---

tags: G&R

---

# Episode 182: March 17th, 2022

## Agenda

- [00:00](https://youtu.be/cMLUkPq7RNo): Introduction

- [01:52](https://youtu.be/cMLUkPq7RNo?t=112): Votes and Polls

- [03:40](https://youtu.be/cMLUkPq7RNo?t=223): MIPs Update

- [10:20](https://youtu.be/cMLUkPq7RNo?t=620): Forum at a Glance

- [19:39](https://youtu.be/cMLUkPq7RNo?t=1179): Initiatives Update

- [1:01:01](https://youtu.be/cMLUkPq7RNo?t=3661): Discussion

- [1:18:15](https://youtu.be/cMLUkPq7RNo?t=4695): Open Discussion

- [1:22:54](https://youtu.be/cMLUkPq7RNo?t=4974): Conclusion

## Video

<https://youtu.be/cMLUkPq7RNo>

## Introduction

### Agenda and Preamble

#### Payton Rose

[00:00](https://youtu.be/cMLUkPq7RNo)

- Hello everyone, and welcome. This is the #182 Governance and Risk meeting here at MakerDAO. My Name is Payton or Prose 11 online, and I am one of the Governance Facilitators. I am joined live by a group of awesome Maker people interested in the protocol. We are here to give a weekly update to discuss some of the things going on in governance, some of the risks that the protocol is facing, and answer any questions or concerns by the audience here joining us today. The meeting is being recorded, so try not to talk over one another. If you have questions, feel free to utilize the raise hand feature in Zoom. Then I know I should call on you. You can also drop comments in the chat, and I will be more than happy to read them out if you are unable or otherwise unwilling to hop on the mic.

- Our Agenda Today:

- We will start with the governance round-up go over the votes, Maker improvement proposals, and general goings-on in the forum.

- We have a couple of initiative updates, including the off-chain collateral management, February financials, and a resilience initiative.

- That resilience initiatives should be closely related to Budget management, spending growth, and all that good stuff we have listed under discussions.

- After getting through all that, there will be open discussions if we still have time.

## General Updates

### Votes

#### Payton Rose

[1:52](https://youtu.be/cMLUkPq7RNo?t=112)

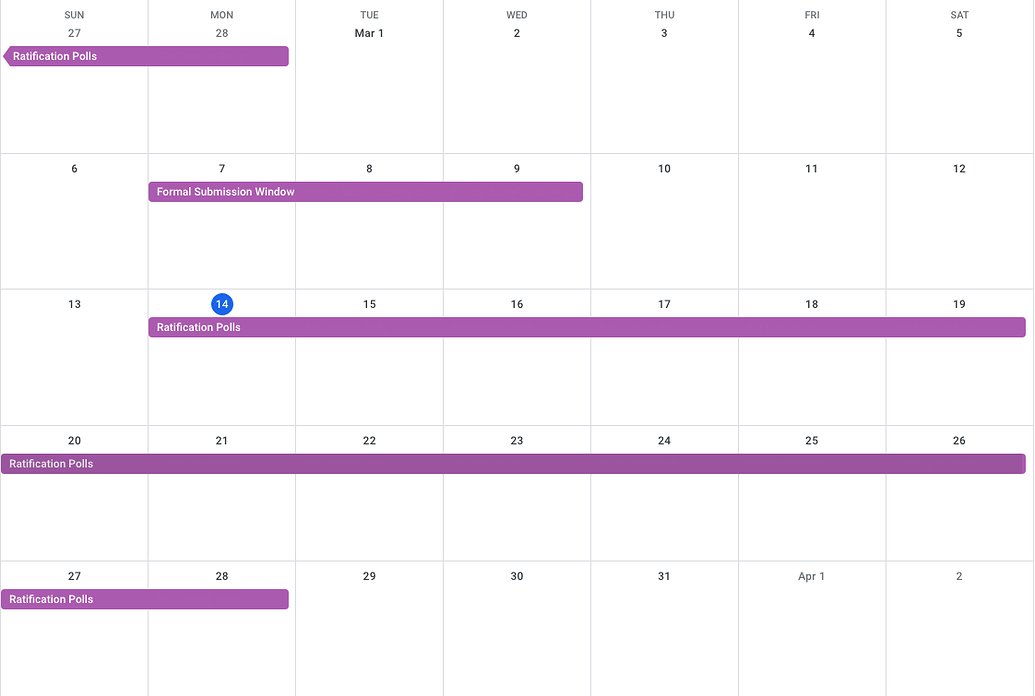

*Polls:*

- 2 Weekly Polls - PASSED

- Fund Ambassadors Program Pilot – PASSED

- Amend MIP64 to clarify critical web bounty amount (MIP4c3-SP1) – PASSED

- 9 Ongoing Ratification Polls to be Covered in our MIPs Update

*Executive:*

- Last Week’s Executive - Passed and Executed

- Curve stETH-ETH Onboarding, Rate Limited Flapper, Immunefi Bug Bounty Payouts

- No Executive Proposal this week!

