---

tags: Monthly Core Unit Updates

---

# November pt. 2

# Monthly Core Unit Updates (Thread)

### November 2021

# Risk

## **Risk Core Unit Month in Review: November 2021**

[Monthly Updates](https://forum.makerdao.com/search?expanded=true&q=%23risk-001%20Month%20in%20Review%20in%3Atitle)

This post summarises the tasks, work, and activities of the [@Risk-Core-Unit](https://forum.makerdao.com/groups/risk-core-unit) for the month of November. Our primary focus this month is outlined below.

This month we have investigated three new vault types, a WBTC-B vault, a PSM-GUSD-A vault, and a WBTC-C vault. The [WBTC-B risk assessment](https://forum.makerdao.com/t/wbtc-b-collateral-onboarding-risk-assessment/11397) was published on November 3 and onboarded on November 22, after the [executive](https://vote.makerdao.com/executive/template-executive-proposal-onboarding-wbtc-b-increasing-wbtc-a-stability-fee-change-of-covenants-for-p1-drop-offboarding-collaterals-november-19-2021?network=mainnet#proposal-detail) passed. The [PSM-GUSD-A risk assessment](https://forum.makerdao.com/t/psm-gusd-a-collateral-onboarding-risk-evaluation/11559), as a response to the GUSD PSM proposal from Gemini, was published on November 10. The [executive](https://vote.makerdao.com/executive/template-executive-vote-onboarding-new-vault-types-parameter-changes-and-core-unit-budget-distributions-november-26-2021?network=mainnet#proposal-detail) containing the PSM-GUSD-A passed on November 26. Finally, proposed risk parameters for a [WBTC-C vault](https://forum.makerdao.com/t/proposed-risk-parameters-for-wbtc-c-vault-type/11707) were published on November 18. These were also part of the executive vote which passed on November 26.

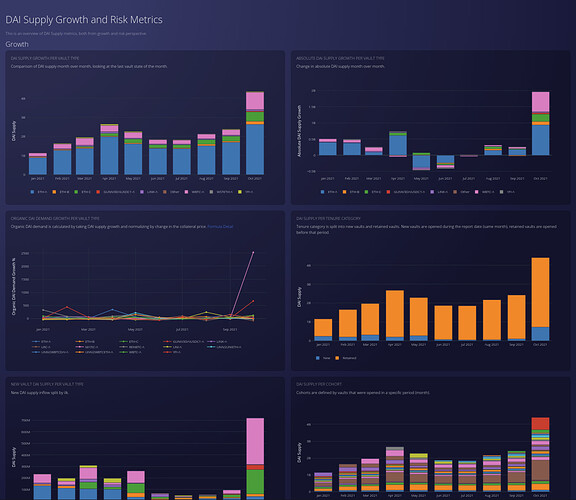

We have introduced a new [initiative](https://docs.google.com/presentation/d/1M41o6EpYKTSykNRmiReju_kEeSmY7vzaaKnLsV1xJ78/edit#slide=id.p) that aims to track DAI supply growth and risk metrics. These metrics are meant to be included in the KPI Framework as part of the [Monthly Strategy Review](https://forum.makerdao.com/t/monthly-strategy-review-process-review-discussion-public-call-on-10-26-21-1-30pm-utc/11183). We have also included these metrics in the [MakerDAO Risk Dashboard](https://maker.blockanalitica.com/dai-supply-growth/) website.

A Dust Analysis and Signal Request was posted on the forum. The Signal Request queried the support for increasing the dust parameter for different Maker vaults. The poll closed on November 25. The results can be seen [here](https://forum.makerdao.com/t/signal-request-adjusting-dust-parameter-2021-4/11598). There are currently two active on-chain polls on increasing the dust parameter: (i) [increasing the dust parameter for ETH-B](https://vote.makerdao.com/polling/QmZXnn16?network=mainnet), and (ii) [increasing the dust parameter for all vault types excluding ETH-B and ETH-C](https://vote.makerdao.com/polling/QmUYLPcr?network=mainnet).

Several proposals have been posted this month, including: (i) increasing debt ceilings for different vault types (GUNIV3DAIUSDC1-A, Staked ETH, and Aave D3M), (ii) decreasing the target borrow rate for Aave D3M, (iii) auction throughput parameter adjustments, and (iv) offboarding collateral parameters. More information about these proposals are set out below.

Two Risk Core Unit members, [@Primoz](https://forum.makerdao.com/u/primoz) and [@monet-supply](https://forum.makerdao.com/u/monet-supply), are part of the MakerDAO Open Market Committee. Due to the increased use of WBTC as collateral, the committee proposed to increase the SF from 2.5% to 4% for WBTC-A and from 5% to 7% for WBTC-B in a [mid-month parameter changes proposal](https://forum.makerdao.com/t/mid-month-parameter-changes-proposal-ppg-omc-001-2021-11-10/11562). These changes were part of the [executive](https://vote.makerdao.com/executive/template-executive-proposal-onboarding-wbtc-b-increasing-wbtc-a-stability-fee-change-of-covenants-for-p1-drop-offboarding-collaterals-november-19-2021?network=mainnet#proposal-detail) that passed on November 20. The [end of month parameter changes proposal](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825) includes proposed changes such as: (i) increasing the stability fee for ETH-A, ETH-B, LINK-A, MANA-A, UNI-A, GUSD-A, and Uniswap V2-LPs, (ii) decreasing the stability fee for GUNIV3DAIUSDC1-A, and (iii) increasing the debt ceiling to 2000m and increasing gap to 80m for WBTC-A. The proposed changes are currently included in an [on-chain poll](https://vote.makerdao.com/polling/QmNqCZGa?network=mainnet#poll-detail), and if passed, will be included in the executive vote on December 3.

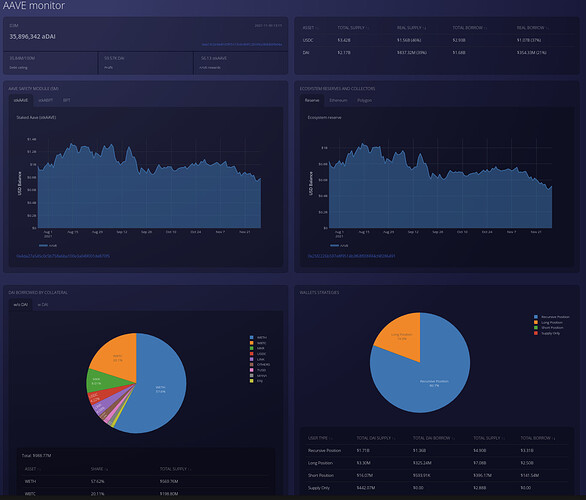

Finally, several updates and improvements to the [MakerDAO Risk Dashboard](https://maker.blockanalitica.com/) were undertaken, such as: (i) improvements to the AAVE monitoring dashboard, (ii) an improved vault protection score model, and (iii) the option to search vaults by user wallet address/vault id. More information about these updates are set out below.

This is the fourth monthly summary published by the Risk Core Unit. To read last month's summary, click [here](https://forum.makerdao.com/t/risk-core-unit-month-in-review-october-2021/11352). We will continue to update the community on a monthly basis going forward. We value any questions, specific requests, or suggestions regarding these updates. Please add any comments below or get in touch directly with members of the [@Risk-Core-Unit](https://forum.makerdao.com/groups/risk-core-unit).

#### [](https://forum.makerdao.com/t/risk-core-unit-month-in-review-november-2021/11914#collateral-onboarding-risk-assessments-1)Collateral Onboarding Risk Assessments

- [[WBTC-B] Collateral Onboarding Risk Assessment (Nov 3, 2021)](https://forum.makerdao.com/t/wbtc-b-collateral-onboarding-risk-assessment/11397)

- [[PSM-GUSD-A] Collateral Onboarding Risk Evaluation (Nov 10, 2021) 1](https://forum.makerdao.com/t/psm-gusd-a-collateral-onboarding-risk-evaluation/11559)

- [Proposed Risk Parameters for WBTC-C Vault Type (Nov 18, 2021)](https://forum.makerdao.com/t/proposed-risk-parameters-for-wbtc-c-vault-type/11707)

#### [](https://forum.makerdao.com/t/risk-core-unit-month-in-review-november-2021/11914#other-analyses-2)Other Analyses

- [DAI Supply Growth and Risk Metrics (Nov 18, 2021)](https://forum.makerdao.com/t/dai-supply-growth-and-risk-metrics/11704)

#### [](https://forum.makerdao.com/t/risk-core-unit-month-in-review-november-2021/11914#signal-requests-3)Signal Requests

- [[Signal Request] Adjusting Dust Parameter (2021-4) (Nov 11, 2021)](https://forum.makerdao.com/t/signal-request-adjusting-dust-parameter-2021-4/11598)

- [[Signal Request] - D3M Parameters & Guidance for MOMC (Nov 30, 2021)](https://forum.makerdao.com/t/signal-request-d3m-parameters-guidance-for-momc/11898)

#### [](https://forum.makerdao.com/t/risk-core-unit-month-in-review-november-2021/11914#proposals-4)Proposals

- [Request to raise the GUNIV3DAIUSDC1-A DC to 500M (Nov 3, 2021)](https://forum.makerdao.com/t/request-to-raise-the-guniv3daiusdc1-a-dc-to-500m/11394)

- [Request to raise Staked ETH DC to 50M (Nov 3, 2021)](https://forum.makerdao.com/t/request-to-raise-staked-eth-dc-to-50m/11402)

- [D3M - DC Increase & Target Borrow Rate Decrease Proposal (Nov 4, 2021)](https://forum.makerdao.com/t/d3m-dc-increase-target-borrow-rate-decrease-proposal/11421)

- [Auction Throughput Parameters Adjustments - Nov 9 2021 (Nov 9, 2021)](https://forum.makerdao.com/t/auction-throughput-parameters-adjustments-nov-9-2021/11531)

- [Proposed Offboarding Collateral Parameters #2 (Nov 10, 2021)](https://forum.makerdao.com/t/proposed-offboarding-collateral-parameters-2/11548)

