---

title: Demo_11

tags: MF

---

# Fraudulent Firms Detection via Binary Classification in Audit Risk Scores

#### keywords: *fraud detection*, *binary classification*, *audit risk*, *logistic regression*, *random forest*, *SVM*, *KNN*, *neural network*

:::info

陽交大資財系機器學習與金融科技期末報告,由許智超,李亦涵,鄧惠文共同編輯。最後更新時間2021/11/22。

:::

---

## 1. Motivations

I am interested in building a ***classification model*** in detecting ***fraudulent firms***, to help auditors reduce the ***audit risk***.

---

## 2. Data Visualization (EDA)

有關各領域(sectors)的公司數量:

||||

|:---:|:---:|:---:|

|灌溉Irrigation (114)|公共衛生Public Health (77)|建築與道路Buildings and Roads (82)|

|森林Forest (70)|一般企業Corporate (47)|畜牧業Animal Husbandry (95)|

|傳播Communication (1)|電子Electrical (4)|土地Land (5)|

|科學科技業Science and Technology (3)|旅遊業Tourism (1)|漁業Fisheries (41)|

|工業Industries (37)|農業Agriculture (200)|

---

### 名詞解釋

- **財報審計**:

1. 財報是否有恰當地編制?

2. 公允反應財務信息?

- **審計風險(audit risk)**: 審計師發表不恰當的審計意見的風險

$$審計風險(audit\ risk) = $$

$$=重大錯報風險(material\ misstatement\ risk) \times 檢查風險(detection\ risk)$$

$$= (固有風險(inherent\ risk) \times 控制風險(control\ risk)) \times 檢查風險(detection\ risk)$$

---

- **重大錯報風險(material misstatement risk)**:

1. 與審計師無關

2. 固有風險 $\times$ 控制風險

- **固有風險(inherent risk)**:

> 例如:會計人員將200元記錄成200萬元的風險。

- **控制風險(control risk)**:

> 例如:會計人員將200元記錄成200萬元了,而會計主管也未能即時發現並糾正的風險。

- **檢查風險(detection risk)**:

1. 只與審計師相關

2. 不可能將發生率降至0

> 例如: 會計人員將200元記錄成200萬元了,而會計主管也未能即時發現並糾正,然後審計人員測試時還是沒有發現的風險。

**條件機率!?**

---

### 變數說明

### 固有風險因子(Inherent Risk Factors)

|Variables|Columns|Descriptions|

|---|---|---|

|$x_A$|**PARA_A**|稽核(inspection)中的*計畫支出(planned expenditure)* 總額,與財報A(summary report A)之間,分歧(discrepancy)的總金額,單位是印度貨幣「盧比Rs」。我們代稱此為「A情況」|

|$p_A$|**Score_A**|上述分歧發生的機率值,此稱「分數A」|

|$risk_A$|**Risk_A**|風險分數A = A情況損失總額 $\times$ 機率值 = "PARA_A" $\times$ "Score_A"|

---

|Variables|Columns|Descriptions|

|---|---|---|

|$x_B$|**PARA_B**|稽核(inspection)中的*非計畫支出(unplanned expenditure)* 總額,與財報B(summary report B)之間,分歧(discrepancy)的總金額,單位是印度貨幣「盧比Rs」。我們代稱此為「B情況」|

|$p_B$|**Score_B**|上述分歧發生的機率值,此稱「分數B」|

|$risk_B$|**Risk_B**|風險分數B = B情況損失總額 $\times$ 機率值 = "PARA_B" $\times$ "Score_B"|

|<hr/>|<hr/>|

|$total_{AB}$|**TOTAL**|上述兩種分歧情況加總的總損失金額,也就是"PARA_A" $+$ "PARA_B"|

---

|Variables|Columns|Descriptions|

|---|---|---|

|$x_c$|**numbers**|歷史資料的分歧分數(historical discrepancy score)|

|$p_c$|**Risk_B.1**|對應上述歷史資料分歧分數,類似機率值/權重的東西|

|$risk_C$|**Risk_C**|風險分數C = 歷史分歧分數 $\times$ 對應權重 = "numbers" $\times$ "Risk_B.1"|

---

|Variables|Columns|Descriptions|

|---|---|---|

|$x_D$|**Money_Value**|過去的審計中,錯報(misstatements)的金額總額|

|$p_D$|**Score_MV**|對應上述歷史錯報金額總額,類似機率值/權重的東西|

|$risk_D$|**Risk_D**|風險分數D = 歷史錯報金額總額 $\times$ 對應權重 = "Money_Value" $\times$ "Score_MV"|

|<hr/>|<hr/>|

|$total_{in}$|**Inherent_Risk**|就是總固有風險分數|

---

### 控制風險因子(Control Risk Factors)

|Variables|Columns|Descriptions|

|---|---|---|

|$x_{SS}$|**Sector_score**|根據每筆資料所屬的部門(sector),使用一些分析程序計算出來的,該部門的歷史風險分數(historical risk score)|

