Initial thoughts about potential Ethereum <> ICP integration opportunities - meant as starting point for discussions!

- **ICP with (wrapped) assets** bridged from Eth L1 and Bitcoin

- Canisters for high performant/cheap logic execution

- Smart contracts holding assets on source chain (e.g Bitcoin / Ethereum) and wrapped representation on network (e.g. ckBTC, ckETH or ckERC20xx - ckUSDC?!)

- **Pro**: easy interaction with assets from other L1s, cheaper, faster logic execution

- **Con**:

- **Increases risk for asset holders** (for principle) - e.g. tBTC limited usage on ETH

- tBTC (after 2 years - less then 300 BTC) - https://coinmarketcap.com/currencies/tbtc/

- wBTC (162,000 BTC)- https://coinmarketcap.com/currencies/wrapped-bitcoin/

- **even wBTC & tBTC -> less than 1% of BTC is wrapped ** (after many years)

- **DeFi yield vs. risk to lose principle** (coming from a more secure network BTC -> ETH -> ICP) often not worth it. DeFi yields high usually based on speculation/leverage, no magic way to make safe yield on BTC

- **Complexity with L2s will explode - ckETH-Optimism; ckETH-Abitrum, ckETH-zkSync... + ERC20-xx on each of them, etc. ?**

- **My current conclusion - for discussion**

- Define L2 strategy?!

- Focus on **usecases that require lower risk for the assets**, but have benefits from cheap/fast movement - e.g. ordinals or maybe micropayments using USDC?

- **ICP as EVM sidechain** (with wrapped assets)

- run EVM on a cheaper/faster network (e.g. running EVM rust on ICP subnet)

- often with simple bridges to bring (wrapped) assets from other EVM/non-EVM networks

- Approach similar to many other L1s like Avalance, etc - popular and temp successful on 2021

- **Pro**: reuse of existing Solidity code e.g. Uniswap or Gnosis Safe

- **Con**: demand might be limited in 2023 given alternatives with EVM Rollups (optimistic and EVM) with security model & roadmap aligned to Ethereum L1

- **My current conclusion: **

- Likely easy to implement - worth offering the option, if easy - interest from Eth community likely limited

- Potentially interesting for ICP use cases to leverage battle tested solidty code (and community) e.g. Gnosis Safe for ICP use-cases?

