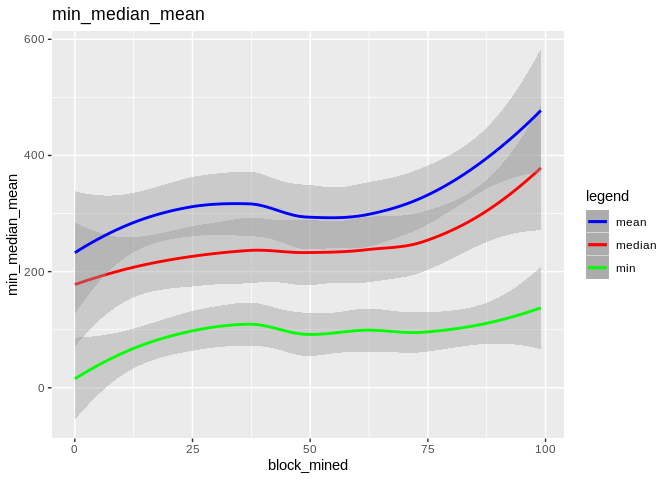

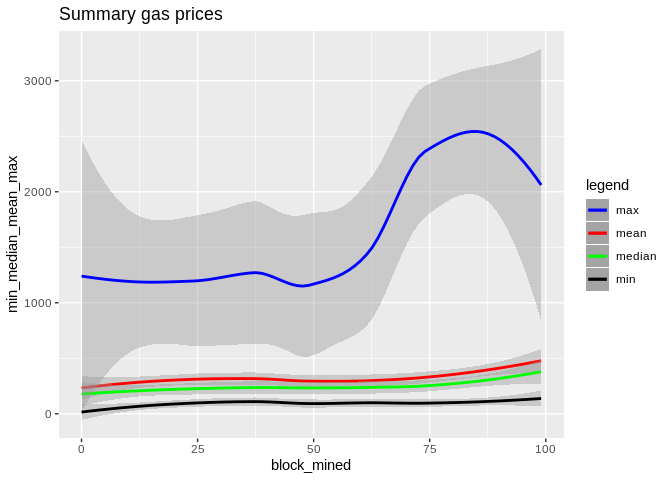

Now, we throw out the `round_gp_10gpwei` column and divide the `gas_price` by 10<sup>8</sup>. Then we group our gas prices data by the blocks and we compute a summary (`min,median,mean,max`). The blocks are consecutive and their numbers are made to start from zero in order to have a bit more visually appealing plots!

Here are some plots. `geom_smooth()` uses by default the Local Regression (`loess` for short):

*Loess Regression is the most common method used to smoothen a volatile time series. It is a non-parametric methods where least squares regression is performed in localized subsets, which makes it a suitable candidate for smoothing any numerical vector.*

To show the effectiveness/stability of median over other methods, we plot the data points along with the prediction curve of each (`min,median,mean,max`). Notice the scale of `max` is quite different therefore, although it seems stable its prediction curve has much higher errors than median. See the last two plots to compare the scale of their fluctutations.

Here is the max, median, and min statistics summary plot:

Here is how the mean and median and minimum curves compare:

Here is how all curves compare:

<!-- Let us see how the method `gam` errors compare in each case: -->

<!-- Here you will first need to normalized each column to make this meaningful -->

<!-- ```{r} -->

<!-- gam.med <- gam(min_gas_price~block_mined,data=tx.summary) -->

<!-- gam.med$deviance -->

<!-- ``` -->

## Summary and further resources

Designed an attack for EIP-1559 and proposed an alternative transaction fee pricing protocol based on the Almgren–Chriss framework and median price auctions.

- https://ethresear.ch/t/path-dependence-of-eip-1559-and-the-simulation-of-the-resulting-permanent-loss/8964

- https://github.com/ethereum/EIPs/blob/master/EIPS/eip-3416.md

Sign in with Wallet

Sign in with Wallet