---

|Variables|Columns|Descriptions|

|---|---|---|

|$x_E$|**District_Loss**|一個區域(district)在*近10年內(in the last 10 years)* 的歷史風險分數(historical risk score)

|$p_E$|**PROB**|對應上述某區域10年內歷史風險分數,類似機率值/權重的東西|

|$risk_E$|**RiSk_E**|風險分數E = 某區域10年內歷史風險分數 $\times$ 對應權重 = "District_Loss" $\times$ "PROB"|

---

|Variables|Columns|Descriptions|

|---|---|---|

|$x_F$|**History**|此公司*近10年內*的歷史損失(historical loss)的平均(average)|

|$p_F$|**Prob**|對應上述公司10年內的歷史損失平均,類似機率值/權重的東西|

|$risk_F$|**Risk_F**|風險分數F = 公司10年內的歷史損失平均 $\times$ 對應權重 = "History" $\times$ "Prob"|

|<hr/>|<hr/>|

|$total_{co}$|**CONTROL_RISK**|就是總控制風險分數|

---

### 檢查風險因子(Detection Risk Factors)

|Variables|Columns|Descriptions|

|---|---|---|

|$risk_{DR}$|**Detection_Risk**|就是檢查風險分數|

---

### 其他特徵(Other Features)

|Variables|Columns|Descriptions|

|---|---|---|

|$x_{loc}$|**LOCATION_ID**|每筆資料所屬城市/省份的唯一ID編號|

|$x_s$|**Score**|不明分數,資料來源論文並未敘明|

---

|Variables|Columns|Descriptions|

|---|---|---|

|$y_{score}$|**Audit_Risk**|使用一些分析程序計算出來的總風險分數(total risk score)|

|$y$|**Risk**|每筆資料是否為詐欺公司的二元類別變數。***This is the target feature!***|

---

### EDA部份

```python=

#匯入函式庫

import numpy as np

import pandas as pd

import matplotlib.pyplot as plt

#這一行魔法函式可以省略每次的plt.show(),直接顯示

%matplotlib inline

import seaborn as sns

import os

#因為我們沒有testing data,所以要切一份出來

#以下EDA將會進行於trainig data

from sklearn import model_selection

#圖片樣式美化

plt.style.use('dark_background')

```

```python=

#切換工作目錄

os.chdir("C:\\Users\\GL75\\OneDrive\\桌面\\機器學習與金融科技\\Project")

#讀入資料

data = pd.read_csv('audit_data.csv')

```

```python=

#觀察資料格式

#顯示所有的行,為了觀察各變數名稱,以及它們之間的關係

pd.options.display.max_columns = None

data.head() #展示頭5筆的資料

```

---

資料的樣子

---

```python=

#列出所有行的標題,也就是變數名稱

data.columns

```

---

### 資料前處理

重新命名

```python=

#有些變數名稱不太統一,我們稍微修正,統一大小寫格式

data.rename(columns = {'RiSk_E':'Risk_E', 'LOCATION_ID':'Location_ID', 'PARA_A': 'Para_A', 'PARA_B':'Para_B', 'TOTAL': 'Total', 'PROB': 'ProbA', 'Prob': 'ProbB', 'CONTROL_RISK': 'Control_Risk'}, inplace = True)

```

<br>刪除變數Total

```python=

#因為變數TOTAL其實就等於PARA_A+PARA_B,沒有額外貢獻資訊

#因此我們drop掉這個變數

data.drop(['Total'], axis = 1, inplace = True) #inplace = True可以直接就地修改

```

---

沒有缺失值

```python=

data.info()

#可以看到總共有776筆資料,全部變數都沒有缺失值(null value)

#除了"District_Loss", "History"以及目標變數"Risk"是整數型別(int32),"LOCATION_ID"是某種object以外

#其他所有變數都是浮點數型別(float64)

```

---

敘述統計量

```python=

#以下列出基本的敘述統計量(descriptive statistics)

data.describe()

```

---

刪除變數"Detection_Risk":

1. mean = Q1 = Q3 = 0.5

2. standard deviation = 0

全是0.5?!by nunique() ... indeed!

```python=

data['Detection_Risk'].nunique()

```

```python=

data.drop(['Detection_Risk'], axis = 1, inplace = True)

```

---

刪除變數"Location_ID":

1. Unknown Data type

2. Not helpful

```python=

data['Location_ID'].dtypes

```

```python=

data.drop(['Location_ID'], axis = 1, inplace = True)

```

---

相關係數

```python=

#首先是熱力圖heatmap

plt.figure(figsize = (20, 20))

sns.heatmap(data.corr(), annot = True, cmap = 'coolwarm')

plt.savefig("heatmap.png")

```

---

1. "Sector_score"跟其他變數之間都呈現負相關。

> 特別是"Score_A", "Score_MV", "Score" 和 "Risk"。

2. 有些變數間有極高的正相關:

* **完全正相關(1或0.99)**:

||||||

|:---:|:---:|:---:|:---:|:---:|

|Para_A|Para_B|Score_B.1|Money_Value|Risk_F|

|Risk_A|Risk_B|Risk_C|Risk_D|History|

* **極高度正相關(0.9以上)**:

|||||||

|:---:|:---:|:---:|:---:|:---:|:---:|

|numbers|numbers|District_Loss|Score_B|Audit_Risk|Audit_Risk|

|Score_B.1|Risk_C|Risk_E|Score|Para_B|Risk_B|

保留變數:

