Protecting whales against censorship and MEV with trustless dark pools

Silur@EthZurich

---

## Agenda

- Problem formulation

- Prior work, aztec and friends

- On dark pools

- SEC vs Dark pools

- Trust model

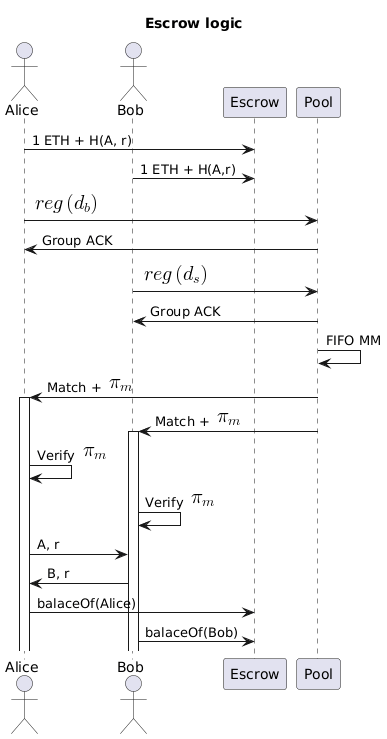

- Escrow phase

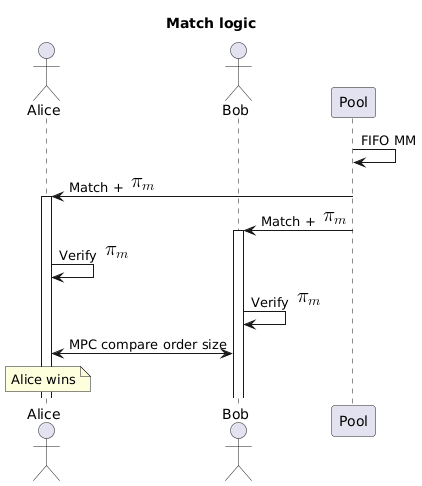

- Matching

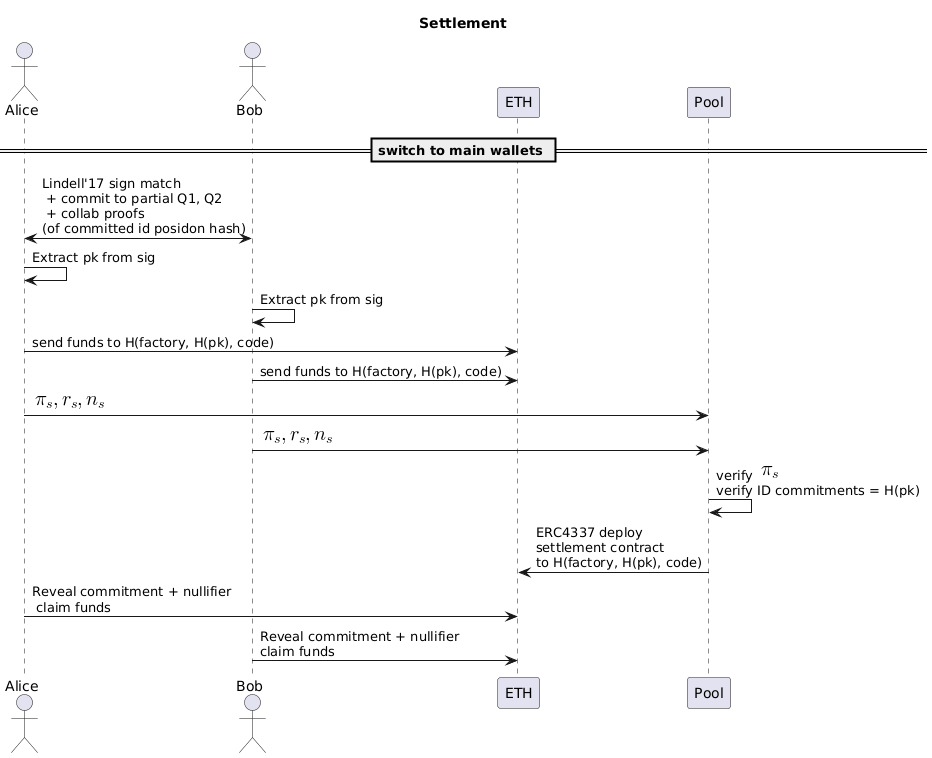

- Settlement

- ZkEVM?

