# **Why does Gauntlet recommend freezing CRV on Aave v2?**

Freezing prevents continued excessive buildup of CRV, preventing further concentration. We don’t know how much CRV the user has on the backend that he can add to add this concentration.

- The tradeoff is that user cannot use CRV to protect his position should it become liquidatable.

- This is the point - freezing forces the user to deposit other collateral or repay debt. There is speculation that the user cannot access funds to repay his USDT debt; however, the proposal has influenced the user to repay a portion of the debt, as seen [here](https://www.theblock.co/post/234884/curve-founder-returns-1-3-million-usdt-to-aave-to-curb-liquidation-risk?utm_source=twitter&utm_medium=social), where he is quoted as ““It’s better to be a bit more careful with this position on Aave. Even if [the] proposal gets rejected, it's better for me to act as if it was executed."

- Unfrozen CRV incentivizes the user to protect his position by depositing CRV, which will add further concentration risk, rather than repaying his debt.

Simply put, we don’t know how liquidity and market conditions will develop in the future, and cannot assign a probabilistic outlook on this. This is why additional CRV added to this position ultimately increases risk in the future. We don’t want situation where 1. position has much more CRV as collateral, 2. CRV liquidity has declined even more, making this position more difficult to remove.

---

**Why do increases in CRV collateral add additional tangible risk?**

- **Increases in CRV collateral add insolvency risk linearly with respect to the marginal increase in CRV position, which can be superproportional with respect to original position. In other words, increasing the CRV position by x% can increase insolvencies by MORE THAN x%.**

