## On liquidity comparisons to Nov 2022

**It is impossible to predict where CRV price stabilizes.** A breach of 0.4 may cause more price discovery, since

- OTC bid forms a soft barrier

- not reflected in current Binance spot orderbook

- crucially, first liquidation levels are below the OTC bid

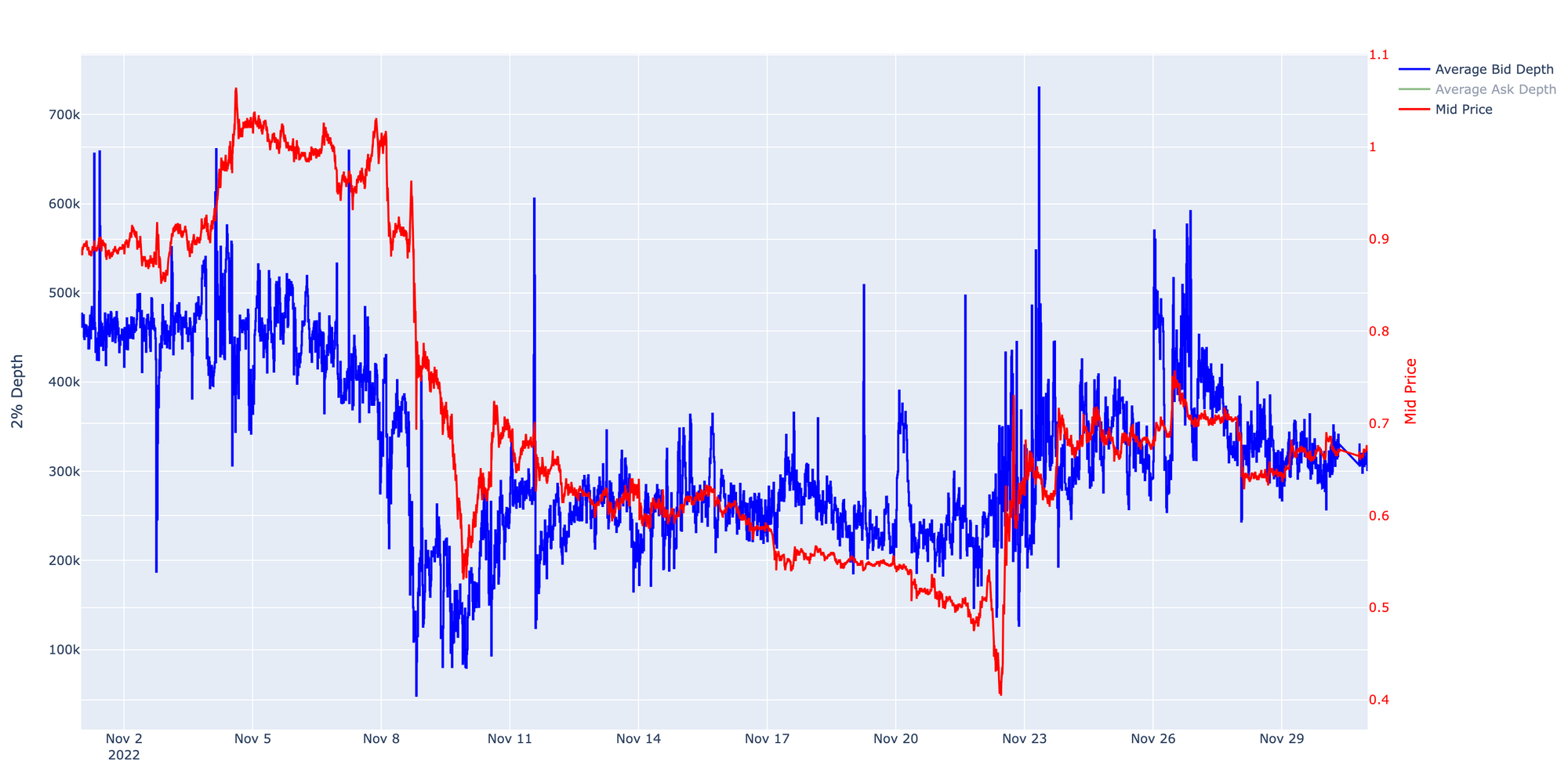

However, we aim to shed some light on how CRV liquidity behaved during the FTX crisis and the Avi Eisenberg incident. We look at how both DEX and CEX liquidity evolved back then to try to form a proxy for how liquidity might evolve if CRV undergoes more stress today.