#### [](https://forum.makerdao.com/t/risk-core-unit-month-in-review-november-2021/11914#makerdao-open-market-committee-5)MakerDAO Open Market Committee

- [Mid-month Parameter Changes Proposal - PPG-OMC-001 - 2021-11-10 (Nov 10, 2021)](https://forum.makerdao.com/t/mid-month-parameter-changes-proposal-ppg-omc-001-2021-11-10/11562)

- [Parameter Changes Proposal - PPG-OMC-001 - 2021-11-25 (Nov 25, 2021)](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825)

#### [](https://forum.makerdao.com/t/risk-core-unit-month-in-review-november-2021/11914#community-engagements-on-the-maker-forum-6)Community Engagements on the Maker Forum

- [D3M - DC Increase & Target Borrow Rate Decrease Proposal - reply from Primoz (Nov 4, 2021)](https://forum.makerdao.com/t/d3m-dc-increase-target-borrow-rate-decrease-proposal/11421/13)

- [[Signal Request] Increasing the Surplus Buffer (2021-11) - reply from Primoz (Nov 4, 2021)](https://forum.makerdao.com/t/signal-request-increasing-the-surplus-buffer-2021-11/11448/7)

- [D3M - DC Increase & Target Borrow Rate Decrease Proposal - reply from monet-supply (Nov 5, 2021)](https://forum.makerdao.com/t/d3m-dc-increase-target-borrow-rate-decrease-proposal/11421/20)

- [[Signal Request] Increasing the Surplus Buffer (2021-11) - reply from Primoz (Nov 9, 2021)](https://forum.makerdao.com/t/signal-request-increasing-the-surplus-buffer-2021-11/11448/40)

- [[Signal Request] Adjusting Dust Parameter (2021-4) - reply from monet-supply (Nov 12, 2021)](https://forum.makerdao.com/t/signal-request-adjusting-dust-parameter-2021-4/11598/3)

- [Over 1 Billion less "DAI" per USDC - reply from rema (Nov 14, 2021)](https://forum.makerdao.com/t/over-1-billion-less-dai-per-usdc/11628/3)

- [Proposed Risk Parameters for WBTC-C Vault Type - reply from rema (Nov 18, 2021)](https://forum.makerdao.com/t/proposed-risk-parameters-for-wbtc-c-vault-type/11707/5)

- [Proposal to Increase the D3M DC from 50M to 100M - reply from Primoz (Nov 20, 2021)](https://forum.makerdao.com/t/proposal-to-increase-the-d3m-dc-from-50m-to-100m/11737/4)

- [[G-UNI DAI / USDC 0.01% tier] Onboard G-UNI for UniV3's new 0.01% fee tier - reply from monet-supply (Nov 23, 2021)](https://forum.makerdao.com/t/g-uni-dai-usdc-0-01-tier-onboard-g-uni-for-univ3s-new-0-01-fee-tier/11738/9)

#### [](https://forum.makerdao.com/t/risk-core-unit-month-in-review-november-2021/11914#maker-dashboard-7)Maker Dashboard

- DAI Supply Growth and Risk Metrics dashboard [MakerDAO Risk Dashboard | Block Analitica 5](https://maker.blockanalitica.com/dai-supply-growth/)

- AAVE monitor dashboard [MakerDAO Risk Dashboard | Block Analitica](https://maker.blockanalitica.com/monitor/aave/) We are now tracking main AAVE wallets. We also track users' positions inside AAVE and check which assets are backing DAI and how much there is real DAI borrow/supply.

- Improved vault protection score model

- All vaults are now also on one page [MakerDAO Risk Dashboard | Block Analitica](https://maker.blockanalitica.com/vaults/all/)

- Option to search vaults by user wallet address/vault id

- Lots of other small improvements and bug fixes

#### [](https://forum.makerdao.com/t/risk-core-unit-month-in-review-november-2021/11914#pending-work-8)Pending Work

- ALM Framework

- Compound D3M Risk Assessment

- Add more DeFi protocols and rates to the [DeFi section](https://maker.blockanalitica.com/defi/) of the Maker Risk Dashboard

- Research on D3M alternatives

- D3M Parameters Adjustment Signal

To read more about previous work and engagement from the Risk Core Unit, please visit our [forum archive](https://maker.blockanalitica.com/forum-archive/), where we document all relevant topics and discussions that the Risk Core Unit participates in on the Maker Governance Forum.

# Sidestream Auction Services

## **SAS-001 Roadmap, Contact and Links**

#### Roadmap, Contact and Links

Here's an overview of ways to get in touch with us, see and contribute to our roadmap etc.

Roadmap

- We follow a two-week sprint cycle with the goal to release at the end of each sprint. The release notes will be posted every second Friday to our [forum section](https://forum.makerdao.com/c/core-units/sidestream-core-unit/58)

- To see what we are building next, you can check out our [public roadmap](https://github.com/makerdao-sas/Roadmap/projects/1)

- Go [here](https://github.com/makerdao-sas/Roadmap) for more details on how the roadmap works and how to participate

Contact

- Get in touch with us via:

- Our public discord channel - #sidestream-auction-services-public - on the MakerDAO Official Discord

- Our[ forum section](https://forum.makerdao.com/c/core-units/sidestream-core-unit/58)

We also will start sharing more ad hoc information on our [Twitter Account](https://twitter.com/MakerDAO_SAS) soon.

Links

- Web tool for collateral auction participation can be found [here](https://auctions.makerdao.network/)

- CU Web Presence can be found [here](https://www.sidestream.tech/maker-dao)

- Transparency Reports can be found [here](https://github.com/makerdao-sas/transparency-reporting)

- Roadmap can be found [here](https://github.com/makerdao-sas/Roadmap/projects/1)

# StarkNet Engineering

## **Starknet wormhole implementation updates**

#### References

- [Maker Multichain strategy](https://forum.makerdao.com/t/a-multichain-strategy-and-roadmap-for-maker/8380)

- Introduction to [Wormhole design](https://forum.makerdao.com/t/introducing-maker-wormhole/11550)

- [MiP39c2 - sp19](https://forum.makerdao.com/t/mip39c2-sp19-adding-the-starknet-engineering-core-unit-sne-001/9745): Adding the Starknet Engineering Core Unit (SECU)

- [Maker <> Starknet bridge repo](https://github.com/makerdao/starknet-dai-bridge)

- [Maker <> Starknet bridge audit report](https://chainsecurity.com/security-audit/makerdao-starknet-dai-bridge/)

- [MIP40c3: Starknet wormhole implementation](https://forum.makerdao.com/t/mip40c3-spxx-starknet-wormhole-implementation/12041)

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#sentence-summary-2)Sentence summary

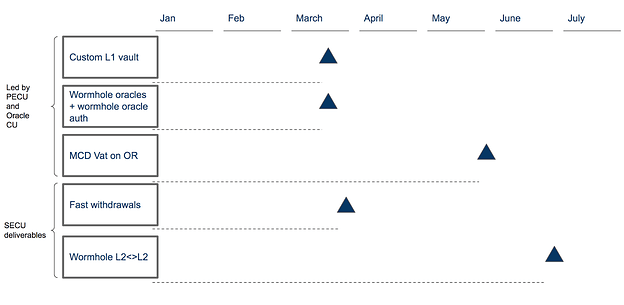

This post provides references to the deliverables of phase I work ([github](https://github.com/makerdao/starknet-dai-bridge), [audit](https://chainsecurity.com/security-audit/makerdao-starknet-dai-bridge/)) and more context to the subproposal [MIP40c3](https://forum.makerdao.com/t/mip40c3-spxx-starknet-wormhole-implementation/12041) which proposes a budget extension for the Starknet Engineering core unit to implement on Starknet the [wormhole design](https://forum.makerdao.com/t/introducing-maker-wormhole/11550) put forward by the PECU. It includes building the necessary components to enable the L2->L1 fast withdrawal and the L2 <> L2 teleportation; we plan for a delivery respectively in April and July 2022.

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#introduction-3)Introduction

[PECU's post](https://forum.makerdao.com/t/a-multichain-strategy-and-roadmap-for-maker/8380) in May opened the discussion about the role of Maker in a complex and fastly growing multi-chain ecosystem. As Ethereum gas fees are becoming prohibitive for a large number of use cases on Ethereum, users are pushed to use L2 and other scaling solutions, hence making it a priority for DAI to be easily accessible and usable on those chains.

In parallel, user experience in the multi-chain ecosystem is still immature, particularly when it comes to moving funds around the ecosystem across domains. [The wormhole design](https://forum.makerdao.com/t/introducing-maker-wormhole/11550) lays out a design that would facilitate moving DAI across domains, and potentially making DAI the easiest token to transfer across domains.

The wormhole design introduces two main user workflows: L2->L1 fast withdrawals, and L2 → L2 wormhole (also called teleportation). PECU has been designing the components for the L2->L1 fast withdrawals for an expected delivery in Q1, and the components for the teleportation for an expected delivery in Q2.

In this context, SECU already built the bridge which is a key component of those designs. The bridge audit report should be available by mid-December. The Starknet Engineering CU is asking for a budget extension ([MIP40c3](https://forum.makerdao.com/t/mip40c3-spxx-starknet-wormhole-implementation/12041)) to build the fast withdrawal and the wormhole in parallel, for a delivery timeline aligned (or slightly behind) with that of PECU, i.e., around April and July 2022 respectively.

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#motivation-4)Motivation

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#why-do-we-want-to-expand-the-maker-protocol-behind-ethereum-5)Why do we want to expand the Maker protocol behind Ethereum?

Gas fees have been exceptionally high lately, increasing more than 20x between June and October 2021, hence putting a lot of pressure on users to migrate to other domains (L2 or cheaper L1s). As users are expected to use new domains more and more, it is crucial for Maker to establish footholds on these platforms - in order to keep DAI highly usable and interchangeable among them.

Furthermore, operating on a scaled and fast environment comes with its own set of unique opportunities.

