# Pre-Seed Fundraising: A Comprehensive Guide by trustfinta.com

URL: https://www.trustfinta.com/blog/pre-seed-fundraising-a-comprehensive-guide?utm_source=Finta&utm_campaign=1858d5e091-RSS_EMAIL_CAMPAIGN&utm_medium=email&utm_term=0_d46e491551-1858d5e091-614440073

Getting pre-seed funding can be a challenging process, but there are several strategies that founders can use to increase their chances of success. First, founders should prepare a compelling pitch that clearly articulates the value proposition of their business and explains why it's a good investment opportunity. Along with building their financial projection model. Founders should then begin to identify potential investors who may be interested in their business, such as angel investors or venture capitalists. Taking the time to research these investors to determine their if their investment criteria and preferences align with what the company is doing, can make a big difference once you begin outreach to your target investor list. Finding any mutual connections for a warm introduction to the investor you want to meet will unlock more meetings and conversations for the round.

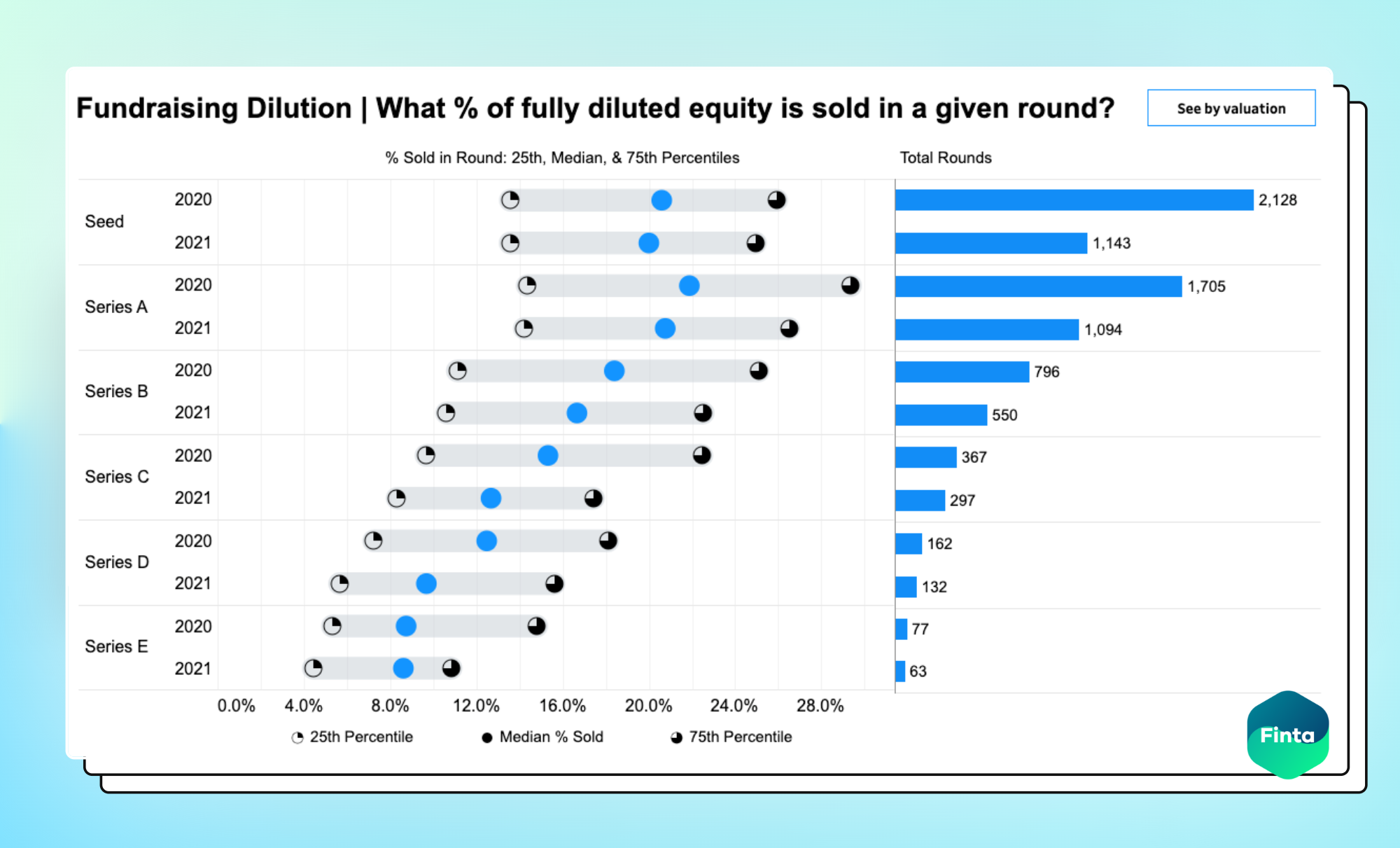

As a general guideline, founders should aim to give up no more than 15-25% of their company at the pre-seed stage, in order to preserve enough equity for future rounds of follow on funding. Below is aggregated data from Carta across 2020 and 2021 showing the average fundraising dilution in a given round.

When considering a potential investment opportunity, pre-seed investors are typically looking for the following:

• **A clear value proposition**: Pre-seed investors want to understand what sets your business apart and why it's a compelling investment opportunity. Your pitch should clearly articulate your value proposition and explain how your product or service solves a real problem in the market. A strong narrative and story around the mission of the company is critical for an investor to emotionally connect with your business.

• **A strong team with relevant experience:** Pre-seed investors want to see that you have a team with the right mix of skills and experience to execute on your vision. This includes a founder or co-founder with a strong track record of success, as well as other team members who bring relevant expertise to the table.

• **A large and growing market:** Pre-seed investors want to see that you're targeting a market with significant growth potential. This means that you should be able to show that there is a large and growing industry for your product or service.

• **A financial model:** Pre-seed investors want to see that your business has been well thought out and has a plan for generating revenue. This typically outlines your revenue streams, margins, and projected growth trajectory.

• **A well-defined go-to-market strategy**: Pre-seed investors want to see that you have a well-defined go-to-market strategy that outlines how you plan to acquire customers and grow your business. This may include details on your marketing and sales channels, customer acquisition costs, and customer lifetime value.

By addressing these key areas in your pitch deck or business plan, you can increase your chances of securing pre-seed funding and setting your business on the path to success.