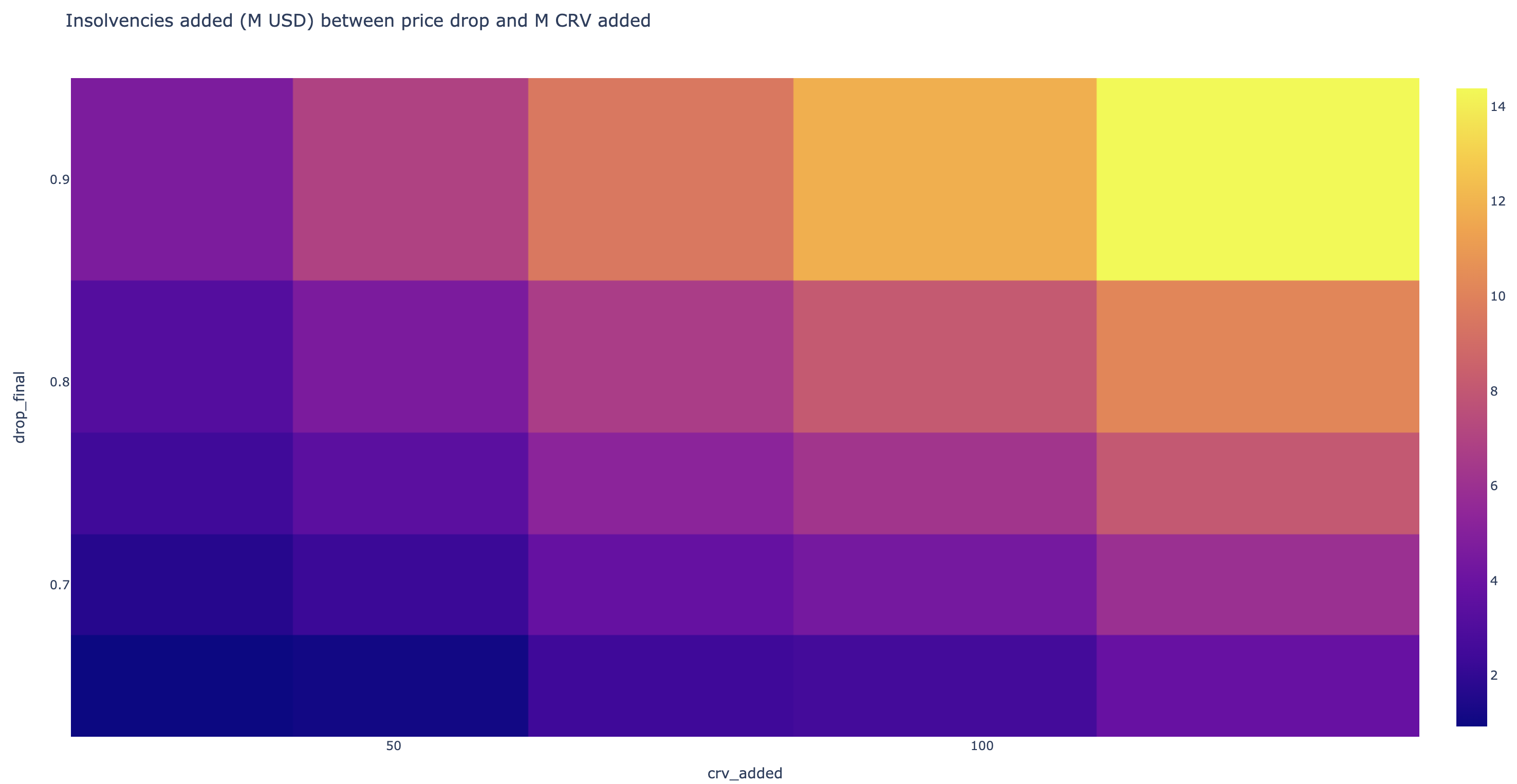

- Given the user’s current position, suppose there were an initial CRV price drop that forces him to adjust his positions, and he needs to either repay USDT debt or refill CRV collateral to maintain a “safe” HF. For example - suppose his target HF is 1.6, and CRV drops 16%. That means his HF has dropped to 1.4 (supply 288m CRV, borrow 62m USDT, CRV price $0.62, current data as of 2023/06/16 23:30 UTC). This implies he either needs to repay 7.7m USDT or deposit 41m CRV to return his HF to 1.6. **The following heatmap shows the relationship of increased insolvencies between adding CRV collateral vs repaying USDT debt, when HF is held constant, to the CRV price drop and amount of additional CRV added**.

- Let the initial drop be drop_init (above example is 16%). Then his default insolvencies, assuming liquidations occur after price has stabilized after a big drop of x%, are

- $\text{debt_default} - \frac{(1-x)\text{CRV balance_default}}{(1+\text{CRV_LB}}$

- His insolvencies after repaying are

- $\text{debt_default} (1-\text{drop_init}) - \frac{(1-x)(\text{CRV balance_default})(1-\text{drop_init})}{ (1+\text{CRV_LB})} = (1-\text{drop_init})*\text{Insolvencies_default}$

- **This implies that the insolvency is linear with respect to how much CRV we refill, and by how much CRV price drops by**

- His insolvencies after refilling with CRV are the same as his default insolvencies, since USD balances remain the same.

- Therefore, refilling relative to repaying debt can increase final insolvencies by $1/(1-\text{drop_init)} - 1$, which is the same as the CRV refill amount.

- L**iquidations will mostly occur once the price has stabilized, if the stabilized price is lower than -70%, liquidations will drive the account towards realized insolvency.** HF is currently 1.7, and currently CRV needs to decrease by 40% to trigger liquidations and 70% to trigger insolvencies. Our simulations show that there is current liquidity levels can only support ~$6m in liquidation as CRV decreases in price. Drawing parallels to USDC depeg, liquidity deteriorates as CRV price drops, thresholding liquidation volume. Only when price stabilizes and begins to trend flat does liquidation volume increase.

- **As a result, if $\text{final_price}(CRV)$ stabilizes at a price less than the $\text{min_price_no_insolvency}(CRV)$, any liquidation will continue to drive the HF downwards. Moreover, if increased CRV supply from refills can continue to exert downwards pressure on the stabilized CRV price, so the more CRV refill/supply, the lower the effective liquidation price could be and greater the harm on the user HF.**

- To illustrate the potential speed of liquidations, during the previous CRV incident on 2022-11-22, 50m of CRV debt was repaid in 1 hr of time as CRV went from 0.61 to 0.71.