Currently, there is a 35% drop to liquidation and a ~63% drop to first insolvencies. Using historical context, **we estimate CEX and DEX liquidity to drop by 50% with sudden price drop to liquidation levels, and liquidity to drop by 75-80% with a sudden price drop to insolvency levels. At lower liquidity levels, CRV price is likely to be significantly more volatile. Where CRV price stabilizes will be impossible to predict.**

Binance currently accounts for roughly 1/3 of the depth and the majority of the volume.

- FTX event

- DEX liquidity roughly dropped by 50%, and CEX liquidity roughly dropped by 80% during the FTX event.

- Avi event

- DEX liquidity dropped by ~30-40%, CEX liquidity was noisy but did not meaningfully change

- Binance CRV/USDT spot market, November 2022

- CRVETH Curve pool liquidity

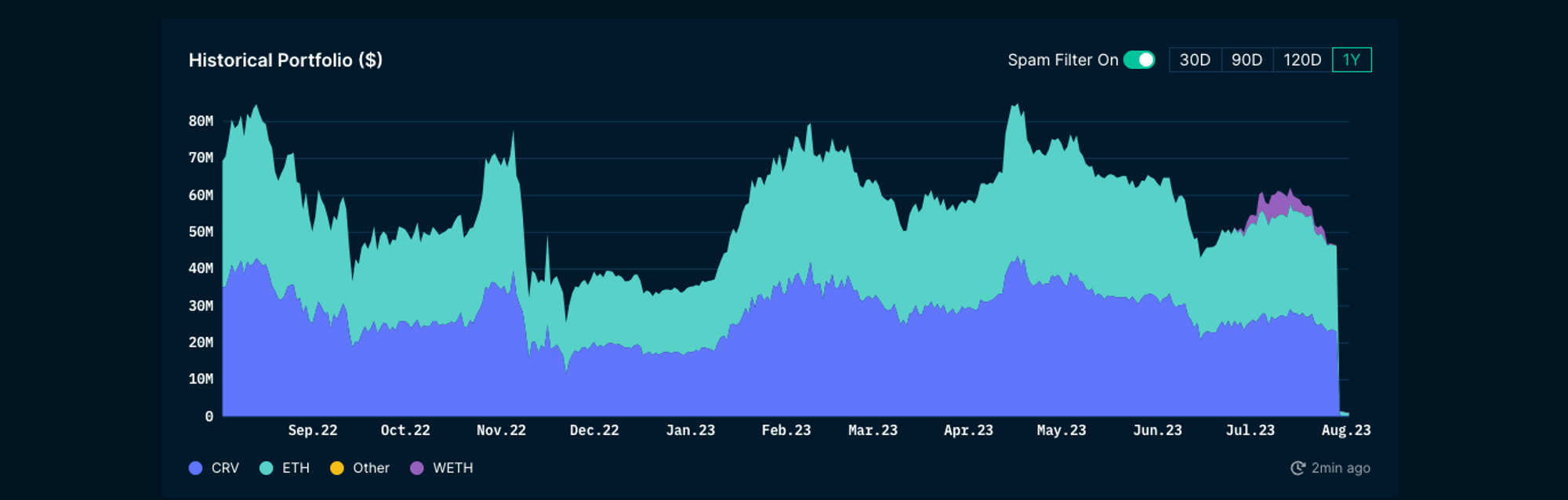

## ******************************On TVL changes******************************

v3 has seen an increase in TVL in the past month.

---

v2 has seen a decrease of roughly 700m TVL.

