---

title: "MSL310 - Financial Institutions and Markets"

subtitle: "Group Assignment Part A"

date: "February 04, 2022"

geometry: margin=2cm

linestretch: "2"

---

<!-- <style>

img {

filter: grayscale(100%);

}

img.colored {

filter: grayscale(0%);

}

table{

width:100% ;

}

</style> -->

<center ><img src= "https://upload.wikimedia.org/wikipedia/sa/6/66/IIT_Delhi_logo.png" width="200" height="200" class="colored" /> </center>

<div style="page-break-after: always"></div>

## Table of Contents

- [Authors](#authors)

- [Documentation](#documentation)

- [Documentation Statistics](#documentation-statistics)

- [Problem Statement](#problem-statement)

- [Background](#background)

- [Data](#data)

- [Methodology](#methodology)

- [Analysis](#analysis)

- [Conclusion](#conclusion)

- [References](#references)

## Authors

| Name | Entry No. | Email ID |

|---------------------|-------------|--------------------------------|

|Ankit Kumar Meena|2019EE30555|ee3190555@iitd.ac.in|

|Bhargav Sidram Halipeth|2019EE30562|ee3190562@iitd.ac.in|

|Bhushan Singh|2019ME20875|me2190875@iitd.ac.in|

|Chandresh Yadav|2019ME20876|me2190876@iitd.ac.in|

| Vijay kumar | 2019EE30606 |ee3190606@iitd.ac.in|

[Back to Table of Contents](#table-of-contents)

## Submission details

| | |

|--------------------------------------|-------------------------------------------------------------|

| Contact for correction/clarification |Bhargav Sidram: +91 9379201441 |

| Submitted to | Prof. Neeru Chaudhry, Instructor, MSL310- Financial Markets And Institutions |

| Date of submission | 04 February, 2022 |

## Documentation Statistics

|Word count |942|

|--------------------------------------|-----|

|Average number of words per sentence |14 |

|Total number of sentences |65 |

|Total number of characters |5,824|

[Back to Table of Contents](#table-of-contents)

<div style="page-break-after: always;"></div>

## Problem Statement

### How did China’s property giant collapse and what are its impacts on the world as well as on the Indian economy?

## Background

Evergrande group was originally founded as the Hengda group by Chinese businessman Hui Ka Yan in 1996 in Guangzhou, Southern China. The company’s billionaire founder is a member of the Chinese People’s Political Consultative Conference, an elite group of politically well-connected advisers. Evergrande is a huge real estate empire with millions of apartments in various cities in China. In terms of revenue, it had a revenue of nearly US$ 78 billion in the year 2020 and an active presence in more than 200 cities in China undertaking hundreds of projects.

The company has built so many buildings that there are not enough people who can afford to buy those apartments or houses. This situation has caused it to near default on loans many times but has managed to avert it. Many creditors gave loans to Evergrande as it grew and expanded into new businesses but eventually Evergrande ended up in more debt than it could repay.