### MIPs

#### Sebix

[03:40](https://youtu.be/cMLUkPq7RNo?t=223)

[Weekly MIPs Update #78](https://forum.makerdao.com/t/weekly-mips-update-78/13903)

[MIPs General Update](https://youtu.be/cMLUkPq7RNo?t=223)

[MIPs](https://youtu.be/cMLUkPq7RNo?t=247)

[CU Budgets](https://youtu.be/cMLUkPq7RNo?t=286)

[CU Offboarding](https://youtu.be/cMLUkPq7RNo?t=300)

[Amendments](https://youtu.be/cMLUkPq7RNo?t=324)

[Keeper Network Onboarding](https://youtu.be/cMLUkPq7RNo?t=345)

[Declarations Of Intent](https://youtu.be/cMLUkPq7RNo?t=358)

[Proposals In RFC](https://youtu.be/cMLUkPq7RNo?t=379)

[MIPs](https://youtu.be/cMLUkPq7RNo?t=386)

[CU Budgets](https://youtu.be/cMLUkPq7RNo?t=430)

[CU Onboarding Set](https://youtu.be/cMLUkPq7RNo?t=465)

[Amendments](https://youtu.be/cMLUkPq7RNo?t=479)

[Others](https://youtu.be/cMLUkPq7RNo?t=516)

### Forum at a Glance

#### Artem Gordon

[10:20](https://youtu.be/cMLUkPq7RNo?t=620)

Post: [Forum at a Glance: March 10th - 16th, 2022](https://forum.makerdao.com/t/forum-at-a-glance-march-10-16-2022/13977)

Video: [Forum at a Glance](https://youtu.be/cMLUkPq7RNo?t=620)

- _Announcements_:

- [Content for MakerDAO Twitter Account](https://youtu.be/cMLUkPq7RNo?t=630)

- [Introducing the Ecosystem Performance API and Dashboard Objective](https://youtu.be/cMLUkPq7RNo?t=684)

- [The Lending Oversight Core Unit (LOVE-001)](https://youtu.be/cMLUkPq7RNo?t=744)

- [No Planned Executive 2022-03-18](https://youtu.be/cMLUkPq7RNo?t=823)

- _Discussions_

- [Aggressive Growth Strategy](https://youtu.be/cMLUkPq7RNo?t=849)

- [stkMKR: Maker Staking and Tokenomics Revision](https://youtu.be/cMLUkPq7RNo?t=963)

- [Call for Responsible Budget and Process / RFC Budget Request MIP ](https://youtu.be/cMLUkPq7RNo?t=1026)

- _Active Signal Requests_:

- [Promote: "MIP4c3-SP2: MIP62 Amendments" to an on-chain poll](https://youtu.be/cMLUkPq7RNo?t=1097)

- [Onboard D3M For Notional Finance](https://youtu.be/cMLUkPq7RNo?t=1111)

- [Onboard PAXG](https://youtu.be/cMLUkPq7RNo?t=1134)

## Initiatives Update

### Off-Chain Collateral Management

#### David Utrobin

[19:39](https://youtu.be/cMLUkPq7RNo?t=1179)

- _Contents_:

- Milestone 1: Lead existing deals through the due diligence pipeline.

- Milestone 2: Graduate RWA-related CUs from the SES incubation program.

- Milestone 3: Revamp Collateral onboarding pipeline for applicants.

- Milestone 4: Lead Maple Finance through Legal R&D project.

- Milestone 5: Lead Centrifuge through Legal Framework R&D.

- Milestone 6: Publish ALM legal research report.

- Milestone 7: Update existing greenlit off-chain MIP6 applications.

- [Milestone 1](https://youtu.be/cMLUkPq7RNo?t=1230)

- David Utrobin: The first milestone has been broken up into per deal sub milestones. The milestone is to lead the existing deals through the due diligence pipeline that real-world finance effects. And basically, our target dates here were for the end of Q2, and the last time I brought this update to the call, the team was focusing mainly on Monetalis V1, SocGen, and 6S. The assessments have been delivered with Monetalis V1 and SocGen, and the ball is in their court. The status of that is delivered from the real-world finance side. And SocGen, I believe, is still in progress.

- Christian: On the SocGen transaction precisely, in terms of what has to happen, I think two parts are happening now, which is the technical diligence. The CES team ensures that SocGen's token works and how it works within the Maker vault. An exception case for actually, still working through that issue. There were some technical differences between what SocGen had put together and the kind of standard Maker token. But in terms of the contracting itself, there are three agreements. We have been going back and forth with SocGen on two of the three; their counsel has prepared the agreements. SocGen is driving the speed at which documents get ready. It involves making sure that the agreement reflects the transaction outlined and agreed upon with SocGen. It also ensures that some of the legal issues that pop up, based on the structure that we are seeing, are adequately addressed. There was an issue that we were looking into, as to French law, the creation of the pledge, the SocGen holding the keys to its token, and what that meant for transferability of the underlying asset if there was a liquidation. We are working through those issues with the external counsel to make sure that when we put the risk assessment together, we fully understand the various nuances of the token itself and how that token interplays with the underlying agreements.

- David Utrobin: That process you described with SocGen applies to every one of these efforts levels. There is a technical and a legal assessment that has to happen. It is like a volleyball match, going back and forth.