## On where withdrawals went

**Total Withdrawals Difference**: $563.327M since 7/30 from Ethereum Aave v2 accounts.

### **Breakdown Categories**

- **Unclear final destination**: $64.827M

- **Staked in stUSDT (Justin Sun)**: $52.4M

- **Held in wallet**: $192.3M

- **Migrate to v3 Ethereum**: $186.1M

- **Compound**: $7.3M

- **Binance**: $7M

- **Huobi**: $53.4M

### **Exclusions**

- **CRV founder**: $36.5M `0x7a16ff8270133f063aab6c9977183d9e72835428`

- **Withdrawals from Morpho**: $26.0M `0x777777c9898d384f785ee44acfe945efdff5f3e0`

- **Flamincome Protocol**: $12.1M `0x1d0c2555a0002a54de13749af384223691bcb4d6`

## **Details**

### **Unclear final destination**

- `0xa38aa9ae8953f245b44e84b6f25e0032e58b1f42`: $29.9M

- `0x1da05bce1edd2369cddcb35e747859ef6a675010`: $15.8M

- `0xccee999c040caa91e2e1e23ea99d5e154e1e94c4`: $6.9M

- `0x77fcae921e3df22810c5a1ac1d33f2586bba028f`: $6M

- `0x526d0047725d48bbc6e24c7b82a3e47c1af1f62f`: $5.6M

- `0x06185ca50a8ab43726b08d8e65c6f2173fb2b236`: $0.627M

### Huobi

- `0xbcb742aadb031de5de937108799e89a392f07df1`: $53.4M

### **Staked in stUSDT (Justin Sun)**

- `0x176f3dab24a159341c0509bb36b833e7fdd0a132`: $52.4M

### **Held in wallet**

- `0x02ed4a07431bcc26c5519ebf8473ee221f26da8b`: $33.3M

- `0x32c98a981fe7c333bd4e8e7630e8e0cf5ce20987`: $30.0M

- `0x8cc2af700d686e7e21135681511992c972dbd8ea`: $30.6M

- `0xf9b43deb017253448eea94ad790db67541487021`: $24.5M

- `0x769952be34f5f9b267e5a467149219e646968bd7`: $16.5M

- `0x817f6e501e640c5efbadbe98bf3f896a694212b5`: $10.8M

- `0x900ca99de58dc581c04f3844b3e56370654dc79e`: $10.6M

- `0x13939d994b1a27753de29adddb56d175e846608b`: $7.8M

- `0xf08600e1de0ae7294ab3e245e433f4121b93c75a`: $7.1M

- `0x29cc23660158f945942dac47a9db1c0177f31c77`: $6.1M

- `0xdc77b2c59db1b02f988e8e08a60fbe9139447cc3`: $6M

- `0xc49515cbce8a5ba7e82b46abf3401400fd94233e`: $5M

- `0xc6f69e100bbb34d3a18caa01d3e2e1ca76214e16`: $5M

### **Migrate to Ethereum v3**

- `0x171c53d55b1bcb725f660677d9e8bad7fd084282`: $63.2M

- `0x06e4cb4f3ba9a2916b6384acbdeaa74daaf91550`: $20.8M

- `0x05bc11f64c6515bb384b05bfd3e0d0424fa65aa4`: $20.5M

- `0x3c9ea5c4fec2a77e23dd82539f4414266fe8f757`: $24.3M

- `0xb748952c7bc638f31775245964707bcc5ddfabfc`: $128M (Migration via Migration Tool)