- Reducing costs and increasing speed for certain modules, allowing to rethink the logic of some components of the module (e.g., Oracle, Liquidation)

- Increasing the collateral types available. In the past year, Maker had to off-board a number of collateral types for profitability reasons. The cost of operating was exceeding the revenues yielded by the collateral type. In a cheaper environment, there is an opportunity for Maker to make those collaterals profitable as well as on-board L2 native tokens as collateral

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#leveraging-makers-strength-to-make-dai-more-attractive-6)Leveraging Maker's strength to make DAI more attractive

While competing lending protocols have rushed to build pools onto cheaper domains, Maker has been taking a slower approach to develop the wormhole design that leverages Maker's unique position to make DAI the most used stable coin across the ecosystem. This constitutes a preliminary step before allowing users to mint against collateral on new domains.

The wormhole design proposed by PECU leverages Maker's battle-tested oracles as well as its ability to mint DAI to facilitate the user experience of moving DAI around the ecosystem. Solutions like the Hop protocol are using a combination of bridges and AMMs. Not relying on AMMs means more reliability and predictability, and less fees. Using oracles allows for teleportation, which means almost instant availabiilty of DAI on the target domain.

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#what-does-it-mean-to-expand-maker-7)What does it mean to expand Maker

For DAI to become the fungible token to facilitate liquidity flows and trade in and across ecosystem, the following conditions need to hold true:

- It must be possible to transfer DAI between L1 and L2 without multiple version of DAI (DAI bridge)

- It must be possible to withdraw funds from L2 to L1 quickly (Fast withdrawals)

- It must be possible to use and transfer DAI across multiple L2s (DAI wormhole)

- It must be possible to mint DAI using L2 collateral type (MCD on L2)

- It must be possible to do all of the above within accepted risk/securities boundaries (Risk assessment)

Currently, the PECU, Oracles CU, and SECU are focused on enabling the fast withdrawals and the wormhole.

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#wormhole-design-8)Wormhole design

*The intent of this section is to provide all the readers a high-level understanding of the wormhole design, it is combining information from the post ["Introducing Maker Wormhole"](https://forum.makerdao.com/t/introducing-maker-wormhole/11550) as well as discussions with PECU and internal design documents. It is not a holistic description of the design and all the edge cases. Technical readers who are familiar with the matter can skip to the next section.*

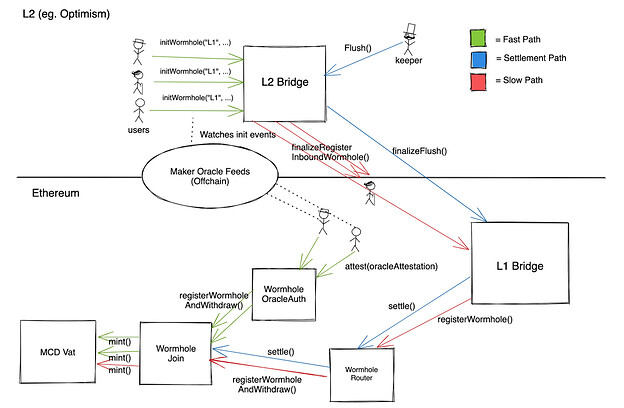

The purpose of the wormhole design is to enable DAI fast withdrawals to L1 and teleportation from source domain to target domain. Domain in this context can designate a L2, a sidechain, or a L1. In the regular case, withdrawal delay can be one week for Optimistic rollups, down to 3 to 8 hours for zk-rollups like Starknet. The wormhole design can make those in minutes. You will find below a quick summary of the fast path (happy flows).

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#l2-l1-fast-withdrawals-9)L2 → L1 Fast withdrawals

Walking through the fast path of the fast withdrawal workflow in the wormhole design:

1. User submits a fast withdrawal request to the L2 DAI bridge (initiateWormhole) to withdraw 100 DAI. DAI on L2 is burnt

2. User gets an attestation that they burnt DAI and requested a fast withdrawal to L1 (off-chain oracle)

3. User provides attestation to WormholeOracleAuth contract on L1 that verifies that their attestation is correctly signed by the Maker Oracle Feed. User mints 100 DAI on L1 from WormholeJoin as long as the wormhole debt ceiling is not reached, the debt outstanding to be repaid is 100 DAI

Periodically, a keeper calls Flush on L2 DAI bridge which sends a L2->L1 message to release the DAI from the L1 bridge contract and pay back the 100 DAI debt. In the case where the Oracle Network is not available for any reason, the user can go through the slow path by calling the L1 bridge (using the event that was emitted when calling initWormhole) to finalize the withdrawal via the wormhole router.

*Figure 1: L2 → L1 Fast withdrawal*

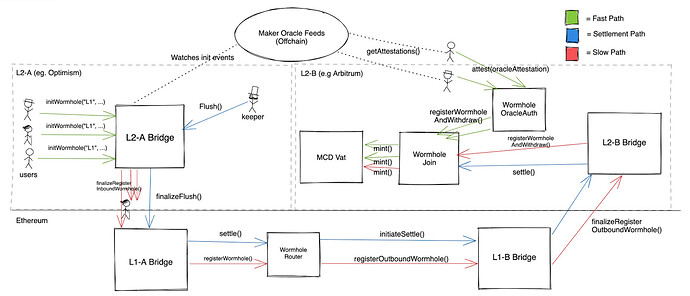

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#l2-l2-teleportation-10)L2 <> L2 teleportation

Walking through the steps of the fast path of the teleportation workflow from L2A to L2B:

1. User submits a teleportation request to the L2A DAI bridge (initiateWormhole) to withdraw 100 DAI. DAI on L2A is burnt.

2. User gets an attestation that they burnt DAI and requested a fast withdrawal to L1 (off-chain oracle)

3. User provides attestation to WormholeOracleAuth contract on L2B that verifies that their attestation is correctly signed by the Maker Oracle Feed. User mints 100 DAI on L2B as long as the L2B debt ceiling is not reached. The debt outstanding to be repaid is 100 DAI

4. Periodically, a keeper calls Flush on L2 DAI bridge which sends a L2->L1 message to release the DAI from the L2A bridge contract on L1 to the L2B bridge contract on L1 via the wormhole router

5. Similarly to a deposit, DAI is now locked in L2B bridge on L1, DAI is minted on L2B and used to pay back the debt on L2B

Similarly to the fast withdrawal workflow, in case of oracle failure, the user can go through the slow path by directly calling the L1 bridge. The slow path timing depends on the L2. For Starknet it will be at maximum a few hours.

*Figure 2: L2 <> L2 teleportation*

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#starknet-wormhole-implementation-11)Starknet wormhole implementation

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#roadmap-12)Roadmap

The Starknet implementation will be done in parallel of the PECU's implementation on EVM-compatible chains. The PECU, Oracles CU, Risk CU, and SECU will collaborate on the technical implementations as well as the risk parameters definition for each domain.

The wormholing requires the MCD Vat and other related contracts to be built on L2, which prepares for phase III (minting on L2 with collateral). Maker will benefit from building the wormhole design on two L2s in parallel to realize the value promised by the design and for end-to-end tests purposes.

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#important-differences-between-starknet-and-ors-13)Important differences between Starknet and ORs

This section focuses on the differences between ORs and Starknet that may introduce wormhole implementation specificities.

State update frequency: Starknet state update frequency on L1 is currently every few hours. The update frequency should be reduced to less than an hour towards the end of 2022. Optimistic rollups typically have a one week period before a state update is final. The main difference in user experience is that the slow path in the fast withdrawal flow would be much faster with Starknet than with other rollups.

Trusted Finality: With ORs, provided the existence of verifiers (and existence of the fraud proof mechanism), all the transactions present in the canonical transaction chain (CTC) are included with 100% certainty in the next state update. Hence, in that scenario, a non-malicious and non-corrupted oracle reading from the CTC can provide attestations with 100% reliability that a wormhole request will be included in the next state update. Note that Optimism for example does not have fraud proofs implemented at the moment, hence the statement above does not hold true yet.

With Starknet, the transactions are final only when they are submitted to L1. However, mechanisms are being developed by Starkware to assure that a transaction will be included with certainty in the next batch, assuming that the sequencer(s) are rational agents. We refer to this method as "checkpoints", and involves sequencers posting collateral and committing to a sequence of transactions to include in each next batch.

Decentralization: Starknet is planning on starting the implementation of its decentralization plan before Q3 2022. Anyone could then become a sequencer. The decentralization plans of different ORs vary yet are less aggressive than that of Starknet.

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#risk-management-14)Risk management

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#risk-of-minting-unbacked-dai-15)Risk of minting unbacked DAI

In the wormhole context, minting unbacked DAI means minting DAI from a wormhole vault such that the underlying debt will not be repaid. In such an event, MKR holders would directly be hurt because the debt would be queued as bad debt. There are two main risk factors that could lead to minting unbacked DAI:

Malicious oracle: If a malicious oracle provides a false attestation, the user could mint DAI out of thin air from a custom vault which won't see its debt repaid. The oracles are reading directly from L2 nodes, they are not providing signed prices from exchanges like the price oracle.

Trusted Finality and malicious sequencer(s): Transactions on StarkNet are considered final only when a proof attesting their correctness is published on L1, and the state is updated. However, waiting until a proof is published on L1 for the fast withdrawal (or teleportation) defeats the purpose as the user could just perform a regular request within this timeframe.

This means that the Oracle is exposed to attack from StarkNet's sequencer ( and after decentralization - sequencers) where the sequencer(s) would "lie" to the Oracle about some fast withdrawal request that they are about to include. After the Oracle provides the attestation to the user, the sequencer(s) would exclude the request from the stream of transactions they are actually proving, practically executing a double spend attack.

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#risk-of-unacceptable-user-experience-16)Risk of unacceptable user experience

The wormhole users have expectations of a fast and seamless experience. Providing an experience that's worse than the regular withdrawals is a reputational risk for Maker. Censorship and oracle failure are the main risk factors here.