- Christian: To end to a higher level concerning every single one of these transactions, each asset will be different; some will be tokenized, some will not be tokenized, some will be partially tokenized, and some will have Centrifuge. They all bring a different set of issues to the applicant from another jurisdiction. We have to address how we (as Maker) interact to integrate with the real world. It is no longer a Delaware statutory trust situation when dealing with a transaction in a jurisdiction outside of the US. Then, that involves several other issues that need to be considered both by the applicant and ourselves. That is probably one of the biggest issues I deal with: the DeFi real-world integration piece. Each one of these transactions has that.

- Luca: We are doing a lot of heavy lifting that we would expect the counterparties to do themselves in the medium term. We expect them to come up with an application as ready as possible. We are onboarding because we want to do business in the most prudent way possible. We are also pushing counterparties to productize and standardize as much as possible their package on a technological and legal side, that they will come with a set of characteristics that are meet the minimum requirements in our site; that way, we do not have to reinvent the wheel all the time. That is the ambition we are having. We are trying to work for the short term because we know the community is eager to do business with real word borrowers. They are also eager to work for the long term in standardizing productizing. I think we do not want to transform Maker into an old TradFi bank; we want to push borrowers to innovate on the technological side. Everything is running smoother, better, and safer than we were used to in the old world.

- [Milestone 2](https://youtu.be/cMLUkPq7RNo?t=1613)

- David Utrobin: Milestone two is to graduate the three real-world asset-related Core Units from the SES incubation program. I believe the intention is to take the existing real-world finance Core Unit, split it into three, and each has its specific scope. These are the LINC Core Unit (the Lending Incubator), the RWA legal Core Unit (the legal and transaction services Core Unit), and the LOVE Core Unit (the Lending Oversight Core Unit). Combining these CUs effectively splits up the work it takes to take an application from being submitted to being assessed to be integrated. Of course, other teams play a huge role in that. The SES incubation program has several standard steps for each Core Unit. The three of these are all in progress and are in varying stages of being put together.

- [Milestone 3](https://youtu.be/cMLUkPq7RNo?t=1691)

- David Utrobin: Milestone three is a revamp of the collateral onboarding pipeline for applicants. For this one, I will give it over to Monkey Irish for a brief overview.

- Robert: Hello everyone. I know the title might be a bit different from what I suggest because there are multiple Core Units involved in revamping the pipeline for applicants. To give you a very quick update, this is the upcoming revisions to the collateral onboarding process, part of the MIPs that I put into the RFC process is the basis for some upcoming actions. One of them is to update all, both are on, and off-chain greenlit collateral, with an explanation of some additional guidance and parameters that we would like to see to ensure the growth and the health of any collateral that has been proposed as a MIP6. We want to give that publisher of the MIP6 a comeback opportunity and either respond to it, update their MIP6, or maybe even withdraw that. We are talking about some very basic parameters. How much Dai can be generated? Is there liquidity in the market for this particular instrument? Are we working with key stakeholders in the community to ensure the parameters? Nikola is working on the parameters inside the CES group to ensure we have plenty of feedback from the CU before we go into the forums and post that. We are talking about the April time frame to do this because it will generate a lot of activity and chatter in the forums. We just want to be very careful that we have the necessary CUs lined up to be able to answer questions. And as part of that, to tack on to something that I think Luca was talking about, I would also put another action to set expectations and clarity on what is possible today, as it relates to the proposals that are being made for real-world assets onboarding. We do have tech today. I want to make sure that we are clear in the community the mechanisms that we have available to us. We would love to see some proposed mechanisms in the future, but some work needs to be done before we get there. Again, there are realities and expectations that we just want to set to let everyone know if we decide to onboard a piece of collateral, the process by which we would do that today.

- [Milestone 4-5](https://youtu.be/cMLUkPq7RNo?t=1875)

- David Utrobin: Milestone four and five are both very similar. One is to Lead Maple Finance through an ongoing legal R&D project and similarly Lead Centrifuge through an ongoing legal framework R&D project.

- Christian: We have just gotten started on the Maple Finance one and Centrifuge; we have made a little more progress. I think Centrifuge posted something recently. We are now just discussing the agreement—and just trying to make sure that the points that the community raised in the past concerning Centrifuge and its improvements to the overall structure of their transaction are being addressed.

- [Milestone 6](https://youtu.be/cMLUkPq7RNo?t=1926)

- David Utrobin: Milestone six is to publish an ALM asset-liability management legal research report.

- Christian: This one is trying to find the first time to bring on new assets to replace the USDC. Again, the real-world DeFi touchpoint is locked right now. We are just looking for various keys to unlock that. We are having discussions with various people. Frankly, the more conversations we have with people, the better understanding we have of counterparties issues, and I feel more confident that we will find that key. Still, as Luca would say, it is the first time that has ever been done, so it is not something that you can necessarily rush into. We want to make sure that it is done right.

- [Milestone 7](https://youtu.be/cMLUkPq7RNo?t=1994)

- David Utrobin: Milestone seven is to update the existing greenlit off-chain, MIP6 collateral applications with the status update, which Robert already alluded to. It is part of our milestone three throughout the overall process. Milestone seven is to provide an answer to all the existing applications that are waiting to hear back. That is about it for the collateral management off-chain. If you have any suggestions on how we can improve our brevity or the level of depth you would like us to cover for any of these, please let us know.