---

## The problem

- Large token movements create hysteria on markets

- "Large" can actually way small on low-liquidity ERC20 token markets

- Investors get nagged, even censorsed in ERC20 pools, especially with low TLV/Volume and forced to OTC

- Team members cannot exit without panic

- MEV

---

## But we already have token privacy solutions

- They do allow amazing token wrapping and mixing....

- ...But do not hide the initial "open" transaction

- Such privacy contracts are blacklisted, watched, censored

- In most cases, private sale phase token investments will require you to use a new wallet.

- "Indication of intent" is key

---

## Challenges with fully on-chain privacy

- Known contract instances of existing privacy solutions create the same hysteria as plain token movement

- Account-based privacy is only possible iff the "kickoff" transaction happens offchain

- This is very hard to address with the DEX model

---

## Enter dark pools

- In fiat markets, dark pools are exchanges where the orderbook is not public

- Identities and order sizes of participants only become visible when they have no market impact anymore... sounds like a commitment protocol :)

- Traditionally, the service is trusted as matchmaking correctness is entirely up to the backend

- This is also the reason dark pools received a bad reputation, such services did tend to cheat a lot.

---

<small>source: ia.cr/2020/662</small>

---

- Formally allowed (and regulated) by "Regulation National Market System", no more tornado-cash style drama

- Fiat dark pool data enters the Consolidated Tape, but only as OTC

- Easy to start the "kick-off" transaction offchain

---

## Addressing the trust issues with ZK

- On traditional markets all control on asset movement happens behind curtains, lots of HFT, price discovery, arbitrage happening

- ZK tech allows us to address these trust issues, and create an untrusted dark liquidity pool

---

## Prior works on crypto dark pool

DeepOcean https://arxiv.org/pdf/1910.02359.pdf

- [X] Accountability of the matchmaking service

- [ ] Has no specifics on asset commitment and settlement at all

- [ ] Not compatible with DeFi models and decentralized markets

---

Rialto

- indication of intent with the kickoff balance range proof

---

Renegade.fi, Kicking-The-Bucket, ia.cr/2022/923 and other MPC-based solutions

- [X] Completely trusless & Decentralized 🎉

- [!] all require a separate p2p messaging layer to operate :(

---

## Proposed Instantiation

Threat model:

- Operator is honest-but-curious

- Operator does not know the exact liquidity of the CLOB

- Alice and Bob cannot learn each others order sizes prior settlement

- Early aborts induce a reimbrusement

- Operator cannot learn neither parties exact order sizes

- We operate on 256 bit integers

---

## Main components

- Escrow system to reimbruse aborts

- CREATE2 fund movements

- Yao's "millionaire protocol"

- Lindell'17 two-party ecdsa

- Collaborative ZK at settlement

- ERC4337 account abstraction

- ZK as a glue for correctness of each step :)

---

<aside class="notes">

H here is a poseidon hash

proof contains that they belong to different groups and their settlement nullifiers are not used up

</aside>

---

---

<aside class="notes">

r_s is a settlement commitment, n_s is it's nullifier

code includes an escrow safety flag where etiher

side can prove no funds in the address after a timeout

to receive all their funds +1 ETH from the endparty

</aside>

---

## What about ZkEVM?

- assuming a fully compatible ZkEVM, the escrow protocol can be omitted as we can prove balances better.

- shift from the current "optimistic abort" protocol to a really preventive trust model

---

## Thanks for your attention

<small>Special thanks to **Tristan Litre** and **Adam Gagol** for useful insights and literature!</small>

{"metaMigratedAt":"2023-06-17T13:58:53.465Z","metaMigratedFrom":"YAML","breaks":true,"title":"Protecting whales against censorship and MEV with trustless dark pools","contributors":"[{\"id\":\"f4d4af67-750e-4c99-b33e-c04b6d99a6c6\",\"add\":13250,\"del\":7803}]"}