Oracle infrastructure: In case oracles are down (or maliciously non-responsive to a single user), users would not be able to fast withdraw (or teleport) at all. The slow path being more cumbersome that the normal path (without wormhole), it would make for a very negative user experience.

Censorship by StarkNet Sequencer(s): In case the user isn't able to push their request (or subsequent calls) as a StarkNet transaction due to being censored by StarkNet's sequencer(s). The censorship risk exists for the following calls: initiateWormhole (on source domain), mint (on target domain), flush (on source domain), settle (on target domain).

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#risk-remediation-17)Risk remediation

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#starknet-risk-remediation-18)Starknet risk remediation

Starknet is bound to evolve over the next year. Upgrades mitigating the risks mentioned in the section above are being planned.

Fast Finality: StarkWare is currently working on guaranteeing an intermediate-level of finality that would be established a few minutes after the transaction is received. The design is still being discussed, but for example it could rely on high economic incentives to the sequencer to prove the sequence of txs it committed to (other mechanisms in addition/instead this example are considered as well). Such kind of enforcement will make the double-spend attack by the sequencer irrational for reasonable amounts of DAI transfers. This feature is expected within 6-9 months.

Decentralization: Within 9 months StarkNet is planning to be fully decentralized, meaning that anyone (including the censored user) could become the sequencer - eliminating the censorship risk and its associated negative impact on the user experience.

#### [](https://forum.makerdao.com/t/starknet-wormhole-implementation-details/12042#makerdao-risk-remediation-19)MakerDAO risk remediation

This list of risk remediation is not exhaustive. The Risk CU will work with PECU, Oracles CU, and Starknet Engineering CU to define risk parameters for each wormhole domain.

Oracles redundancy: Oracles failure being the most important risk factor, for each rollup multiple oracles will read from multiple nodes with a different underlying infrastructure (different providers and methodologies), hence reducing the single-point of failure risk.

Wormhole source domain ceiling: The maximum amount of DAI that can be minted based on an oracle attestation from the source domain. This ceiling directly caps the risk of an oracle providing a false attestation on a given domain.

Wormhole debt ceiling: The maximum amount of DAI that can be minted on Ethereum domain. It represents the amount of DAI that can be used at the same time for fast withdrawal L2->L1 purpose.

DAI bridge limit: Like for other domains, the Starknet bridge will have a DAI bridge limit defined by the Risk CU. DAI bridge limit represents the maximum amount of DAI in the official bridge (i.e., in the L1 escrow contract). If Starknet was to go down, it is the maximum amount of DAI that MakerDAO would need to redistribute to users on L1 through the exit mechanism.

---

For more November updates, check out the [MIP40c3-SP47: Core Unit Budget (SNE-001) - Phase II: StarkNet Fast Withdrawal and Wormhole](https://forum.makerdao.com/t/mip40c3-sp47-core-unit-budget-sne-001-phase-ii-starknet-fast-withdrawal-and-wormhole/12041)

# Strategic Happiness

## **November Burbanomics Review**

# ""

# Sustainable Ecosystem Scaling

[Weekly Updates](https://forum.makerdao.com/search?expanded=true&q=%23ses-001%20Update%20in%3Atitle%20order%3Alatest_topic)

## **SES Updates - 04.11.2021**

#### Incubator News

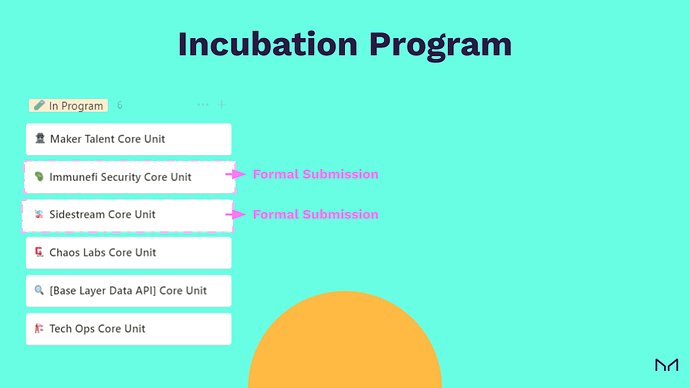

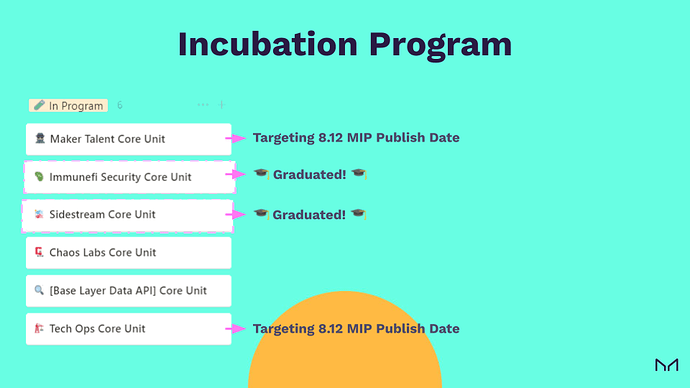

[Immunefi Security Core Unit ](https://forum.makerdao.com/t/mip39c2-sp24-adding-immunefi-security-core-unit-is-001/10810)and [Sidestream Core Unit](https://forum.makerdao.com/t/mip39c2-sp-adding-sidestream-auction-services-core-unit-sas-001/10796) MIPs have entered Formal Submission.

#### [](https://forum.makerdao.com/t/ses-updates-04-11-2021/11447#ses-weekly-status-update-spotlight-project-sandbox-update-2)SES Weekly Status Update Spotlight: Project Sandbox Update

Project Sandbox aims to design an improved architecture for the Maker Protocol that enables parallel smart contract development. Team Lead [@Wouter](https://forum.makerdao.com/u/wouter) from SES will share an update on the status of the project, discussing the design considerations, risk management and next steps for the team.

[Add the SES Status Update Call to your calendar:](https://calendar.google.com/event?action=TEMPLATE&tmeid=MWxrdDZzMmxtZWQ3cTFoNWVma3B2aWswMXRfMjAyMTExMDVUMTUzMDAwWiByZXRyb0BzZXMubWFrZXJkYW8ubmV0d29yaw&tmsrc=retro%40ses.makerdao.network&scp=ALL) November 5, 2021 11:30 AM

#### [](https://forum.makerdao.com/t/ses-updates-04-11-2021/11447#project-focus-3)Project Focus

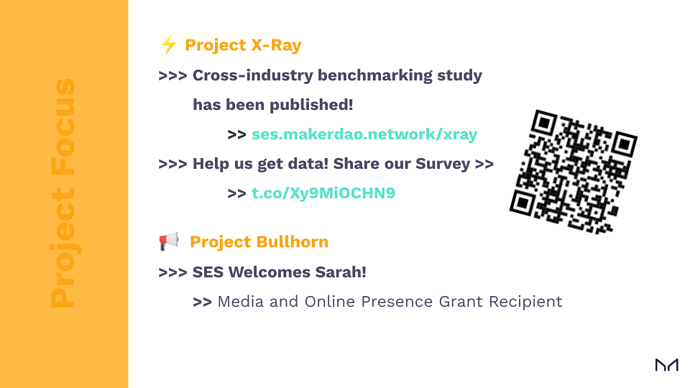

Project X-Ray has published their cross-industry benchmarking study, focusing on best practices in developer awareness, onboarding, and retention. Explore the research for yourself at ses.makerdao.network/xray.

We need your help to support our project! [Share our survey to help us gain insights.](https://t.co/Xy9MiOCHN9)

SES also welcomes Sarah Doll - a media and online presence expert - as a grant recipient. Sarah will help SES with building a robust and inviting online presence for SES.

#### [](https://forum.makerdao.com/t/ses-updates-04-11-2021/11447#contacts-4)Contacts

#### [](https://forum.makerdao.com/t/ses-updates-04-11-2021/11447#links-5)Links

- [Discord](https://discord.gg/h64CXspejc)

- [Drive](https://drive.google.com/drive/u/1/folders/0AFnWIfR4at7jUk9PVA)

- [Notion](https://ses.makerdao.network/)

---

## **SES Updates - 11.11.2021**

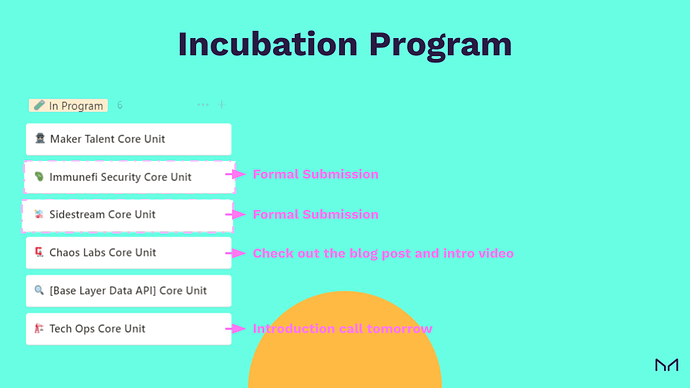

#### Incubator News

- [Immunefi Security Core Unit ](https://forum.makerdao.com/t/mip39c2-sp24-adding-immunefi-security-core-unit-is-001/10810)and [Sidestream Core Unit](https://forum.makerdao.com/t/mip39c2-sp-adding-sidestream-auction-services-core-unit-sas-001/10796) MIPs are in Formal Submission.

- [Chaos Labs' Blog Postis live on SES's new Blog.](https://ses.makerdao.network/Chaos-Labs-joins-SES-Incubation-Program-639e9127ced44be59ae415700e75617f) Also, watch their [introduction video here](https://drive.google.com/file/d/1yOnfyTgYtTW2xmSjpOFbPRetzfZPUc/view).

- Tech Ops Incubation Team has an introductory call tomorrow on SES's Weekly Update call.

#### [](https://forum.makerdao.com/t/ses-updates-11-11-2021/11594#ses-weekly-status-update-spotlight-sandbox-update-2)SES Weekly Status Update Spotlight: Sandbox Update

The Tech Ops Incubation team will present their proposed core unit on SES's Weekly Status Update call this Friday.