### February Financials

#### Aes

[35:02](https://youtu.be/cMLUkPq7RNo?t=2102)

- Before talking through the Cash Burn Analysis, we will cover the financials.

- In February, the protocol revenue decreased by 75% compared to the prior month, driven by nearly a 100% reduction in liquidation income.

- Our net interest income was down 34% compared to the prior month.

- Workforce and Oracle Gas expenses were down 17% and 60%, respectively. Note that the workforce expenses reflected on-chain flows might not reflect the actual cash burn. Please reference the [expense reports](https://forum.makerdao.com/t/makerdao-actual-expenses-vs-budget-january-2022/13720) posted on the Forum to find this information.

- Recurring income was down 38%, and lending markets continued to take a beating through mid-March. We started to see signs of life the past few days in collateral prices. Hopefully, this trend will continue.

- Here is a waterfall chart breaking out the month-over-month change in recurring net protocol income.

- As we all know, risk-weighted assets have continued to unwind for several months. Yields have decreased as well. We have taken a significant hit to the bottom line. Lower workforce and Oracle expenses are not enough to offset the large decreases in the change in assets and yield.

- I would like to address the ETH Lending Market Share on level one.

- This chart shows the past six months of the ETH Lending Market. As you can see, we have been essentially in a bear market since October.

- Compared to last month, ETH lending markets retracted 6%, and we are down 14% from November, with Maker losing 13% of the share from January and 15% from November. We are trying to dig into these numbers to better understand where this ETH is going. Whether it is into staked ETH, as we've recently opened those wallets, and so has Aave for deposits, or if it is users unwinding due to bearish crypto market conditions.

- Next, I would like to introduce you to Adrian, also known as _adcv_ on the Forums. He will be presenting a cash flow analysis and opening up a discussion around budgeting, given the recent [Forum](https://forum.makerdao.com/t/rfc-budget-request-mip-break-on-going-from-expansion-budget-requests-budget-polling-to-rcv/13877) [activity](https://forum.makerdao.com/t/call-for-responsible-budget-and-process/13816).

- Adrian recently joined the Strategic Finance Team as a CEO and General Manager and M&A Investment Banking at Goldman Sachs.

#### Adrian

[37:50](https://youtu.be/cMLUkPq7RNo?t=2270)

- Hello everyone. I am pleased to come on board, and I look forward to meeting you all. I am sorry to jump in with a grim subject like MIP budgeting, but I have to start somewhere.

- We want to highlight the conversation that has been happening in some of the Forum posts.

- There has been plenty of frustration with the lack of clarity in how we accept the budgets and the processes involved in doing so. Particularly the frequency with which they arise on the Forum; they are sporadic and try to fit the Governance windows.

- It can be overwhelming for MKR Holders and Delegates to evaluate this diligently.

- As a result, we have decided to do some back-of-the-envelope simulations, and we wanted to show you the results and conclusions.

- On this slide, we show a simplified P&L focusing only on recurring items, excluding liquidation and training.

- From top to bottom, we start with assets. Net Portfolio Yield brings us to revenue, excluding liquidations and trading fees. Then, Core Unit Operating Expenses and Oracle gas to get the recurring Net Protocol Cash Flow.

- The line below the yellow row shows what this would look like if we approved 100% of the proposed new Core Unit expenses. Lastly, we present a hypothetical increase in Core Unit expenses related to customer acquisitions. This is something in which some of our competitors engage, but Maker does not. However, it may engage in the future.

- From left to right, we have illustrated various scenarios--ranging from bull to super bear--and the impact these might have on the protocol cash flow. These show the size of the asset exposure relative to today.

- We are assuming long-term yield comparison as competition intensifies, and we believe that 2% Net Portfolio Yield will decline across each of the increasements, with no scenario in which they will trend back up.

- We presume Oracle gas scales with the size of the assets in the protocol, which may or may not be completely true, but we have tried to come up with a heuristic, and in any case, gas is not one of the main cost-drivers.

- I would like to focus on a few takeaways from this slide.

- Firstly, our operating environment is highly volatile. That is very likely to appear in any of these scenarios; it is still early in the adoption group and in a stage where things move in fits and starts, rather than continuously pumping an s-curve style of growth.

- Secondly, we also want to highlight the impact of ongoing operating expenses on the profitability and sustainability of the protocol. The key message here is that adding operating costs makes cash flow more sensitive to environmental changes.

Sebastien is noting that we excluded stock-based compensations in a very start-up fashion. Maker expenses are not in this table, but they would come on top.

- There are two distinctly different types of risks we would like people to take away from this slide regarding the exposure that our protocol faces.

- The first one is being caught off-guard with high operating expenses, yielding little business results when conditions deteriorate.

- The second one is the opposite: being caught off-guard with low investments in growth in an environment where the market is pumping and then lagging behind our competitors and losing share.

- We summarize these two risks as insolvency--which has happened once before to Maker--. There is also the risk of being flipped by a competitor with an income and position against which Maker should be defended and invested.