> **完全正相關**: "Risk_A"、"Risk_B"、"Risk_C"、"Risk_D" 和 "Risk_F"

> **極高度正相關**: "Score_B.1", "Risk_E"。

至於變數"Score"因為我們不了解,因此不會隨意刪除。

故"Score"與"Score_B"這組2個都保留。

3. 刪除變數"Audit_Risk":

A. 受所有risk分數影響

B. 目標變數(target variable)"Risk"的判斷基準

```python=

data.drop(["Para_A","Para_B","Score_B.1","Money_Value","History","numbers","District_Loss","Audit_Risk"], axis = 1, inplace = True)

```

---

刪除變數後的correlation heatmap

-> better!

```python=

plt.figure(figsize = (20, 20))

sns.heatmap(data.corr(), annot = True, cmap = 'coolwarm')

plt.savefig("heatmap_deleteHighCorr.png")

```

扣除相關係數後,其他變數之間,彼此已經沒有嚴重的高相關性了。

---

相關性:目標變數 **"Risk"** vs. 其他

```python=

#首先,將Risk這個變數獨立出來,叫做y,之後要當target用的,所以不要混在一起

y = data.Risk

#除此之外的其他資料就是我們要用來分類的變數dataset,叫做x

x = data.drop(['Risk'], axis = 1)

x.corrwith(y).plot.bar(figsize = (20, 10), fontsize = 20, grid = True, color = ['r','g','b'] * 3).set_title("Correlation between 'Risk' and other variables", fontsize = 20)

plt.savefig("risk_corr_with_others.png")

```

如前所述,除了變數**Sector_score**和所有其他變數之間都呈現*負相關*以外,其他變數都和目標變數**Risk**之間都呈現或多或少的正相關(相關係數從0.2~0.8左右)。

---

```python=

y = pd.DataFrame({'Risk':data['Risk']}) #把y從pandas的Series轉成DataFrame

#以便後續分析使用

```

---

樣本中的**違約比例**

```python=

sns.countplot(y['Risk'], label = 'Count')

```

```python=

y.value_counts(normalize = True)

```

> About **39.3%**

---

## 3. Problem formulation and our methods

$$

Audit\ Risk=f(Inherent\ Risk, Control\ Risk, Detection\ Risk)\\

= f(\sum_{i=A}^Drisk_i+\sum_{j=E}^Frisk_j+risk_{DR})=f(total\ risk \ score)=f(y_{score})\\

\begin{cases}

1 & \text{if total risk score} \ge {1}\\

0 & \text{if total risk score < 1}

\end{cases}\\

$$

$$

\text{Prediction = 1 denotes that the firm might be fraudulent, 0 otherwise.}

$$

我們想要找出模型$f()$,這個模型使用**審計風險**中的各種風險分數當成輸入,輸出一個二元預測值,代表這筆觀察值的公司**是否有詐欺風險存在**。

越準確越好,使用**混淆矩陣**,以及其他有關方法測量(準確率、精確率、召回率、F1分數、ROC以及AUC等等)。

**Benchmark Method**: 伯努力試驗(*Bernoulli trials*) $n$ 次。

1. 0/1分別代表可能不是/是詐欺公司。

2. $n$ = 訓練/測試資料集長度

3. $p$ = 樣本中的詐欺公司比例 $\approx$ **39.3%**

<br>**Models Used**:

1. 羅吉斯回歸(Logistic Regression)

2. 隨機森林(Random Forest) :trophy:

3. K-近鄰演算法(K Nearest Neighbor)

4. 支持向量機(Support Vector Machine)

5. 簡單神經網路(Vanilla Neural Network)

<br>**In-sample and Out-of-sample Analysis**:

```python=

from sklearn.model_selection import train_test_split

```

1. 訓練資料:驗證資料 = 3:1

2. 用ground truth的比例去做**分層抽樣 (stratified sampling)**

3. 隨機打亂資料 (*seed = 42*)

```python=

x_train, x_test, y_train, y_test = train_test_split(x, y, test_size = 0.25, stratify = y, random_state = 42)

```

---

## 4. Analysis and Conclusion

### 切割驗證資料集

請見3. problem formulation中的**In-sample and Out-of-sample Analysis**

### 資料前處理 (Data Preprocessing)

使用*sklearn*的**StandardScaler**將所有變數**標準化**

> 都是連續型

```python=

from sklearn.preprocessing import StandardScaler

```

```python=

stdScaler = StandardScaler()

#我們先用fit_transform()找出訓練資料的統計量值特徵,再用這些將訓練資料標準化

x_train_scaled = pd.DataFrame(stdScaler.fit_transform(x_train))

#然後再對測試資料直接用transform(),拿訓練資料的這些統計量值,對測試資料標準化。

#原因是我們假設他們出自相同分布,所以當然沒必要重新fit一次

x_test_scaled = pd.DataFrame(stdScaler.transform(x_test))

#要注意fit_transform()和transform不能倒過來用,不然會報錯!