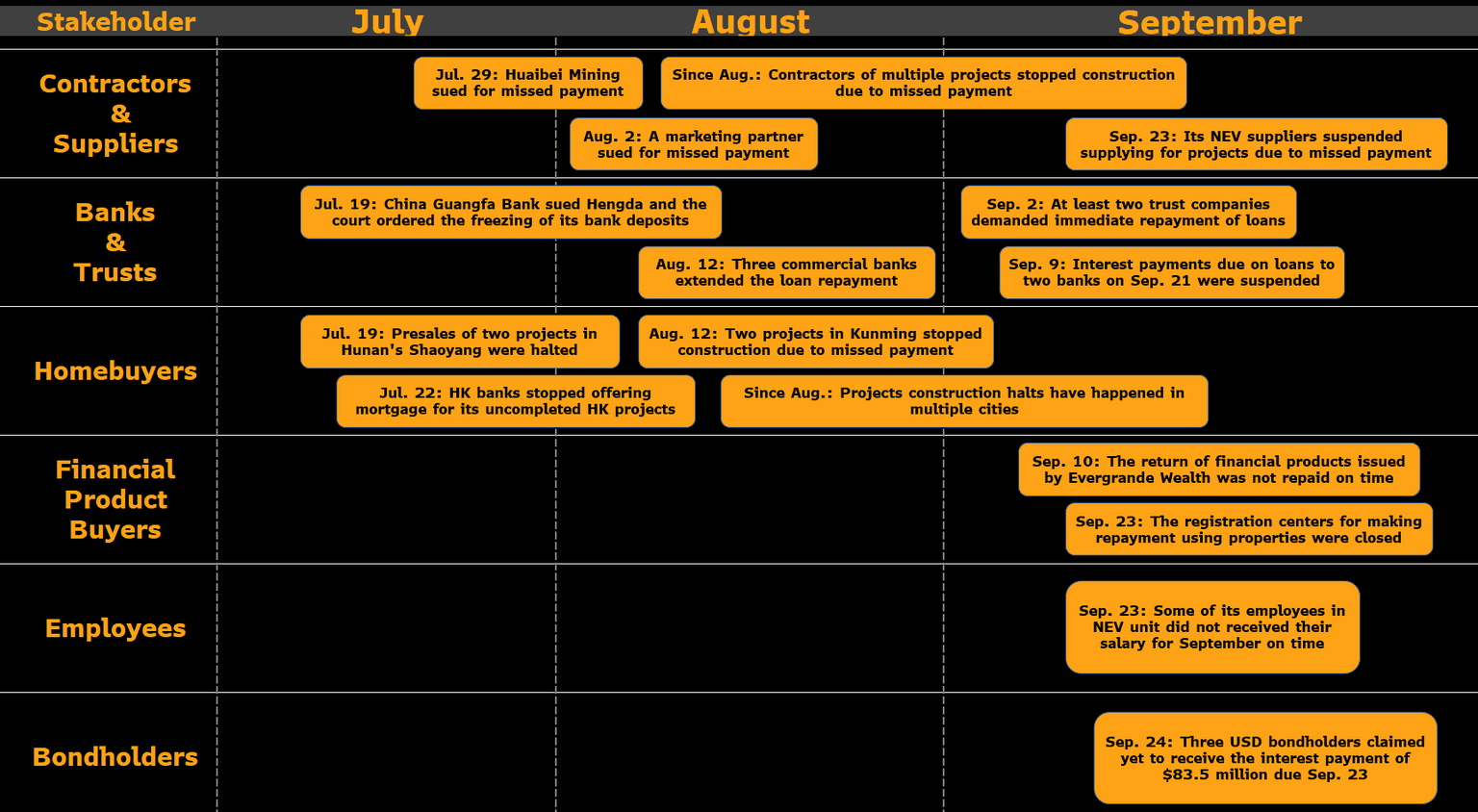

There are many lawsuits from homebuyers who have buildings left in the middle of the construction. The reckless borrowing habits of Evergrande have forced it to sell parts of its business empire which is also a seemingly failing effort. Additionally, the fall in demand for houses and the slowing rate of sales has caused an alarming situation for the economy.

<div style="page-break-after: always;"></div>

## Data

The sheer amount of loans taken by the company and the number of incomplete projects which have left many people with no homes or partially built homes are seen in the numbers in various reports.

* In 280 cities of China, Evergrande is undertaking nearly 1300 projects.

* Every 4’th apartment of china built by Evergrande there were 120,000 people employed by Evergrande and working with 38 lakh contractors

* Revenue generated by the company in the financial year 2020-21 was 574,446 HKD.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/IKVVW7XKERNAZO7CX6IVGD5UNI.jpg)

[reference link](https://www.reuters.com/world/china/china-evergrande-bondholders-limbo-over-debt-resolution-2021-09-24/)