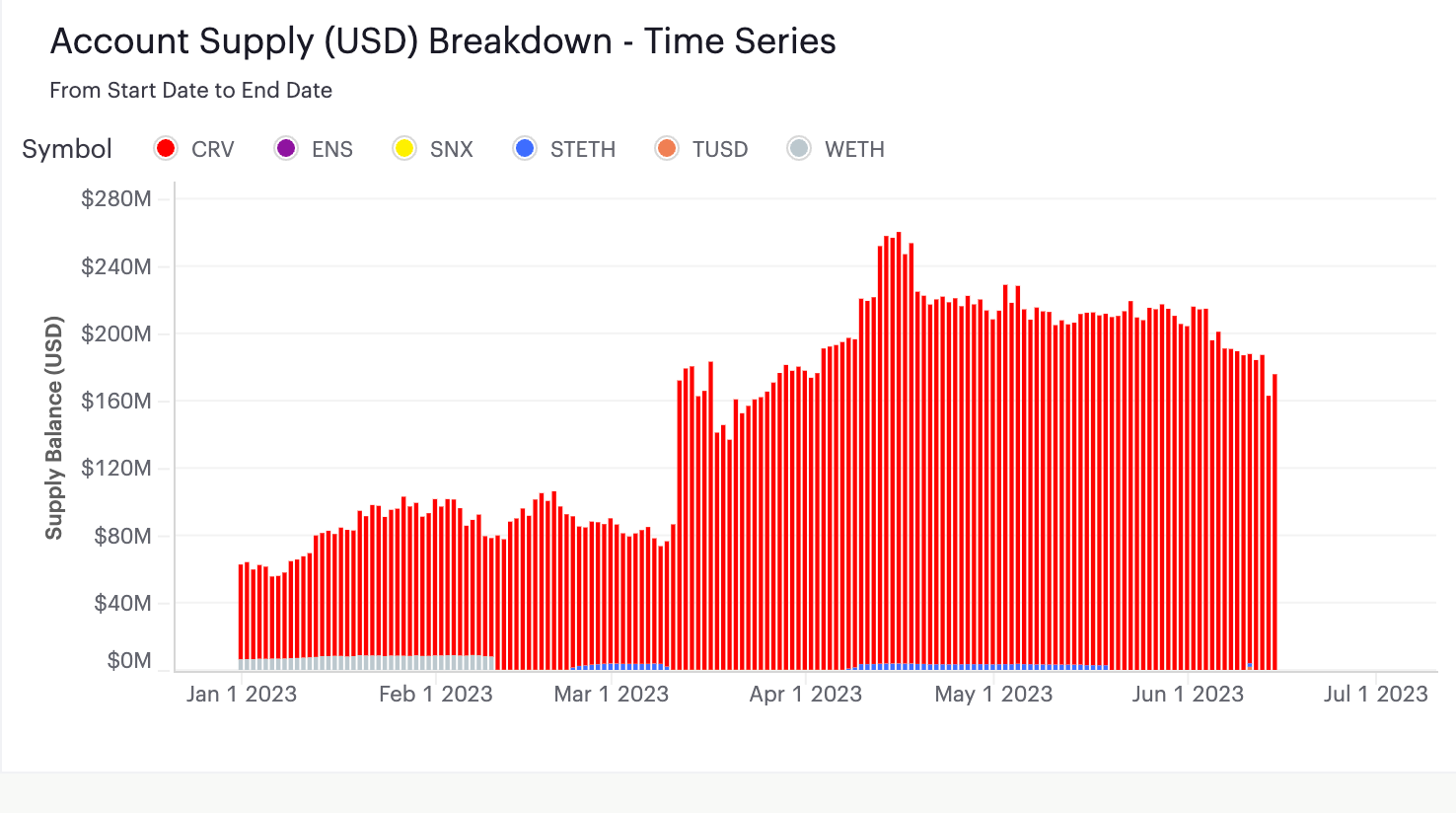

- **The user has the capacity to greatly increase his CRV position.** For context, the user’s CRV position has doubled over the past half year. The user has roughly 150m CRV on other lending platforms, and 60m CRV unlock in the next year, which means he has the capacity to increase his Aave v2 position by almost 70%.

---

**On preventing borrow from increasing**

- This was our intention behind setting LTV to 0, and we look forward to the improvement across Aave v2 to make that check more rigorous and not circumventable. Like we discussed before, the user’s position is a two-sided problem. In order to de-risk the position, it should be approached from both sides - prevent the supply from growing any further, and restricting the user from taking out more borrow.

---

**On freezing being too extreme**

- This is the philosophical problem of defi - as risk managers, Gauntlet is looking to absolutely minimize bad debt on Aave that can result from market risk. At times, the best course of action is to intervene in a fairly extreme manner, similar to our pause suggestions during the USDC depeg. As defi gets more developed, we look forward to new automated, algorithmic mechanisms that serve as killswitches to stop normal behavior in abnormal events.