[Add the SES Status Update Call to your calendar:](https://calendar.google.com/event?action=TEMPLATE&tmeid=NnYzMnYxZG9jOWwwY3FlcWduODdxcmNqZDRfMjAyMTExMTJUMTUzMDAwWiBtYWtlcmRhby5jb21fM2VmaG0yZ2hpcGtzZWdsMDA5a3RuaW9tZGtAZw&tmsrc=makerdao.com_3efhm2ghipksegl009ktniomdk%40group.calendar.google.com&scp=ALL) November 12, 2021 10:30 AM

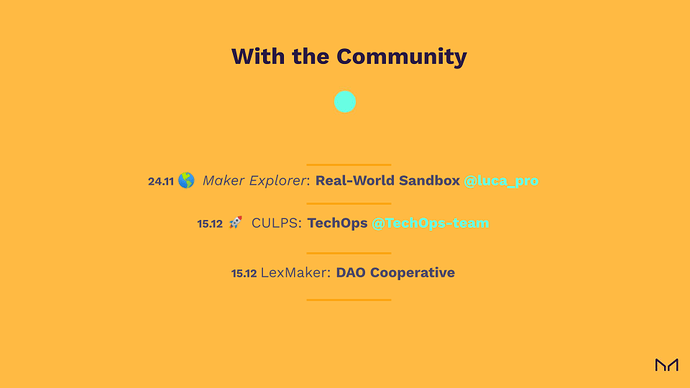

#### [](https://forum.makerdao.com/t/ses-updates-11-11-2021/11594#with-the-community-3)With the Community

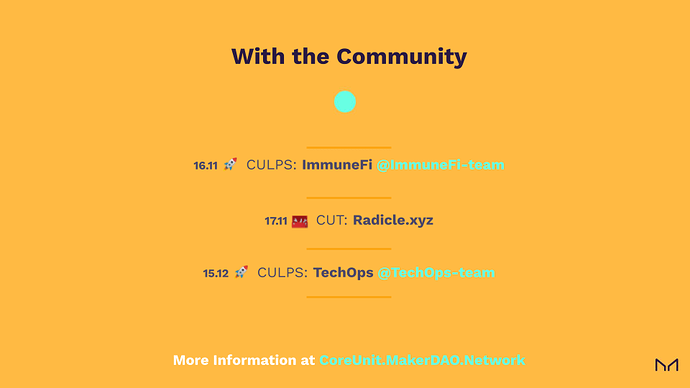

[](https://forum.makerdao.com/t/ses-updates-11-11-2021/11594#we-have-two-calls-planned-for-next-week-4)We have two calls planned for next week:

- 16.11  CULPS: ImmuneFi @ImmuneFi-team - [Add to your Calendar!](https://calendar.google.com/event?action=TEMPLATE&tmeid=NXRhZWZ0bWhkOHNzdWQ4NDM1aGZiZmxyMGEgbWFrZXJkYW8uY29tXzNlZmhtMmdoaXBrc2VnbDAwOWt0bmlvbWRrQGc&tmsrc=makerdao.com_3efhm2ghipksegl009ktniomdk%40group.calendar.google.com)

- 17.11  CUT: Radicle.xyz - [Add to your Calendar!](https://calendar.google.com/event?action=TEMPLATE&tmeid=MWhhMjZwZzlsdGhzYW84am84aWhsOXByZTUgbWFrZXJkYW8uY29tXzNlZmhtMmdoaXBrc2VnbDAwOWt0bmlvbWRrQGc&tmsrc=makerdao.com_3efhm2ghipksegl009ktniomdk%40group.calendar.google.com)

[](https://forum.makerdao.com/t/ses-updates-11-11-2021/11594#and-one-future-call-planned-in-december-5)And one future call planned in December:

- 15.12  CULPS: TechOps @TechOps-team

#### [](https://forum.makerdao.com/t/ses-updates-11-11-2021/11594#project-focus-6)Project Focus

Project Bullhorn has soft launched the SES Blog. Our first two posts are from [Project X-Ray](https://ses.makerdao.network/How-MakerDAO-can-turn-the-crypto-developer-deficit-into-an-opportunity-to-attract-new-developers-26607c2f4c0a4169a424070b2dba33b6) and [Chaos Labs.](https://ses.makerdao.network/Chaos-Labs-joins-SES-Incubation-Program-639e9127ced44be59ae415700e75617f) Find our blog at SES.MakerDAO.network/blog

The SES Grants Pipeline is filling! Additional Research & Scholarship grants are in the works and will be announced soon.

#### [](https://forum.makerdao.com/t/ses-updates-11-11-2021/11594#quick-updates-7)Quick Updates

- [@lollike](https://forum.makerdao.com/u/lollike) joins the CES Core Unit on Monday! We will miss him and are excited to continue working with him in his new role!

> Nikolaj joined Maker out of passion for crypto & blockchain tech. He said that work at the innovation lab at one of the largest fintech companies in Nordics was not hard on enough, so he joined Maker.

>

> Nikolaj has been a joy to work with providing technical expertise and structured, strategic support. He took initiatives in designing the incubation program and did lift a mountain of project management work with various incubee teams.

>

> Plus he is a nice person, great teammate and pleasant to be around. In one sentence, Nikolaj is an expert we will miss at SES.

>

> We are glad to see him stay in the Maker Ecosystem and look forward to collaborating with him in his new role at CES!

- Huge thank you to [@Lenkla](https://forum.makerdao.com/u/lenkla) from SES for coordinating the [ENS Airdrop!](https://etherscan.io/token/0xc18360217d8f7ab5e7c516566761ea12ce7f9d72?a=0xBE8E3e3618f7474F8cB1d074A26afFef007E98FB)

> MakerDAO was named as a strategic partner and Lenkla took the initiative to coordinate the airdrop and direct the tokens to the Maker Protocol Pause Proxy. Maker received 46,296.30 ENS tokens (currently valued at over 2.5M DAI). Thank you!

---

## **SES Updates - 18.11.2021**

#### Incubator News

- [Immunefi Security Core Unit](https://vote.makerdao.com/polling/QmSbiSTX#vote-breakdown)and [Sidestream Core Unit](https://vote.makerdao.com/polling/QmPnAkS4#vote-breakdown) have 3 days left for ratification voting, both with 99% yes votes.

- Maker Talent Core Unit and Tech Ops Core Unit are targeting publishing their MIP by 8.12.

#### [](https://forum.makerdao.com/t/ses-updates-18-11-2021/11717#ses-weekly-status-update-spotlight-real-world-sandbox-report-preview-2)SES Weekly Status Update Spotlight: Real-World Sandbox Report Preview

Luca Prosperi, [@luca_pro](https://forum.makerdao.com/u/luca_pro) will present a preview of the Real-World Sandbox report on this Friday's SES Status Update Call. A full discussion of his report will be facilitated on SES's newest community call next Wednesday 24.11: [*Maker Explorer*](https://forum.makerdao.com/t/maker-explorer-1-real-world-sandbox-grant-report/11715)

[Add the SES Status Update Call to your calendar:](https://calendar.google.com/event?action=TEMPLATE&tmeid=NnYzMnYxZG9jOWwwY3FlcWduODdxcmNqZDRfMjAyMTExMTlUMTUzMDAwWiBtYWtlcmRhby5jb21fM2VmaG0yZ2hpcGtzZWdsMDA5a3RuaW9tZGtAZw&tmsrc=makerdao.com_3efhm2ghipksegl009ktniomdk%40group.calendar.google.com&scp=ALL) November 19, 2021 10:30 AM

#### [](https://forum.makerdao.com/t/ses-updates-18-11-2021/11717#with-the-community-3)With the Community

[](https://forum.makerdao.com/t/ses-updates-18-11-2021/11717#toolbox-culps-immunefi-4) CULPS: Immunefi

[ Recording Live!](https://forum.makerdao.com/t/core-unit-launch-pod-sessions-session-21-immunefi-security-core-unit/11560)

[](https://forum.makerdao.com/t/ses-updates-18-11-2021/11717#rocket-cut-radiclexyz-5) CUT: Radicle.xyz

[ Recording Live!](https://forum.makerdao.com/t/core-unit-tools-11-radicle-xyz/11557)

#### [](https://forum.makerdao.com/t/ses-updates-18-11-2021/11717#earth_americas-announcing-maker-explorer-6) Announcing *Maker Explorer*!

This is a new series that SES is launching focusing on exploring real-world assets. We will host Luca Prosperi as he presents his findings funded by SES Research Grants.

[Learn more here.](https://forum.makerdao.com/t/maker-explorer-1-real-world-sandbox-grant-report/11715)

[Add *Maker Explorer* to your calendar here.](https://calendar.google.com/event?action=TEMPLATE&tmeid=NGZlZW00NHNjZzRraXYwcnZmbzFrY3JpdGEgbWFrZXJkYW8uY29tXzNlZmhtMmdoaXBrc2VnbDAwOWt0bmlvbWRrQGc&tmsrc=makerdao.com_3efhm2ghipksegl009ktniomdk%40group.calendar.google.com)

[](https://forum.makerdao.com/t/ses-updates-18-11-2021/11717#rocket-1512-culps-techops-7) 15.12 CULPS: TechOps

Watch for the forum post coming soon!

[](https://forum.makerdao.com/t/ses-updates-18-11-2021/11717#man_judge-1512-lexmaker-dao-cooperative-8) 15.12 LexMaker: Dao Cooperative

Watch for the forum post coming soon!

#### [](https://forum.makerdao.com/t/ses-updates-18-11-2021/11717#project-focus-9)Project Focus

[](https://forum.makerdao.com/t/ses-updates-18-11-2021/11717#see_no_evil-dao-budget-transparency-10) DAO Budget Transparency

SES has published the first tool in support of improving DAO budget transparency. Our interactive MIP Map presents Core Unit budgets in a living tool, with updated links to explore streaming payments and transactions on chain. [Read more about it here](https://forum.makerdao.com/t/introducing-the-cu-budget-transparency-map/11656).