```

<br>將訓練資料以及驗證資料的ground truth都轉成**ndarray**格式

```python=

y_train_np = y_train['Risk'].to_numpy()

ground_truth = y_test['Risk'].to_numpy()

```

---

### Benchmark Method: Binomial Sampling

> $n$ = 訓練/測試資料集長度

> $p$ = 39.3%

```python=

np.random.seed(42)

n_train = len(x_train_scaled.index) #縮放後訓練資料集的長度

n_test = len(x_test_scaled.index) #縮放後測試資料集的長度

p = y.value_counts(normalize = True)[1] #樣本中的有審計風險的公司比例約為39.3%,以此做為估計量

#從進行n次的白努力試驗(Bernoulli's Trials),機率約為39.3%,n取決於資料集長度

benchmark_train = np.random.binomial(1, p, n_train)

benchmark_test = np.random.binomial(1, p, n_test)

```

---

### Cross Validation for Benchmark Method

之後所有方法都用**K-fold validation**,$K=10$

```python=

Kfold = model_selection.KFold(n_splits = 10, random_state = 42, shuffle = True)

acc = []

for _, test_idx in Kfold.split(x_train_scaled):

predicted = benchmark_train[test_idx]

ground_truth = y_train['Risk'].to_numpy()[test_idx]

#計算這次fold的驗證資料的準確率(accuracy)

acc.append((predicted == ground_truth).sum() / len(test_idx))

```

<br>驗證資料的準確率(accuracy)約為

> 50.7%

```python=

acc_val = sum(acc) / len(acc)

print(acc_val)

```

<br>

---

### Model Evaluation for Benchmark Method

先求出真實答案&預測結果

```python=

ground_truth = y_test['Risk'].to_numpy()

predicted = benchmark_test

```

<br>使用*sklearn*套件中,*metrics*包裡面的**accuracy_score, f1_score, precision_score, recall_score, roc_auc_score**等方法

計算**準確率、F1分數、精確率、召回率、ROC的AUC**

```python=

from sklearn.metrics import accuracy_score, f1_score, precision_score, recall_score, roc_auc_score

```

<br>一樣,往後其他模型也都這樣做。

```python=

accuracy = accuracy_score(ground_truth, predicted)

precision = precision_score(ground_truth, predicted)

recall = recall_score(ground_truth, predicted)

F1 = f1_score(ground_truth, predicted)

ROC = roc_auc_score(ground_truth, predicted)

results_benchmark = pd.DataFrame([['Benchmark Method', accuracy, acc_val, precision, recall, F1, ROC]], columns = ['Model', 'Accuracy','Cross Val Accuracy', 'Precision', 'Recall', 'F1 Score','ROC'])

results_benchmark

```

<br>

---

### Logistic Regression

1. 加上L1懲罰項做正則化

> 減弱羅吉斯回歸模型的精度,提高泛化效果,避免過擬合(overfitting)

2. 隨機打亂數據

> *seed = 42* 方便比較

```python=

from sklearn.linear_model import LogisticRegression

logReg = LogisticRegression(random_state = 42, penalty = 'l1', solver='liblinear') #l1 penalty

logReg.fit(x_train_scaled, y_train_np)

```

---

### Cross Validation for Logistic Regression

往後方法都透過*sklearn*套件中,*model_selection*包裡面的現成函數

**cross_val_score**來進行**交叉驗證**

```python=

from sklearn.model_selection import cross_val_score

```

<br>**10-fold validation**

```python=

Kfold = model_selection.KFold(n_splits = 10, random_state = 42, shuffle = True)

scoring = 'accuracy' #我們要看交叉驗證的準確率如何

```

<br>驗證資料的準確率(accuracy)約為

> 96.4%

```python=

acc_logReg = cross_val_score(estimator = logReg, X = x_train_scaled, y = y_train_np, cv = Kfold, scoring = scoring)

acc_val = acc_logReg.mean()

print(acc_val)

```

<br>

---

### Model Evaluation for Logistic Regression

先求出真實答案&預測結果

```python=

ground_truth = y_test['Risk'].to_numpy()

predicted = logReg.predict(x_test_scaled)

```

<br>使用*sklearn*的現成函數計算performances

```python=

accuracy = accuracy_score(ground_truth, predicted)

precision = precision_score(ground_truth, predicted)

recall = recall_score(ground_truth, predicted)

F1 = f1_score(ground_truth, predicted)

ROC = roc_auc_score(ground_truth, predicted)

results_logReg = pd.DataFrame([['Logistic Regression', accuracy, acc_val, precision, recall, F1, ROC]], columns = ['Model', 'Accuracy','Cross Val Accuracy', 'Precision', 'Recall', 'F1 Score','ROC'])

results_logReg