- With this context in mind, we want to loop back to some of the concerns that members of the community have raised regarding how we manage operating and expense budgets for Core Units; bearing in mind that we want to be flexible enough to mitigate both of the risks: under-spending and over-spending.

[42:53](https://youtu.be/cMLUkPq7RNo?t=2573)

- We would like to go over some of the risks we mentioned earlier--insolvency and flippening--, and the problems we face in terms of positioning the protocol to mitigate them.

- With insolvency, it appears that the budgeting process is broad and lacks structure. Budgets can be proposed haphazardly at any time and for any amount, without considering overall DAO expenses or how that Core Unit might have performed in the past, or whether that specific activity is a crucial need for the protocol moment.

- Once approved, Core Units have no formal expense reporting requirement. At least not in a standardized way. Therefore, the DAO has minimal visibility on how its funds are spent. There is no formal accountability. It is easier to onboard than offboard, as seen with the MakerDAO Shop.

- To resolve this, we would like to propose budgeting principles that aim to do two things:

- First, helping Core Units remove cognitive overhead when it comes to managing reports. We want CUs to focus on Maker, being a DAO, and their roles as CUs. Thus, minimizing the amount of time spent on paperwork.

- Second--and most important--, equipping MKR Holders and Delegates with the best and most timely operating plans and financial information to make decisions.

- Both of these principles are focused on another set of four main ones:

- Each Core Unit investment should drive new revenues and/or help support the business effectively. In the absence of vowel objectives, or an executive team that can coherently set this direction, an easy way of testing this principle for each investment is asking the questions: are we adding, at least, the amount of revenue that the expenses are increasing? How does this investment support operational efficiency, growth, or user satisfaction?

- Dollar thresholds are used to measure the impact of the change in the budget.

- A little financial transparency is better than nothing, and more is better than a little. We would like to encourage all the Core Units to be as transparent as possible, as it is already part of the Maker culture.

- Flexibility to respond to changing macro environments.

- These two key risks move in either direction. The protocol and CUs need to be prepared to react in an agile way to both scenarios. We want CUs to think 5%, 10%, 20%. What is the minimum that you need to get the job done? What would you need extra in case the market turns? How much can you scale back the expenses in the event of a super bear scenario?

- To summarize, we are aiming to:

- First, DAO-wide organizational goals that support the strategic focus areas. There is a general sense of overall motivation and direction. Nevertheless, there are still numerous conversations about the lack of an on-paper strategy that everyone is striving towards in the same direction. This is probably part of the challenge of being a DAO, but having these organizational goals in mind would be helpful.

- Second--in practical terms, this is something that we can help solve faster--, a budgeting process with a more robust MIP40, with defined budgeting periods and a way to align them with these organizational goals however they might be defined.

- Clear, transparent, standardized, and timely financial reporting.

- A way to measure Core Unit performance and alignment with the mind that MKR Holders have entrusted with them.

- To close out on this topic, in terms of the next steps, the Strategic Finance Team is picking up this mantra of having a bias for action. We are keen to do things, rather than doing less, in communion with the spirit of Maker mentality. We want to take advantage of this G&R call to produce a broader discussion and get preliminary ideas. Next week, we would like to submit a first draft proposal to further discuss this subject. Meanwhile, if you have any thoughts or comments, we are always available on Discord.

- Will mentioned auditability. Who guards the guardians? This is the kind of discussion we wanted to stimulate in this call.

- Thank you for your time. Nice to meet you. I'm sorry I had to take part, as a first appearance, in this serious set of slides. I look forward to interacting with more of you in the future.

[47:56](https://youtu.be/cMLUkPq7RNo?t=2876)

- Aes: Next time we have you present, it will be about Maker numbers going up.

- Adrian: It would be my pleasure.

- Aes: This is a tradition. When I first presented financials, the price was quite down, if I remember correctly.

- Aes: Thank you, Adrian. To tie a bow on this, we know many people, Sustainable Ecosystem Scaling included, who are working on these types of initiatives already. There is plenty of collaboration going on behind the scenes.

- SES presented its performance update on this call, which is also in the pipeline.

- I think we are moving towards a better place in terms of transparency and accountability for the entire DAO. I am excited about that future. We are trying to continually take one step at a time to keep getting better.

- Payton Rose: I appreciate the presentation. I know we have not had too much time for discussion. Hopefully, we will have some at the end of the next one. Resilience does speak well about some of the things we just talked about. I will go ahead and hand it straight over to Wouter, I believe.

### Resilience Improvement

#### Wouter

[49:18](https://youtu.be/cMLUkPq7RNo?t=2958)

- Thank you, Payton. Indeed, resilience is related to building upon what Aes and Adrian have presented.

- First, I want to set the context to why we are starting with this strategic initiative and all the discussion and budget flexibility aforementioned apply to the SES activities.

- Planning the on-set for season two of our Incubation Program with changing market conditions is difficult. It is almost nine months that you need to look into the future. Given the crossroads we are at, it could go in any direction.

- We need strategy and structure around that to be able to fit everything in.

- I believe it was monkey.irish who posted on the Forum asking questions like: Is MakerDAO a start-up, or are we supposed to be an established organization? How are we funded?