---

## **SES Updates - 25.11.2021**

#### Incubator News

- Immunefi Security Core Unit and Sidestream Core Unit proposals have passed and join MakerDAO as its newest two Core Units!

- Maker Talent Core Unit and Tech Ops Core Unit are targeting publishing their MIP by 8.12.

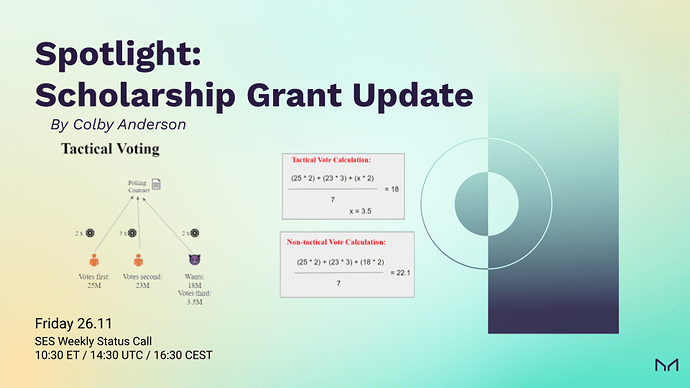

#### [](https://forum.makerdao.com/t/ses-updates-25-11-2021/11826#ses-weekly-status-update-spotlight-scholarship-grant-update-2)SES Weekly Status Update Spotlight: Scholarship Grant Update

Colby Anderson, will present a project update on his scholarship grant focused on governance and range polling.

[Add the SES Status Update Call to your calendar:](https://calendar.google.com/event?action=TEMPLATE&tmeid=NGw4Z2VjbG45NzM1MjdxNGoyNTdiaWpyYzdfMjAyMTExMjZUMTQwMDAwWiByZXRyb0BzZXMubWFrZXJkYW8ubmV0d29yaw&tmsrc=retro%40ses.makerdao.network&scp=ALL) November 26, 2021 10:30 AM

#### [](https://forum.makerdao.com/t/ses-updates-25-11-2021/11826#grants-spotlight-3)Grants Spotlight

- Project Real-World Sandbox: [@luca_pro](https://forum.makerdao.com/u/luca_pro) has presented his findings from his 5 week research grant. His full report (currently in status: Draft for Comments) can be found [here](https://drive.google.com/file/d/1LQp55V26UabzanzR5hFefw-EdfbraC1U/view). A recording of his presentation to the community on Maker Explorer can be found [her1](https://drive.google.com/file/d/1m89ONEXPtePXu3PKhIxUwIFSUSE81qko/view).

- Colby Anderson [@colby](https://forum.makerdao.com/u/colby) is an SES scholarship grant recipient whose work focused on governance and range polling. An update on this work is ready, and will be presented to the community Friday 26.11. Join us for the [SES Weekly Update](https://calendar.google.com/event?action=TEMPLATE&tmeid=NGw4Z2VjbG45NzM1MjdxNGoyNTdiaWpyYzdfMjAyMTExMjZUMTQwMDAwWiByZXRyb0BzZXMubWFrZXJkYW8ubmV0d29yaw&tmsrc=retro%40ses.makerdao.network&scp=ALL) to watch Colby present his latest update.

#### [](https://forum.makerdao.com/t/ses-updates-25-11-2021/11826#with-the-community-4)With the Community

[](https://forum.makerdao.com/t/ses-updates-25-11-2021/11826#earth_americas-announcing-maker-explorer-5) Announcing *Maker Explorer*!

[ Recording Live!](https://forum.makerdao.com/t/core-unit-tools-11-radicle-xyz/11557)

[](https://forum.makerdao.com/t/ses-updates-25-11-2021/11826#rocket-1512-culps-techops-6) 15.12 CULPS: TechOps

Watch for the forum post coming soon!

[](https://forum.makerdao.com/t/ses-updates-25-11-2021/11826#man_judge-1512-lexmaker-dao-cooperative-7) 15.12 LexMaker: Dao Cooperative

Watch for the forum post coming soon!

# **Other Teams**

# Delegates

## **Delegate Round-up - November 2021**

#### Introduction

Apologies for the delay in getting this posted this month. I will try and make sure it's up in a more timely fashion moving forwards.

Welcome to the second edition of The Delegate Round-up. The Delegate Round-up aims to provide an overview of the Recognized Delegates operating within Maker Governance. It also serves as a one-stop forum post where members of the Maker Community can monitor how Recognized Delegates are performing.

The Delegate Round-up is a new initiative from GovAlpha. If there is anything else you would like to see added, please send me a message or leave a comment below.

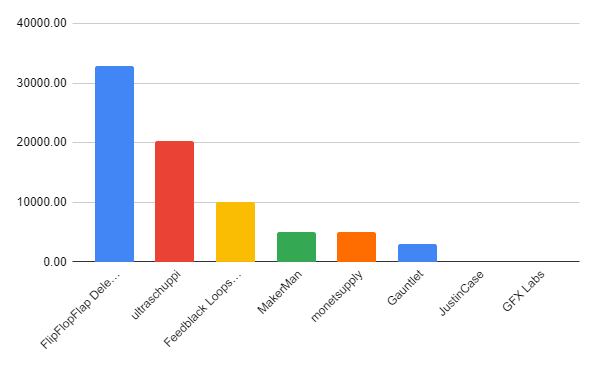

November has seen some changes within the Recognized Delegate landscape. We welcomed three new Recognized Delegates in [@ultraschuppi](https://forum.makerdao.com/u/ultraschuppi), [@GFXLabs](https://forum.makerdao.com/u/gfxlabs) and [@JustinCase](https://forum.makerdao.com/u/justincase). We also saw Field Technologies, Inc. end their time as a Recognized Delegate within the Maker Protocol. Gauntlet ([@inkymaze](https://forum.makerdao.com/u/inkymaze)) received their first delegated MKR - becoming active as a Recognized Delegate. We also saw some redistributions of previously delegated MKR.

November saw the first time that a Recognized Delegate opposed a MakerDAO executive vote when [@MakerMan](https://forum.makerdao.com/u/makerman) opposed the 5th of November Executive Vote. The rationale for this decision can be seen [here](https://forum.makerdao.com/t/makerman-delegate-platform/9891/19). For clarity, GovAlpha supports the right of Recognized Delegates to oppose Executive Votes. For delegate tracking, this was counted as participating in this Executive Vote.

November was also the first month included in the Delegate Compensation Trial - a separate post covering the DAI distributions related to the Delegate Compensation Trial has been [posted here](https://forum.makerdao.com/t/delegate-compensation-breakdown-november-2021/11979).

#### [](https://forum.makerdao.com/t/delegate-round-up-november-2021/12082#recognized-delegates-2)Recognized Delegates

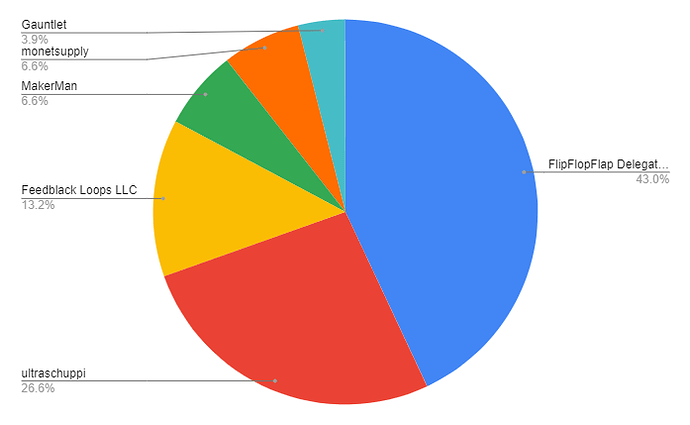

At the end of November, we had eight active Recognized Delegates. In descending order of MKR delegated on the 30th of November, these were:

| Delegate | Delegated MKR | Monthly Change |

| --- | --- | --- |

| [Flip Flop Flap Delegate LLC](https://forum.makerdao.com/t/flip-flop-flap-delegate-llc-platform/9106) | 32,860.61 | +8,957.38 |

| [ultraschuppi](https://forum.makerdao.com/t/ultraschuppi-delegate-platform/11193) | 20,283.58 | +20,283.58 |

| [Feedblack Loops LLC](https://forum.makerdao.com/t/feedblack-loops-llc-delegate-platform/9366) | 10,102.26 | No change |

| [MakerMan](https://forum.makerdao.com/t/makerman-delegate-platform/9891) | 5,071.15 | +9.40 |

| [monetsupply](https://forum.makerdao.com/t/monetsupply-delegate-platform/9545) | 5,039.34 | -100.00 |

| [Gauntlet](https://forum.makerdao.com/t/gauntlet-delegate-platform/9675) | 3000 | +3,000.00 |

| [JustinCase](https://forum.makerdao.com/t/justincase-delegate-platform/11721) | 34.26 | +34.26 |

| [GFX Labs](https://forum.makerdao.com/t/justincase-delegate-platform/11721) | 5.02 | +5.02 |

#### [](https://forum.makerdao.com/t/delegate-round-up-november-2021/12082#recognized-delegates-visualized-3)Recognized Delegates Visualized

#### [](https://forum.makerdao.com/t/delegate-round-up-november-2021/12082#delegate-metrics-4)Delegate Metrics

GovAlpha tracks metrics that monitor Recognized Delegate performance. These are useful to both current and prospective delegators in gauging how active Recognized Delegates have been. The metrics currently tracked for Recognized Delegates center on Participation in on-chain voting and communication by Recognized Delegates regarding their voting choices.

These metrics can be seen on the delegate cards on the [voting portal](https://vote.makerdao.com/delegates?network=mainnet). In addition, a further breakdown of the participation metric is available for each delegate on their pages on the voting portal - here is a link to Flip Flop Flap Delegate LLC's metric page [as an example](https://vote.makerdao.com/address/0xaf8aa6846539033eaf0c3ca4c9c7373e370e039b?network=mainnet#metrics).