```

<br>

---

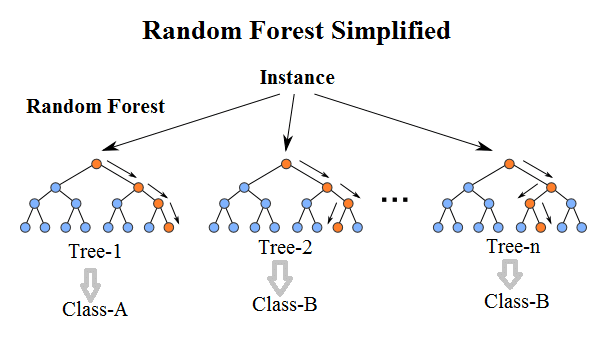

### Random Forest

> Random Forest = Bagging + Decision Tree

---

**Ensemble Learning** a.k.a. 盲人摸象訓練術XD

有下列2種技巧,以面臨學校大考的例子說明。

**Bagging**

> 重複抽樣的概念。

> 狂買參考書來寫

**Boosting**

> 和bagging類似,但更注重改正錯誤

> 也是買參考書,但加強比較弱的、之寫寫錯的部分

---

參數說明:

1. **n_estimators**: 這個隨機森林裡面要包含幾棵決策樹?

> 100棵樹

2. **criterion**: 用來選決策樹的分割特徵的準則

> a. Gini Impurity

> b. Information Gain (by entropy) :heavy_check_mark:

3. 隨機打亂數據

> *seed = 42* 方便比較

```python=

from sklearn.ensemble import RandomForestClassifier

RandF = RandomForestClassifier(n_estimators = 100, criterion = 'entropy', random_state = 42)

RandF.fit(x_train_scaled, y_train_np)

```

---

### Cross Validation for Random Forest

**10-fold validation**

```python=

Kfold = model_selection.KFold(n_splits = 10, random_state = 42, shuffle = True)

scoring = 'accuracy' #我們要看交叉驗證的準確率如何

```

<br>驗證資料的準確率(accuracy)約為

> 99.1%

```python=

acc_RandF = cross_val_score(estimator = RandF, X = x_train_scaled, y = y_train_np, cv = Kfold, scoring = scoring)

acc_val = acc_RandF.mean()

print(acc_val)

```

<br>

---

### Model Evaluation for Random Forest

先求出真實答案&預測結果

```python=

ground_truth = y_test['Risk'].to_numpy()

predicted = RandF.predict(x_test_scaled)

```

<br>使用*sklearn*的現成函數計算performances

```python=

accuracy = accuracy_score(ground_truth, predicted)

precision = precision_score(ground_truth, predicted)

recall = recall_score(ground_truth, predicted)

F1 = f1_score(ground_truth, predicted)

ROC = roc_auc_score(ground_truth, predicted)

results_RandF = pd.DataFrame([['Random Forest', accuracy, acc_val, precision, recall, F1, ROC]], columns = ['Model', 'Accuracy','Cross Val Accuracy', 'Precision', 'Recall', 'F1 Score','ROC'])

results_RandF

```

<br>

隨機森林的表現近乎完美!訓練資料完全命中!

---

### K Nearest Neighbor (KNN) Algorithm

參數說明:**(都使用預設參數,未做更動)**

1. **n_neighbors**: $K$的大小,就是要參考附近幾個點?

> $K=5$

2. **weights**: 附近點的權重?

> 'uniform' (權重都均等)

3. **algorithm**: 使用的演算法

> a. brute force

> b. kd_tree

> c. ball_tree

> d. auto :heavy_check_mark:

4. **leaf_size**: kd樹或ball樹的大小

> 30 (default)

5. **p = 2**

> 歐式距離

6. **metric**: 度量距離的方式

> 'minkowski' (閔氏距離,就是p=2的歐式距離)

```python=

from sklearn.neighbors import KNeighborsClassifier

KNN = KNeighborsClassifier()

KNN.fit(x_train_scaled, y_train_np)

```

---

### Cross Validation for KNN

**10-fold validation**

```python=

Kfold = model_selection.KFold(n_splits = 10, random_state = 42, shuffle = True)

scoring = 'accuracy' #我們要看交叉驗證的準確率如何

```

<br>驗證資料的準確率(accuracy)約為

> 96.6%

```python=

acc_KNN = cross_val_score(estimator = KNN, X = x_train_scaled, y = y_train_np, cv = Kfold, scoring = scoring)

acc_val = acc_KNN.mean()

print(acc_val)

```

<br>

---

### Model Evaluation for KNN

先求出真實答案&預測結果

```python=

ground_truth = y_test['Risk'].to_numpy()

predicted = KNN.predict(x_test_scaled)

```

<br>使用*sklearn*的現成函數計算performances

```python=

accuracy = accuracy_score(ground_truth, predicted)

precision = precision_score(ground_truth, predicted)

recall = recall_score(ground_truth, predicted)

F1 = f1_score(ground_truth, predicted)

ROC = roc_auc_score(ground_truth, predicted)

results_KNN = pd.DataFrame([['K Nearest Neighbor', accuracy, acc_val, precision, recall, F1, ROC]], columns = ['Model', 'Accuracy','Cross Val Accuracy', 'Precision', 'Recall', 'F1 Score','ROC'])

results_KNN