- On the other hand, there are the checks that we want to put in place for expenses. There is a need for continued growth. What does sustainable growth look like? What will MakerDAO look like in a year? Those questions arise as well.

- Our current approach is flexibility and resilience. We are staying on course with what I call _contingency add-ons_, meaning that we are not canceling everything. That might be overreacting.

- We would rather keep working on the Incubation Program with support from minimum viable operations. This is in line with the consideration about what is the minimal cost with which you can operate

- Remaining flexible in terms of scaling parameters, we will not make any sweeping decisions about the number of Facilitator candidates or the number of Core Units that would graduate. At least not sooner than is needed.

- We want to support a budget-neutral scenario, which means the existing budget of the SES Incubation Program--which is completely separate from our permanent team budget--could carry over to the new independent CUs even when they graduate; ergo, the total is net-zero, we can do that without extra cost for the DAO.

- These are SES-specific concerns related to more general worries that have appeared in the DAO.

[52:44](https://youtu.be/cMLUkPq7RNo?t=3164)

- Considerations on operating expenses and sustainable growth amplify the need for a broader strategy and vision in the DAO. Delegates should support this.

- This has been a challenge from the start. Now that we are at this crossroads, it becomes extra important; Evaluating, approve or reject a budget dependent on strategy and vision.

- Subject to the scenario and the direction in which you want to go, the same budget might or might not make sense for a Core Unit.

- Several projects are going on to improve these things. Nevertheless, when looking at the whole set and connecting it to the bigger picture, we believe there is an opportunity to improve our coordination mechanisms.

- We already have several structures in place. We have our MIPs--39, 40, and 41--that define the Core Unit framework.

- We have strategic initiatives as another element to coordinate and bring structure to the DAO.

- These initiatives contain the fundamental roadmaps and OKRs to make reporting on deliverables possible.

- We hope that one day, all of this will result in a broad strategy and vision that we could collaborate on with the Delegates.

- We want to add this new strategic initiative: the Resilience Improvement Strategic Initiative.

- We want to have a plan for all these different scenarios, and we want to make sure that we know how to scale our operations up and down.

- We believe that this additional challenge that we have put before is an opportunity to explore how we can synthesize an emergent strategy and vision with the Delegates. That should be an interesting experiment to coordinate.

- Several ideas have been brought up on how we can improve the issues we face. We want to make sure to bring them all together and that they fit into a broader strategy.

- As Adrian mentioned before, this would be with an iterative approach, where we can combine quick action with longer-term alignment.

- For this initiative, contrary to existing ones, the stakeholders would not include relevant Core Unit representatives only, but interested Delegates as well.

- We will be reaching out to recognized Delegates and asking them to which extent they would like to participate. In the beginning, we will be acting as the initiative Facilitators, at least until the groundwork is set.

- We will hold regular stakeholder alignment meetings, similar to the ones we have for the other strategic initiatives. However, we will go through the entire process, from the problem description to the solution. This would be wider than what we are used to, coordination around building solutions.

- We will try to combine the solutions we come up with as a coherent roadmap within a coherent strategy. Since we are a decentralized organization, we will be open to the possibility that there might not be a single strategy but competing strategies. We are keen to explore this and see how we can deal with that.

- We want to keep things as transparent as possible. There is no reason to limit transparency in any way.

- We already have a Discord channel similar to the other initiatives, called #resilience-stakeholder-alignment. To ensure full transparency around the discussions, we are having, the channel will be available for all MakerDAO members.

- Coordination calls will be open for anyone who wants to join. These will also be recorded for people who cannot join due to, for example, time-zone incompatibility.

- I believe that is all for the presentation.

#### Payton Rose

[1:01:01](https://youtu.be/cMLUkPq7RNo?t=3661)

- Thank you, Wouter. I am sorry that those three things we just presented took some time, but they are intricately related. We will now have an open discussion about the topics we covered and finance-related thoughts, and the general future for MakerDAO.

## Discussion

- It would be logical to ask if there are questions or clarifications needed for any presentations.

- David Utrobin: What is the timeline for redesigning MIP40, which guides the Core Unit budget proposal process? Is Strategic Finance going to lead that revision?

- Aes: Yes. We are working on a revision that we plan to post by next week.

- Payton Rose: Back in the Finance presentation--and I do not know if Mark or Adrian would be ideal to answer this--you mentioned that in broader lending markets, there had been pullback. It is not just at MakerDAO. Can we go over the potential causes or reasons why we might be seeing that?

- Aes: Broadly, a lot of it is due to the crypto market going down the bearish trends. The price on most crypto assets is down from Q4 2021.

- Most recently, due to the conflict in Ukraine, the markets have been even more skittish, and I think people are more concerned about their investment decisions. To the extent that people are leveraging assets through Maker and might be taking more conservative approaches.

- We are also starting to see fundamental changes in the market. L2s and side chains are picking up, as well as staked ETH. These are big trends. We see tons of staked ETH flowing to Maker, and I think that trend is likely to continue. Especially after the merge, staking proliferates to a much higher degree.

- We started to see a little price relief in the past few days, but I am not ready to call that a trend. Perhaps things might turn around.