#### [](https://forum.makerdao.com/t/delegate-round-up-november-2021/12082#participation-5)Participation

For Participation, a score of 100% would mean that a Delegate has voted in all possible polls since they started their role as a Recognized Delegate. GovAlpha tracks Participation in Governance Polls and Executive Polls separately and a combined overall participation rating.

As of the end of November, the Delegate Metrics for Participation were as follows:

| Delegate Name | Poll Participation | Executive Participation | Overall Participation |

| --- | --- | --- | --- |

| Flip Flop Flap Delegate LLC | 100% | 100% | 100% |

| ultraschuppi | 100% | 100% | 100% |

| Feedblack Loops LLC | 88.76% | 100% | 90.10% |

| MakerMan | 91.36% | 72.73% | 89.13% |

| monetsupply | 74.42% | 50.00% | 71.43% |

| Gauntlet | 0.00% | 0.00% | 0.00% |

| JustinCase | 100% | No Data | 100% |

| GFX Labs | 100% | 100% | 100% |

#### [](https://forum.makerdao.com/t/delegate-round-up-november-2021/12082#communication-6)Communication

For Communication, GovAlpha tracks how Recognized Delegates have communicated their voting decisions. Recognized Delegates are rewarded with a higher score for providing reasoning for their voting decisions. For example, a score of 100% would mean a Delegate communicated all of their voting decisions AND gave reasons for reaching these decisions. On the other hand, a score of 50% would indicate a Delegate communicated their decisions but did not provide any reasoning for these decisions. Their scores for each vote are combined to give an overall communication rating.

At the end of November, the Delegate Metrics for Communication are as follows:

| Delegate Name | Overall Communication |

| --- | --- |

| Flip Flop Flap Delegate LLC | 100% |

| ultraschuppi | 100% |

| Feedblack Loops LLC | 98.35% |

| MakerMan | 92.07% |

| monetsupply | 77.14% |

| Gauntlet | No Data |

| JustinCase | 100% |

| GFX Labs | 100% |

#### [](https://forum.makerdao.com/t/delegate-round-up-november-2021/12082#executive-votes-7)Executive Votes

By looking at how long it takes for an Executive Vote to pass, we can infer whether or not the Recognized Delegates are helping streamline the Governance Process.

We have already covered that one of the Recognized Delegates opposed an Executive Vote this month.

In November, the Governance Facilitators posted four Executive Votes to the voting portal. All four of these votes passed successfully.

| Executive Vote | Date Posted | Date Passed | Duration (Days) |

| --- | --- | --- | --- |

| Parameter Changes, Core Unit Budget Distribution | 2021-11-05 | 2021-11-08 | 3* |

| Parameter Changes, Return Unused Budget to the Surplus Buffer | 2021-11-12 | 2021-11-14 | 2 |

| Onboarding WBTC-B, Increasing WBTC-A Stability Fee, Change of Covenants for P1-DROP, Offboarding Collaterals | 2021-11-19 | 2021-11-20 | 1 |

| Onboarding New Vault Types, Parameter Changes, and Core Unit Budget Distributions | 2021-11-26 | 2021-11-26 | 0 |

* This vote was opposed by one of the Recognized Delegates.

#### [](https://forum.makerdao.com/t/delegate-round-up-november-2021/12082#delegate-on-boarding-8)Delegate On-boarding

At the time of writing, GovAlpha has received one new application to become a Recognized Delegate:

[@ACREinvest](https://forum.makerdao.com/u/acreinvest) have thrown their hat into the ring, and their delegate platform can be found [here](https://forum.makerdao.com/t/acreinvest-delegate-platform/11943).

There will be a [Meet Your Delegate call](https://forum.makerdao.com/t/meet-your-delegate-8/11995) with AcreInvest hosted by [@prose11](https://forum.makerdao.com/u/prose11) on 2021-12-08 at 15:30 UTC if anyone would like to hear from our newest Recognized Delegate.

If anyone else wants to hear more about becoming a Recognized Delegate or has any questions, please reach out to one of the GovAlpha team. We will be happy to help.

To review the Recognized Delegate requirements, please see [this forum post](https://forum.makerdao.com/t/recognised-delegate-requirements/9421).

cc: [@GovAlpha-Core-Unit](https://forum.makerdao.com/groups/govalpha-core-unit) [@gov-comms-core-unit](https://forum.makerdao.com/groups/gov-comms-core-unit) [@Recognized-Delegates](https://forum.makerdao.com/groups/recognized-delegates)

# Makerburn

## **Makerburn updates, november 2021**

[Monthly Updates](https://forum.makerdao.com/search?expanded=true&q=%23makerburn%20update%20in%3Atitle)

Hey all!

Here's a bunch of stuff that's changed or added to [makerburn.com](https://makerburn.com/) this past month.

Debt ceilings

I've spent a lot of time lately trying to put more focus on debt ceilings and our tendency to hit them, stopping growth - not only through updates to makerburn, but also here on the forum ([1](https://forum.makerdao.com/t/signal-request-adjust-wbtc-a-dc-iam-line-october-2021/11004/), [2](https://forum.makerdao.com/t/signal-request-adjust-wbtc-a-dc-iam-line-october-2021/11004/8)).

To that end, I've also created a warning on the makerburn dashboard.

A click or tap on this warning will take you to the collateral list where a "capped" filter is pre-applied to single out the relevant collateral(s).

This filter may also be applied manually, and there is an option for "maxed" collaterals as well.

There is also a warning on collateral detail pages.

And a new link to [@lollike](https://forum.makerdao.com/u/lollike)'s [web app 1](https://dciam.vercel.app/) in case you want to help out and trigger a DC increase yourself. Colouration shows when this is possible or critical.

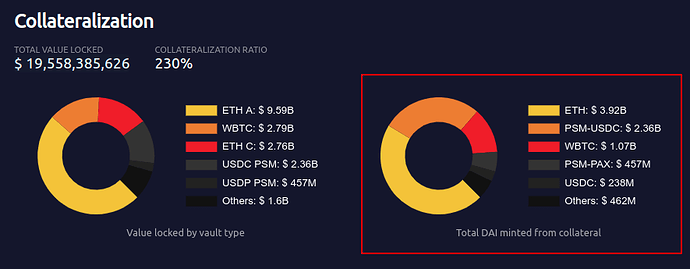

New collateralization doughnut

A new doughnut chart on the bottom of the collateral list page show how much DAI is generated from each type of collateral. ETH, for example, in this case counts the generated DAI total from ETH-A, ETH-B and ETH-C. Note that this chart has filters from the above list applied, so it won't necessarily show data for the entire system.

Chart option for P/E estimate

Default selection also changed to profit estimate, P/E estimate (price over earnings) and fee income.

MakerDAO growth page

In case you've ever wondered how MakerDAO is growing but don't want to read a chart, Makerburn's [got you covered](https://makerburn.com/#/growth). *Only* 9x growth in DAI supply this past year when the year prior it grew by 10x. Woe is us .

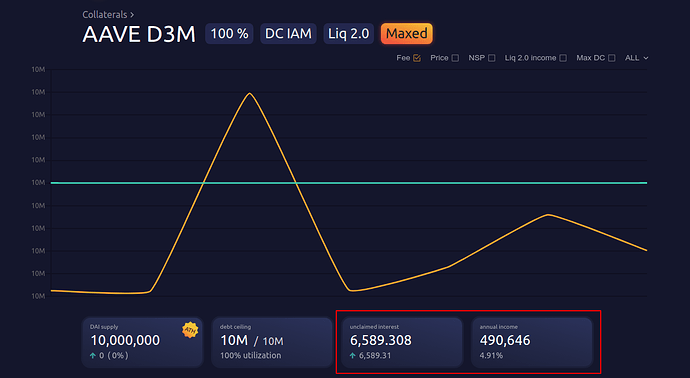

D3M support

Support for the cool new [Aave Direct Depost Module](https://makerburn.com/#/collateral/direct_aavev2_da) (D3M) has been implemented. The "unclaimed interest" counter accrues live based on the current apy of DAI deposits on Aave.

And finally...

Introducing Makerburnbot

Makerburnbot does his best to provide Discord users with cool updates as they happen.

Right now, he will post when large mints happen, when MKR is burned or when new liquidations are triggered. A "large mint" means that the amount of DAI generated exceeds 0.05% of the total system supply (4.33M DAI at this moment when total supply is at 8.67B) or 1% of that collateral's supply (for example 1.5M for ETH-B which is at 150M).

Do you think the bot is too spammy? Maybe it should have a lower limit of 1M for new mints? Or maybe you'd even like to see more updates? Let me know in the comments!

Other stuff

There has also been a lot of minor improvements, like a 2 year duration option for the chart, but I think this post is already long enough.

As always, if there is something you'd like to see changed or added, please don't hesitate to reach out.

Thank you all for using the site

# PPG

## **Mid-month Parameter Changes Proposal - PPG-OMC-001 - 2021-11-10**

[Bi-weekly Proposals](https://forum.makerdao.com/tag/ppg-omc-001)

Parameter Proposal Group: [MakerDAO Open Market Committee](https://forum.makerdao.com/t/parameter-proposal-group-makerdao-open-market-committee/7355)

Authors: [@Primoz](https://forum.makerdao.com/u/primoz), [@LongForWisdom](https://forum.makerdao.com/u/longforwisdom), [@Monet-supply](https://forum.makerdao.com/u/monet-supply), [@SebVentures](https://forum.makerdao.com/u/sebventures), [@Akiva](https://forum.makerdao.com/u/akiva), [@hexonaut](https://forum.makerdao.com/u/hexonaut), [@ultraschuppi](https://forum.makerdao.com/u/ultraschuppi)

#### [](https://forum.makerdao.com/t/mid-month-parameter-changes-proposal-ppg-omc-001-2021-11-10/11562#overview-1)Overview

DAI minting from volatile assets has been accelerating in the last weeks. We are probably going to hit the [Maximum Debt Ceiling](https://makerdao.world/en/learn/governance/module-dciam) of WBTC-A of 1.5 B DAI (increased in the [last Mid-Month Proposal](https://forum.makerdao.com/t/mid-month-parameter-changes-proposal-ppg-omc-001-2021-10-15/11037#wbtc-a-5)) in a few days. This debt-exposure is reaching an unhealthy state so we propose a few changes to slow down a bit.