```

<br>

雖不及隨機森林和羅吉斯回歸的效果,但仍然相當好,都有90%以上。

推測可能是因為只看附近的,所以效果上才不如前述兩者。

---

### Support Vector Machine (SVM)

參數說明:**(部分使用預設參數)**

1. **C**: 錯誤項的懲罰係數

越大訓練樣本越準,但泛化能力降低

> $C=1$ (default)

2. **kernel**: 核函數

可想像成把資料「投影」到更高維度,以方便分類的「投影函數」

> 'rbf' (default)

> 'linear' :heavy_check_mark:

3. **degree, gamma, coef0**: (略)

> 我們選擇linear kernel function,用不到這3個參數

4. **probability**: 是否啟用機率估計

> False (default)

> True :heavy_check_mark:

5. 隨機打亂數據

> *seed = 42* 方便比較

6. 其他參數保持預設,不一一列出

```python=

from sklearn.svm import SVC

SVM = SVC(kernel = "linear", probability = True, random_state = 42)

SVM.fit(x_train_scaled, y_train_np)

```

---

### Cross Validation for SVM

**10-fold validation**

```python=

Kfold = model_selection.KFold(n_splits = 10, random_state = 42, shuffle = True)

scoring = 'accuracy' #我們要看交叉驗證的準確率如何

```

<br>驗證資料的準確率(accuracy)約為

> 97.6%

```python=

acc_SVM = cross_val_score(estimator = SVM, X = x_train_scaled, y = y_train_np, cv = Kfold, scoring = scoring)

acc_val = acc_SVM.mean()

print(acc_val)

```

<br>

---

### Model Evaluation for SVM

先求出真實答案&預測結果

```python=

ground_truth = y_test['Risk'].to_numpy()

predicted = SVM.predict(x_test_scaled)

```

<br>使用*sklearn*的現成函數計算performances

```python=

accuracy = accuracy_score(ground_truth, predicted)

precision = precision_score(ground_truth, predicted)

recall = recall_score(ground_truth, predicted)

F1 = f1_score(ground_truth, predicted)

ROC = roc_auc_score(ground_truth, predicted)

results_SVM = pd.DataFrame([['Support Vector Machine', accuracy, acc_val, precision, recall, F1, ROC]], columns = ['Model', 'Accuracy','Cross Val Accuracy', 'Precision', 'Recall', 'F1 Score','ROC'])

results_SVM

```

<br>

結果略差於隨機森林,略好於KNN,和羅吉斯回歸差不多。

(RF > SVM $\approx$ LogReg > KNN)

仍然是相當不錯的分類表現,甚至都有超過95%。

---

### Neural Network

從**tensorflow**的**keras**匯入需要的方法,比如模型部分

```python=

from tensorflow.keras import backend as K

from tensorflow.keras.models import Sequential

from tensorflow.keras.layers import Dense

```

---

自定義計算精確率、召回率、F1分數的函式。(這部分參考老師的demo檔案)

```python=

def recall_m(y_true, y_pred):

true_positives = K.sum(K.round(K.clip(y_true * y_pred, 0, 1)))

possible_positives = K.sum(K.round(K.clip(y_true, 0, 1)))

recall = true_positives / (possible_positives + K.epsilon())

return recall

def precision_m(y_true, y_pred):

true_positives = K.sum(K.round(K.clip(y_true * y_pred, 0, 1)))

predicted_positives = K.sum(K.round(K.clip(y_pred, 0, 1)))

precision = true_positives / (predicted_positives + K.epsilon())

return precision

def f1_m(y_true, y_pred):

precision = precision_m(y_true, y_pred)

recall = recall_m(y_true, y_pred)

return 2*((precision*recall)/(precision+recall+K.epsilon()))

```

---

### 建造神經網路

1. 模型外面框架

```python=

NN = Sequential()

```

2. 輸入層(input layer):神經元個數 = 變數數量 = **15個**

```python=

x_train_scaled.shape

```

```python=

NN.add(Dense(16, activation = 'relu', input_shape = (x_train_scaled.shape[1], )))

```

3. 第一隱藏層(hidden layer): (程式碼請見上方)

> 16個神經元

> 激活函數(activation function): ***ReLU***

4. 第二隱藏層(hidden layer):

> 128個神經元

> 激活函數: ***ReLU***

```python=

NN.add(Dense(128, activation = 'relu'))

```

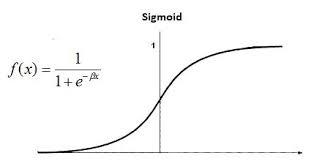

5. 輸出層(output layer)

> 只有**1**個神經元 → 給出預測結果

> 激活函數: ***Sigmoid*** → 因為是0或1的*二元預測*

---

### 組裝神經網路模型

```python=

NN.compile(optimizer = "rmsprop", loss = "binary_crossentropy", metrics = ['accuracy', recall_m, precision_m, f1_m])