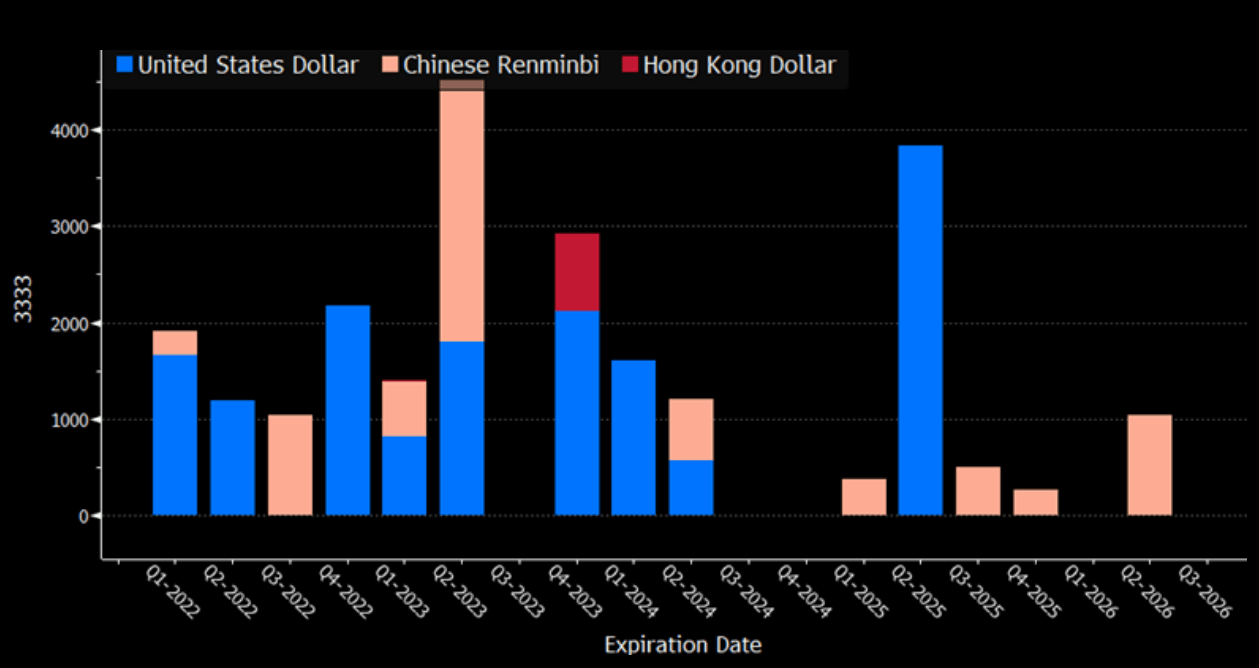

* As of Nov '21, the total liabilities of the company were US$300 bn; this is the biggest debt of any property company in the world. The loans were taken from 121 banks and more than 170 financial firms.

[reference link](https://news.yahoo.com/oaktree-seizes-assets-aoyuan-changes-013747160.html)

* And then the company started to raise public funds on higher return rates because by that time it was a well-trusted company and the offers were attractive so people started investing in it

When the company was performing well instead of repaying its loans it went for diversification as in 2010 company bought a football club and started a football school of the cost US$ 2bn also it entered into the business of retail, EV, and FMCG. On the other hand, the Head promoter of the company, Xu Jiayin, was thinking about his profit. For the financial year, 2019-20 and 2020-21 net profits of the company was Rs 19000 crore and the CEO generated Rs 61000 crore dividend to the shareholders. From this, as the biggest individual shareholder, he got Rs 35000 crore in his pocket. There are other companies with the same kind of situation like HNA group with a debt of US$170 bn and filed for bankruptcy in 2021.

<div style="page-break-after: always;"></div>

## Methodology

In early 2018 the Chinese Central Bank stated in its financial instability report that companies like Evergrande can be quite dangerous to the economy of the country. Evergrande has large numbers of employees, contractors, and businesses that owe money to developers. In recent weeks contagion, fears have intensified as 128 banking institutions and 121 non-banking institutions are exposed to Evergrande.

[reference link](https://www.bloomberg.com/professional/blog/evergrandes-crisis-explained-in-4-bi-charts/)

The S&P 500 fell 2.24%, its worst day since May and the VIX, an index that measures S&P volatility, hit 26.7%, its highest jump since May. There are also concerns around the impact on commodities if demand wanes due to slowing construction, with metal prices taking a hit during trading on Monday.

[reference link](https://www.bloomberg.com/professional/blog/evergrandes-crisis-explained-in-4-bi-charts/)

In mid 2018 the Chinese National Bank expressed in its monetary flimsiness report that organisations like Evergrande can be very risky to the economy of the country. Evergrande has huge quantities of workers for hire and organisations which owe cash to engineers.

Off late, contagion fears have increased as 128 financial organisations and 121 non-banking establishments are presented to Evergrande.The S&P 500 fell 2.24%, its most awful day since May and the VIX, a record which estimates S&P unpredictability, hit 26.7%, its most noteworthy leap since May. There are likewise worries around the effect on items, assuming that requests wind down because of easing back development, with metal costs enduring a shot during exchanging on Monday.

Despite Evergrande’s efforts to lift confidence, with its chairman promising to fulfil responsibilities, the markets are now looking to Beijing to stem the contagion.

<div style="page-break-after: always;"></div>

## Conclusion

Due to a lack of transparency, it is difficult to comment on the actual happenings in China; nonetheless, it is believed that Evergrande will not collapse overnight, and global markets are looking for any policy intervention by the government to limit the domino effect. The Chinese Govt. has to take controlled measures to bail out the debt-trapped company to minimize its impact on the Chinese as well as the world economy.

## References

Bloomberg News. (2022, January 27). China Weighs Breaking Up Evergrande to Contain Property Crisis. Bloomberg. Retrieved February 4, 2022. [reference link](https://www.bloomberg.com/news/articles/2022-01-27/china-is-said-to-weigh-breaking-up-evergrande-to-contain-crisis)

Stevenson, A., & Li, C. (2021, December 9). What to Know About China Evergrande, the Troubled Property Giant. The New York Times. Retrieved February 3, 2022. [reference link](https://www.nytimes.com/article/evergrande-debt-crisis.html)

Bloomberg Intelligence. (2021, October 6). Evergrande’s crisis explained in 4 BI charts. Bloomberg Professional Services. Retrieved February 3, 2022. [reference link](https://www.bloomberg.com/professional/blog/evergrandes-crisis-explained-in-4-bi-charts/)

Charles, A., & Bracken, K. (2021, September 21). What is the Evergrande debt crisis and why does it matter for the global economy? World Economic Forum. Retrieved February 3, 2022. [reference link](https://www.weforum.org/agenda/2021/09/evergrande-debt-crisis-global-economy/)

Sign in with Wallet

Sign in with Wallet