### **Compound**

- `0xdfcaf20a17521a761036af8a3a758fcdd91dfc07`: $7.3M

### **Binance**

- `0x0082ce7f8a3e3c69e7c5cd801760d40d55ce119c`: $7M

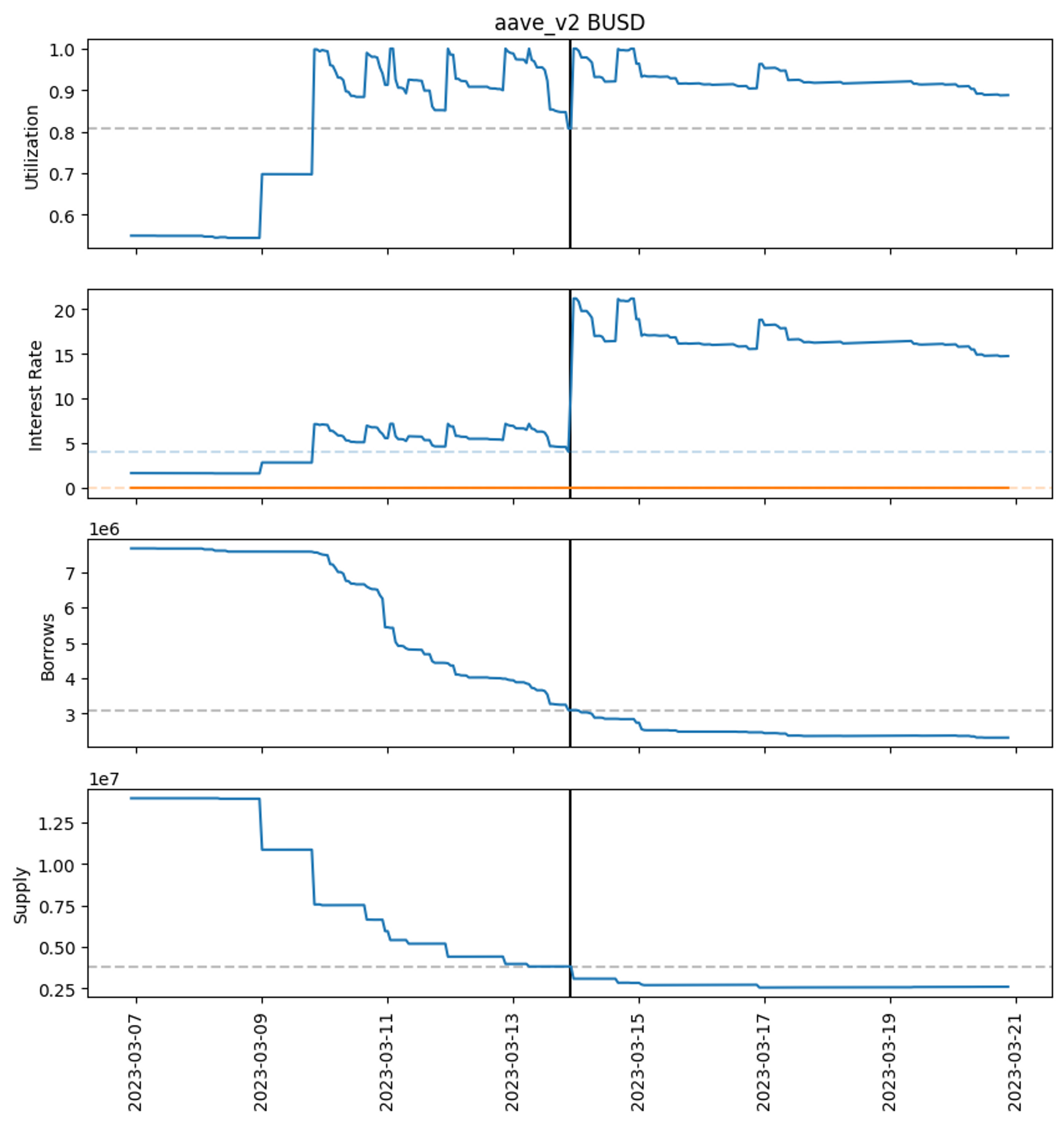

## ******************************************On RF changes to USDT******************************************

- RF changes historically have unclear effects on borrower and supplier behavior.

- Most significant change was BUSD deprecation (RF from 0.1 to 0.999), but was also accompanied by IR param increases.

- Deprecation reached its intended goal in reducing supply and borrow.

- RF change is unlikely to have a significant isolated effect

- assuming RF increase incentivizes suppliers to leave and triggers 100% utilization, the max rate for USDT is 104%, which is lower than loans on Abra (150%)

- RF change directly impacts all other USDT borrower (this account is only 20% of total USDT borrowing)

- USDT suppliers are unable to exit and get lower supply reward to compensate for their added risk