- One thing we are looking at is segmenting customers based on their debt size.

- Largest vaults have brought down their exposure more relative to smaller ones. I am talking about ten million or more size vaults.

- We are trying to do some on-chain analysis to understand where the ETH is flowing and get to the bottom of it, but we are just in the initial stages of that research.

[1:05:04](https://youtu.be/cMLUkPq7RNo?t=3904)

- Frank Cruz: I have a question for Mark regarding how you manage the balance sheet and present it to the community. How do you account for the vesting budget and Dai, which is locked up in the auditor's wallet? How does that fit into the whole outlook in the MKR burn that you presented a few minutes ago?

- Aes: We are not considering the cash balance that each Core Unit has. We are looking at the draw from any other wallets into CU operational wallets.

- One thing we are looking at is the actual burn, money flowing out of those operational wallets relative to the budgets that have been approved. We are underspending those budgets by a significant amount, as you have probably seen. Despite this, we need to have clarity and confidence in how that cash flow will increase.

- This is why we started to do these off-chain/on-chain reconciliations since we are not going through a formal accrual process.

- There is a buffer measured in our balance sheet. We have a surplus buffer plus the cash balance in those other wallets, which is not in the Maker protocol itself. If you look at the surplus buffer on MKR burn, it does not include those other balances, but our financial statements do.

- Frank Cruz: How does a subsidiary--someone like KKR or J.P. Morgan, who has a hundred different subsidiaries--report their earnings when, say, J.P. Morgan's Vision Fund number two is sitting on two hundred million in cash? I am trying to understand how subsidiaries are reporting these to the public markets.

- Aes: Generally, subsidiaries will consolidate into the parent company, but it depends on how much of the subsidiary the parent company owns. Sometimes there are equity investments: if it is greater than 50% ownership, it will consolidate like the pro-rata financials from that subsidiary. If it is less than that, it might account for equity investment on their balance sheet.

- Frank Cruz: Got it. I guess we are not looking at Core Units as subsidiaries, right?

- Aes: Right. I assume that funds in these auditor wallets are still technically controlled by the DAO and the protocol.

- Adrian: About making sure that budget reviews will not be taken personally, we have noted on the conversation in the Forums how heated and emotional it can get.

- Our diagnosis of this is precisely the absence of an objective structure framing budget proposals in the first place. It becomes harder to evaluate things objectively or even right when things are implied.

- Our aim with the revised MIP40 is to bring clarity and, as we mentioned earlier, remove the cognitive overhead for the person submitting the budget so that they do not have to think twice about how to write it in the first place. And so that they can ask themselves the questions: Is this driving revenue? Is this effectively supporting the business? And secondly, for MKR Holders and Delegates to evaluate this as clean, objective, and impersonal as possible.

[1:09:41](https://youtu.be/cMLUkPq7RNo?t=4181)

- MakerMan: In my post, I brought up the idea of segregating operational expenses or critical operations from growth.

- Every organization I have ever been in has distinct segregation on that, and they do status updates: Am I a growth company? Do I have money? Can I grow, or am I in operations mode, trying to get to a place where I can get revenue to do something new?

- The point is that budgets are ultimately the centralizing constraint for an organization. That is a thing we are going to have to deal with.

If you have autonomous people on autonomous CUs that are going to coordinate to do something, you might want to think about enabling them to drive revenue; and ensure their budget requirements from a particular player can be mitigated to some extent. I do not see anybody talking about that, although we are starting the process here. I think that discussion will continue.

- We have got several MIPs, including MIP 6s, that we have done--for Strategic Finance to review and determine which ones led to revenue and its cost.

- Many of these did not lead to revenue, but there is a whole lot that did. Considering that information, we can determine where to focus our energy and what will be a waste of time for the DAO. At least to get the first shot at that.

- These are the things I am considering. In the meantime, I am figuring out how to do coordination around funding and initiatives. I see several CUs doing their initiatives--that is great--but they have to come back and be coordinated. We need a process to tighten that up. That is all I have.

- Aes: I am eager to see a performance evaluation, KPI, and ROI, introduced in the DAO and evolving. Going back to this iteration, we are trying to move forward quickly because little is better than nothing, and more is better than little.

- At a point where we have twenty Core Units and over a hundred contributors, we can start putting together some of these activities and rolling the ball.

- There are priorities for the DAO as a whole and plenty of things that need work, but, given the structure, I think having accountability is crucial. There is plenty of trust going out to contributors. We need to ensure that MKR Holders and their interests are reflected and accounted for.

- We are also in a position where markets have been bearish, cash flow has been declining. We may need to make some tough decisions. If we do not have any process to help facilitate decision-making, it will be messy.

[1:13:53](https://youtu.be/cMLUkPq7RNo?t=4433)

- Tim: I will chime in, but it would just sound like echoing. Mainly, I like the idea of not only tying everything to P&L because that would give us a granular focus that will be tied to market sentiment.

- To Wouter's point on the Forum, I think we need room to take bets and experiment on things. If we do not iterate towards the future we want, what is the point?

- My main contribution, I would say, is to let Core Units that may not be able to tie back to profits start to think about how their initiatives are driving value and think more holistically.