```

> a. 優化器(optimizer): ***RMSProp***

> b. 損失函數(loss function): ***Binary Cross Entropy***

> c. 正確率衡量指標: 準確率***accuracy***、

自定義的召回率、精確率、F1分數***recall_m, precision_m, f1_m***

---

### 訓練神經網路

1. **20**個*epoch*

2. *batch大小* = **60**

> 約訓練資料集的1/10大小

```python=

history = NN.fit(x_train_scaled, y_train_np, epochs = 20, batch_size = 60)

```

訓練過程

---

### 查看每次epoch的表現(plot it out)

```python=

plt.figure(figsize = (25,5))

l = [

{'code':'loss',

'fullname':'Loss'},

{'code':'accuracy',

'fullname':'Accuracy'},

{'code':'precision_m',

'fullname':'Precision'},

{'code':'recall_m',

'fullname':'Recall'},

{'code':'f1_m',

'fullname':'F1 score'},

]

for i in range(5):

plt.subplot(1, 5, i+1).set_title("Model "+l[i]["fullname"])

plt.plot(history.history[l[i]["code"]])

plt.ylabel(l[i]["fullname"])

plt.xlabel("Epoch")

plt.tight_layout()

plt.savefig("NN_performance_plots.png")

```

<br>由左至右:**Loss, Accuracy, Precision, Recall, F1 score**

可以觀察到整體而言,損失有在下降,各項準確指標也有在上升。

雖然上升過程有些微不穩定。

四項準確指標都在約96-98%左右。

---

### Model Evaluation for Neural Network

下列evaluation時的指標,我自己刻程式計算

```python=

if m['type'] == 'Neural Network':

acc = (predicted == ground_truth).sum() / len(predicted)

precision = ground_truth[np.where(predicted == 1)].mean()

recall = predicted[np.where(ground_truth == 1)].mean()

F1 = 2 * precision * recall / (precision + recall)

print("accuracy:", acc)

print("precision:", precision)

print("recall:", recall)

print("F1:", F1)

print("AUC:", AUC)

```

<br>

---

### ROC曲線&曲線下面積AUC

使用*sklearn*套件中,*metrics*包裡面的現成方法**roc_curve, roc_auc_score**

```python=

from sklearn.metrics import roc_curve, roc_auc_score

```

<br>畫圖程式碼部分

```python=

y_test_np = y_test['Risk'].to_numpy()

models = [

{'type': 'Benchmark',

'model': 'Benchmark'},

{'type': 'Logistice Regression',

'model': LogisticRegression(random_state = 42, penalty = 'l1', solver='liblinear')},

{'type': 'Random Forest',

'model': RandomForestClassifier(n_estimators = 100, criterion = 'entropy', random_state = 42)},

{'type': 'K Nearest Neighbor',

'model': KNeighborsClassifier()},

{'type': 'Support Vector Machine',

'model': SVC(kernel = "linear", probability = True, random_state = 42)},

{'type': 'Neural Network',

'model': NN}

]

#預先設定整張圖大小

plt.figure(figsize = (20,10))

#算出每個模型的ROC和AUC,然後把曲線疊加到圖中

for m in models:

#我們需要特別處理我們手刻的benchmark,因為跟其他方法的結構不一樣,是自定義的

if m['type'] == 'Benchmark':

predicted = benchmark_test

#p = y.value_counts(normalize = True)[1],樣本中有審計風險的公司比例。約為39.3%

#n_test = len(x_test_scaled.index),縮放後測試資料集的長度

pred_prob = np.array([p] * n_test)

else:

model = m['model']

if m['type'] == 'Neural Network':

predicted = np.array([1 if model.predict(x_test_scaled)[i] >= 0.5 else 0 for i in range(len(model.predict(x_test_scaled)))], dtype = 'int64') #產生測試資料的預測結果(標籤)

pred_prob = model.predict(x_test_scaled) #產生測試資料預測出的,每筆資料的各標籤的機率

else:

model.fit(x_train_scaled, y_train_np) #訓練模型

predicted = model.predict(x_test_scaled) #產生測試資料的預測結果(標籤)

pred_prob = model.predict_proba(x_test_scaled)[:, 1] #產生測試資料預測出的,每筆資料的各標籤的機率

#計算真陽性率(TP rate)和偽陽性率(FP rate)

FP, TP, thresholds = roc_curve(y_test_np, pred_prob)

#計算AUC,然後呈現在ROC圖的legend中

AUC = roc_auc_score(y_test_np, predicted)

#接著,把結果疊加到ROC圖上

plt.plot(FP, TP, label = '%s ROC (area = %0.2f)' % (m['type'], AUC))

#一些圖片設定(標題、坐標軸標題等等)

plt.plot([0, 1], [0, 1], 'k--') #參考線

plt.xlim([0.0, 1.0]) #限制x軸顯示範圍

plt.ylim([0.0, 1.05]) #限制y軸顯示範圍

plt.xlabel('Specificity(FP rate)') #x軸標題

plt.ylabel('Sensitivity(TP rate)') #y軸標題

plt.title('ROC Figure') #圖片標題

plt.legend() #圖片圖例

plt.savefig("ROC.png") #儲存圖片

```

---

### 各模型ROC&AUC結果比較

---

### :star: **Results**

#### In-sample results (in percentage)

This is the accuracy for validation data.