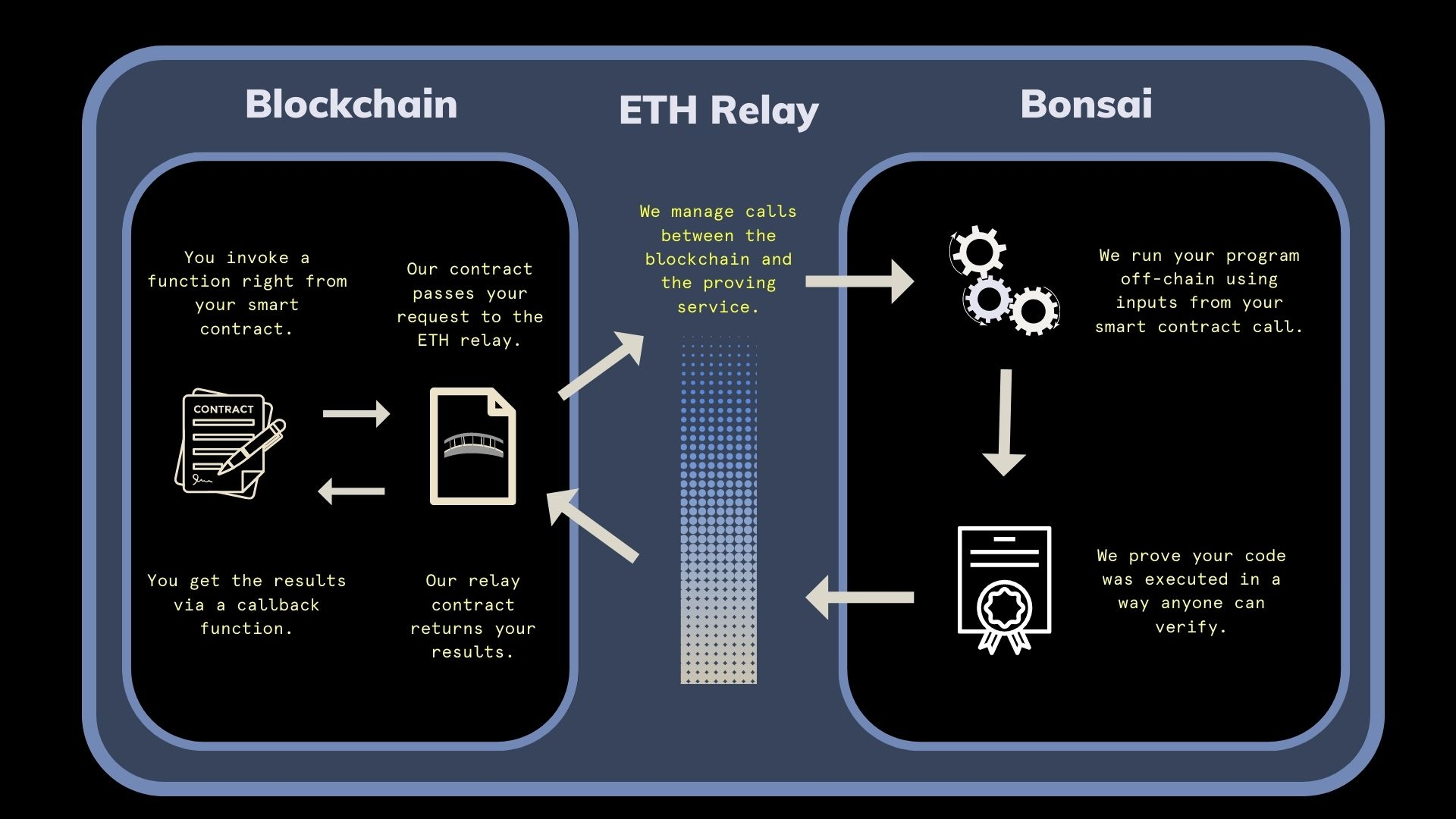

- **ICP as 'co-processor** to **offload certain computation** to a cheaper/faster system

- Risc0, Axiom, HyperOracle (?!) etc. - are building 'zk-processors' for Ethereum (often zkVMs)

- Use a smart contract as interface for developers, place request via smart contract

- Results computed 'offchain' e.g. by zkVM, and result posted back to the chain (with zkProof)

- Bonsai example - from Riso0

-

- Instead of ZK proofs -> ICP as co-processor

- **Pro**

- faster?

- it allows more complex computation

- more data heavy use-cases (e.g. like TheGraph)?

- use-cases with external data source (e.g. risk score based on on & offchain metrics)?

- **Con**: The trust would be to the consensus of the subnet (?!)

- **My current conclusion**

- likely very interesting for certain use-cases?!

- more discussion required, and explore use-cases in more detail

- Question: how hard would build a prototype for this?

- **ICP as to host interfaces for Eth aka programmable wallet**

- Today:

- Mainly Mobile or Browser extension

- Bad UX - seed phrases, not usable on other devices, etc.

- Upcoming:

- **Increased complexity in particular with many L2/L3s**

- Account abstraction / smart contract wallet trend on Ethereum

- Easier interaction without holding assets

- Allows other proofs to unlock transactions?

- Intent signatures instead of transactions big topic in Eth space too, requires different/new wallet

- --> needs & **attention in Ethereum for better wallet solutions**

- **Opportunity - hosted wallet on ICP**

- For 'daily' use-cases (not whales, or large DeFi users)

- Secure UI & great/safe enduser UX (e.g. passkey)

- Cross-L2/L1 (MPC) wallet

- Combined with key rotation / recovery methods & multiSig

- ICP as programmable/flexible MPC wallet with UI in the same 'security zone'

- Question: could Rabby or MM wallet run on ICP? (https://github.com/RabbyHub/Rabby)

- In combination with account abstraction (EIP 4337) / smart contract wallets

- possibility for faster, less costly signature options?

- Use ICP wallet one signer key for Gnosis SAFE wallet (to hold larger assets on Eth)

- Gnosis e.g. can set daily allowances of e.g. 100 USDC per day per key

- Data/Storage

- Store details, configurations, history, etc in a private way for users

- Combine with data for identity use-cases?

- **My current conclusion**

- Most interesting space for now since it could actually solve challenges the Ethereum ecosystem cares about

- Great opportunity to demonstrate the benefits and power of ICP

- ICP needs to establish itself as secure/trustworthy enough to Eth community

- thats why simple/low risk use-cases are likely the best way to get people comfortable (small payments, gaming, etc)

- -> much easier than hold my assets on ICP aka 'DeFi on ICP' ?!

- Question: how to best integrate L2s?

- Question: could a MM Snaps model be possible in the IC ecosystem?