- David Utrobin: That is something that my Core Unit, Governance Communications, struggles with a lot to defend because we do not drive revenues directly. Our impact is more on the stakeholder/user experience side of things. Not just how things get tracked at MakerDAO and how CUs work together on various initiatives, but also how external stakeholders--just investors--can have access to the happenings of MakerDAO: What kind of reports are we putting out? Where do we put them out?

- It is indirect. We do not drive revenue, but we believe ourselves to be very impactful for the day-to-day business operations.

We set KPIs for the team as a whole, our team members, and even our programs. But this is something that is not as easily quantifiable. We see it more as a qualitative matter. Nevertheless, this is something that we are certainly thinking about.

- Artem Gordon: I will quickly add a comment on David's point. Overall, yes, it is true. There are very negligible ways to get a little bit of revenue through publications, but it will not be much. It is something I have been looking into.

- Wouter: I wanted to add to what Tim was saying. It is especially difficult to make calls about budgets and the usefulness of a particular Core Unit if they are not directly driving revenue. If they are, it is an easy decision. You immediately get more by voting them in. If it is a supporting Core Unit or a Core Unit that is valuable in another way, you need a strategy and a vision to fit that in.

- That is where the CUs that are cost leaders, in certain strategies and visions, might make sense, whereas, in other scenarios, they might not. With the new Strategic Initiative, we hope we can help figure out that connection to formulate that emergent strategy we discussed and make it possible to base decisions on that. Numbers and ROIs are not enough. Some things are long-term, some things make sense when following a certain strategy and a vision. We need to be able to express those things as well.

## Open Discussion

[1:18:15](https://youtu.be/cMLUkPq7RNo?t=4695)

- Aes: I want to put some closing thoughts on this ROI versus non-ROI support versus revenue-generating Core Units.

- One thing that we do not discuss enough is the perspective of the Vault users; the customers of the protocol, the people driving the revenue, the cash flow, everything.

- We need to focus a lot more on that perspective--purely like a product perspective--and get growth from those customers. Sometimes we spend our time talking about other things that can add value, do not add value, and do not cost money.

- One important thing is: does Amazon invest in the supply chain because it makes them money? It does not make their money directly, but their supply chain has become a model. How efficient are they shipping packages all over the world, and why?: Because customers love free and fast shipping.

- If we make investments that make the customer/user experience better, that will create value. Even if it is not someone from Growth finding an institutional client, people are naturally drawn to the protocol because it is a purer product than what is on the market.

- We need to have a stronger focus on that area. I am not exactly sure about what metrics we can use to track that at this time, but this is something I would like us to think about more.

- Wouter: That is a good example. The decision is to build that model. When you start building it, you cannot be sure that it will work. You can calculate the hypothetical ROI, but still, there are many things that Maker could do that might be profitable in the future. We do not want to do _all_ these things, so which ones will you do and which things will you not? You need strategy and vision to determine what is in scope and what is not. I think that very well illustrates the problem.

- Payton Rose: Awesome. I appreciate all the points in the Chat. I want to thank you all for staying engaged.

- I have seen many comments like "we should try this" or "we should do this." It is probably a good time to remind you that this is a DAO: if there is something you see that you think would be beneficial, you can do it. We encourage you to take ownership, post things transparently, and engage with the community.

- I appreciate everyone on the call. We are wrapping up. This is the last chance to hear your comments and questions.

- David Utrobin: Another subject that we have not touched on in this conversation, but Sam and that group that posted their strategy for [aggressive growth](https://forum.makerdao.com/t/aggressive-growth-strategy/13958) touched upon, is a capital raise. They are proposing Maker should consider this.

- Typically, people think that the only way Maker can raise capital is by selling MKR or increasing revenues, but Sam makes an excellent point: we can do so with debt. And not only that but there are also more innovative mechanisms that we could build into a capital raise—for example, raising debt/capital from customers--like Vault users and Dai users--and giving them special privileges in the process.

- Beyond just having capital as a result of revenues, I think stakeholders should consider this idea of a capital raise.

## Conclusion

#### Payton Rose

[1:22:54](https://youtu.be/cMLUkPq7RNo?t=4974)

- We seem to be naturally winding down. I am unsure if that is due to the time or people running out of things to say, but I appreciate the conversation. Special thanks to everyone who presented today. As usual, we will be back same place, same time, next week. Thank you, everyone, for joining.

[Suggestion Box](https://app.suggestionox.com/r/GovCallQs)

## Common Abbreviated Terms

`CR`: Collateralization Ratio

`DC`: Debt Ceiling

`ES`: Emergency Shutdown

`SF`: Stability Fee

`DSR`: Dai Savings Rate

`MIP`: Maker Improvement Proposal

`OSM`: Oracle Security Module

`LR`: Liquidation Ratio

`RWA`: Real-World Asset

`RWF`: Real-World Finance

`SC`: Smart Contracts

`Liq`: Liquidations

`CU`: Core Unit

## Credits

- José R. Jiménez produced this summary.

- Constanza produced this summary.

- Larry Wu produced this summary.

- Everyone who spoke and presented on the call, listed in the headers.