|Measures |Benchmark Method|Logistic Regression|Random Forest|KNN|SVM|Neural Network|

|---|:---:|:---:|:---:|:---:|:---:|:---:|

| Accuracy |50.70|96.39|:crown: 99.14|96.56|97.59|97.77|

#### Out-of-sample comparisons (in percentage)

We consider a simple 75%-25% split on the data. In the test data, we have

|Measures |Benchmark Method|Logistic Regression|Random Forest|KNN|SVM|Neural Network|

|---|:---:|:---:|:---:|:---:|:---:|:---:|

| Accuracy |51.55|98.45|:crown:100|96.91|99.48|97.94|

| Precision|35.48|100|:crown:100|98.61|100|98.65|

| Recall |28.95|96.05|:crown:100|93.42|98.68|96.05|

|F1-score|31.88|97.99|:crown:100|95.95|99.34|97.33|

|AUC|47.52|98.03|:crown:100|96.29|99.34|97.60|

---

### :star: **Conclusion**

**Random Forest $>$ SVM $>$ Logistic Regression $>$ Neural Network $\gg$ KNN

$>>>>>>>>>>$ Benchmark Method**

所以我們應該選取***隨機森林(Random Forest)***,當作我們的二元預測模型。

---

### 混淆矩陣 (Confusion Matrix)

使用*sklearn*套件中,*metrics*包裡面的現成方法**confusion_matrix**

```python=

from sklearn.metrics import confusion_matrix

```

<br>畫圖程式碼部分

```python=

predicted = [

{'model': 'Benchmark Method',

'predicted': benchmark_test},

{'model': 'Logistice Regression',

'predicted': logReg.predict(x_test_scaled)},

{'model': 'Random Forest',

'predicted': RandF.predict(x_test_scaled)},

{'model': 'K Nearest Neighbor',

'predicted': KNN.predict(x_test_scaled)},

{'model': 'Support Vector Machine',

'predicted': SVM.predict(x_test_scaled)},

{'model': 'Neural Network',

'predicted': np.array([1 if NN.predict(x_test_scaled)[i] >= 0.5 else 0 for i in range(len(NN.predict(x_test_scaled)))], dtype = 'int64')}

]

plt.figure(figsize = (30, 20))

for i in range(len(predicted)):

cm = confusion_matrix(y_test_np, predicted[i]['predicted'])

plt.subplot(2, 3, i+1).set_title("Confusion Matrix of\n"+predicted[i]['model'])

sns.heatmap(cm, annot = True, fmt = 'd')

plt.savefig("Confusion_Matrixes.png")

#annot: annotation標上數字。

#fmt = 'd': 標上去的數字取整數

```

---

### 各模型混淆矩陣結果比較

從左上到右下:

> **Benchmark Method/ Logistic Regression/ Random Forest**

> **KNN/ SVM/ Neural Network**

可以發現所有模型都遠勝於Benchmark Method。

至於Benchmark Method外,其他5個模型之間的表現,請見***ROC&AUC***部分

---

### Feature Importances (for random forest)

1. Random Forest = 很多 Decision Tree

2. 每棵樹都會有自己挑選的辦法

> 對每棵樹而言,分類用到的變數不同,重要性也不同

#### Q: What is the overall influence for each variable?

---

使用到隨機森林分類器的內建屬性(attribute) -> ***feature_importances_***

```python=

importances = RandF.feature_importances_

indices = np.argsort(importances)[::-1]

#重新編排各個變數(特徵),使得他們對應到上面的這個重要性順序

features = [x.columns[i] for i in indices]

```

<br>畫圖部分程式碼

```python=

#創造一張空圖

plt.figure()

#圖片標題

plt.title("Feature Importances\n for Random Forest")

#加上每個特徵重要性的柱狀圖

#range(x.shape[1])代表所有0~行數-1

plt.bar(range(x.shape[1]), importances[indices])

#把每個特徵(變數)的名字標註到x軸

plt.xticks(range(x.shape[1]), features, rotation = 90)

#儲存圖片

plt.savefig("Feature Importances.png")

```

---

### 變數/特徵的重要性排序圖 (Feature Importance Plot)

可以看到最重要的分類特徵是變數**Inherent_Risk**,也就是說:

**總固有風險**部分,是判斷一個公司是否可能詐欺的一項重要指標。

---

## Future Works

如果能取得台灣公家企業(或普通企業)的風險分數資料,也可針對台灣的企業進行類似分析。

---

## 5. References

[我的資料來源 my dataset (from Kaggle)](https://www.kaggle.com/sid321axn/audit-data)

[參考論文:Fraudulent Firm Classification: A Case Study of an External Audit](https://www.researchgate.net/publication/323655455_Fraudulent_Firm_Classification_A_Case_Study_of_an_External_Audit)

[老師的demo檔案](https://drive.google.com/file/d/1C4tRbnbBhWcBpIsC4uaXkmbGBELegQPY/view?usp=sharing)

---

## 6. Data and Code Storage

Please refer to my E3.

---

Sign in with Wallet

Sign in with Wallet

Sign in with Wallet

Sign in with Wallet