#### [](https://forum.makerdao.com/t/mid-month-parameter-changes-proposal-ppg-omc-001-2021-11-10/11562#risk-overview-2)Risk Overview

[@Risk-Core-Unit](https://forum.makerdao.com/groups/risk-core-unit) suggests the increase of risk compensation for WBTC vaults for a few important reasons:

- Despite WBTC-DAI on-chain liquidity not being as bad, it is still about 3x worse than ETH-DAI liquidity. What concerns us is the fact that about 50% of existing WBTC is used for leverage across three largest DeFi lending platforms. In a price shock scenario, additional WBTC liquidity might potentially need to be sourced by market makers, which would need to rely on a longer than expected redemption cycle. This potentially means WBTC peg could temporarily break, which creates additional issues for Maker which still uses BTC/USD price oracles instead of WBTC/USD price pair.

(https://maker.blockanalitica.com/assets/)

Source: [MakerDAO Risk Dashboard | Block Analitica](https://maker.blockanalitica.com/assets/)

- Loan concentration at WBTC-A vault type is one of the highest as three largest borrowers represent two thirds of the exposure. Further, collateralization ratios of WBTC-A vaults are among lowest compared to other Maker vault types, creating additional liquidation risks.

4](https://maker.blockanalitica.com/vaults/)

Source: [MakerDAO Risk Dashboard | Block Analitica](https://maker.blockanalitica.com/vaults/)

- Maker also became the largest holder of WBTC, surpassing Aave and Compound. As much as this sounds promising, it means Maker carries the largest liquidity risk. Especially since Maker would be the last in line to liquidate WBTC in a price shock scenario (because of the 1h OSM delay) and other platforms could potentially already drain a large part of available WBTC on-chain liquidity.

(https://maker.blockanalitica.com/defi/)

Source: [MakerDAO Risk Dashboard | Block Analitica](https://maker.blockanalitica.com/defi/)

We also believe that a good way to partially mitigate this would be to introduce a higher LR WBTC-C vault, instead of limiting DC on WBTC-A and forcing users to use riskier WBTC-B type.

#### [](https://forum.makerdao.com/t/mid-month-parameter-changes-proposal-ppg-omc-001-2021-11-10/11562#proposed-changes-3)Proposed Changes

[](https://forum.makerdao.com/t/mid-month-parameter-changes-proposal-ppg-omc-001-2021-11-10/11562#wbtc-a-increase-sf-from-25-to-40-4)WBTC-A: Increase SF from 2.5 to 4.0%

[](https://forum.makerdao.com/t/mid-month-parameter-changes-proposal-ppg-omc-001-2021-11-10/11562#wbtc-b-increase-sf-from-50-to-70-5)WBTC-B: Increase SF from 5.0% to 7.0%

#### [](https://forum.makerdao.com/t/mid-month-parameter-changes-proposal-ppg-omc-001-2021-11-10/11562#final-note-6)Final Note

The proposed changes, if confirmed, should increase yearly revenue ceteris paribus by about 18 MM or from 132 MM to 150 MM DAI.

Proposed changes will get included into next week's on-chain poll on November 15, 2021 (Berlin), and if passed, will be included in an executive vote on November 19, 2021 (Berlin).

---

## **Parameter Changes Proposal - PPG-OMC-001 - 2021-11-25**

Parameter Proposal Group: [MakerDAO Open Market Committee ](https://forum.makerdao.com/t/parameter-proposal-group-makerdao-open-market-committee/7355)\

Authors: [@Primoz](https://forum.makerdao.com/u/primoz) [@LongForWisdom](https://forum.makerdao.com/u/longforwisdom), [@Monet-supply](https://forum.makerdao.com/u/monet-supply), [@SebVentures](https://forum.makerdao.com/u/sebventures), [@hexonaut](https://forum.makerdao.com/u/hexonaut), [@ultraschuppi](https://forum.makerdao.com/u/ultraschuppi)

Source: [Risk Premiums & Competitive Rates December 2021](https://docs.google.com/spreadsheets/d/1xXH5cn0WEdiWrbj6ZMoywxAXMPjKvtH5HNofd4TloTw/edit#gid=1552963597)

#### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825#market-overview-1)Market Overview

DAI borrow rates at Compound and Aave have been very volatile over the last month and ended at a level between 2% and 3% after including farming rewards on supplied collateral and borrowed DAI. Aave has recently decreased farming rewards by 30% but we don't expect this to affect DAI rates significantly as the reward distribution between supplied and borrowed DAI changed from 50:50 ratio to 33:66. While rates at two largest Maker competitors are on average in line with current ETH-A rate, note that the rate volatility on these secondary lenders platforms is very high, implying that additional larger borrow amounts could not be sustained at these low rates at Aave and Compound as easily.

This was also one of the main reasons why we thought a smaller increase in ETH-A rate should be sustained by the large borrowers. According to the last [study performed](https://forum.makerdao.com/t/dai-supply-growth-and-risk-metrics/11704), most of the recent debt increase on ETH-A was performed by two entities who represent already two thirds of ETH-A debt exposure.

(https://maker.blockanalitica.com/defi/)\

Source: [MakerDAO Risk Dashboard | Block Analitica](https://maker.blockanalitica.com/defi/)

#### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825#risk-overview-2)Risk Overview

Risk premiums have remained at similar levels over the last months, except for some smaller assets that have seen outflow of liquidity from Sushiswap lately - TVL dropped by more than 1bn in the last 2 weeks, potentially due to different allocation of Sushi liquidity mining rewards. Assets that are being affected are mostly tokens that are currently being offboarded at Maker. YFI liquidity dropped significantly on Sushiswap, but 25m out of 31m YFI-A debt is represented by Yearn treasury and YFI vault strategy, which is normally treated as a safe and well managed position.

WBTC vaults still present a threat at current exposure due to potentially long WBTC redemption cycle issues, but after knowing the largest two borrowers are two large and well capitalized centralized lenders, we feel a bit more relaxed about the state of WBTC vault risk. Additionally the upcoming safer and cheaper WBTC-C vault should offload some of these risks.

The calculated ETH-B risk premium is an outlier currently and has a high value because of the large amount of recently newly opened vaults that the risk model by default treats as medium or high risk, since we don't have any behavioural inputs to use.

#### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825#proposed-changes-3)Proposed Changes

[](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825#eth-a-4)ETH-A

- increase Stability Fee by 0.25% from 2.5% to 2.75%

(https://www.mkranalytics.com/vaults/ETH/ETH-A)

Competitive rates have decreased slightly in the last month. The proposed rate of 2.75% will remain below the competitive rates but bring us closer to them. This continues our policy of proposing small rate changes where possible.

[](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825#eth-b-5)ETH-B

- increase Stability Fee by 0.5% from 6.0% to 6.5%

](https://www.mkranalytics.com/vaults/ETH/ETH-B)

Similar adjustment like with ETH-A. ETH-B users are traditionally less sensitive to rate changes so we propose a bigger increase of the Stability Fee here.

[](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825#wbtc-a-6)WBTC-A

- increase Maximum Debt Ceiling by 500 MM from 1500 MM to 2000 MM

- increase Target Available Debt by 20 MM from 60 MM to 80 MM

[ 1](https://www.mkranalytics.com/vaults/BTC/WBTC-A)

The DAI-minting from WBTC-A has slowed down in the last week, maybe also related to the [Mid-month rates increase](https://forum.makerdao.com/t/mid-month-parameter-changes-proposal-ppg-omc-001-2021-11-10/11562). The primary driver for the accelerated DAI-minting has been identified - [Celsius](https://debank.com/profile/0x87a67e7dc32fdc79853d780c6f516312b4a503b5) - so we feel a lot more confident now with WBTC in general which is why we propose changing `line` and `gap` to allow more DAI from this vault type.

[](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825#link-a-7)LINK-A

- increase Stability Fee by 1.0% from 1.5% to 2.5%

(https://www.mkranalytics.com/vaults/LINK/LINK-A)

We have been keeping the rates for LINK-A artificially low to stimulate DAI-minting. Within the last 6 weeks ~25 MM new DAI have been minted so we think it is time to bring this to a level we have for other similar collateral types.

[](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825#mana-a-8)MANA-A

- increase Stability Fee by 3.0% from 3.0% to 6.0%

[](https://www.mkranalytics.com/vaults/MANA/MANA-A?stats=Fee%20-%20Stability%20Fee%2CDai%20Supply%20-%20Dai%20Supply&start=1605999600&end=1638053999&granularity=Weekly)

With the currently set Stability Fee MANA-A is not a profitable product. We propose to increase the Stability Fee with the target to breakeven with the oracle costs. If this product starts working again, we can decrease the fees again later - if it doesn't the community should think about offboarding it like we already did with a couple of other collateral types.

[](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825#uni-a-9)UNI-A

- increase Stability Fee by 2.0% from 1.0% to 3.0%

[](https://www.mkranalytics.com/vaults/UNI/UNI-A?stats=Fee%20-%20Stability%20Fee%2CDai%20Supply%20-%20Dai%20Supply%2CCollateral%20-%20Collateral%20Price&start=1629842400&end=1637881199&granularity=Daily)

Similar situation as with MANA-A - the rates are artificially low but the intended effect of increased DAI minting is not happening. We applied a similar growth strategy here as we did with LINK-A, but in this case it did not work out. The proposed changes will barely cover the oracle costs.

### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825#gusd-a-10)GUSD-A

- increase Stability Fee by 1.0% from 0.0% to 1.0%

[](https://www.mkranalytics.com/vaults/USD/GUSD-A?stats=Fee%20-%20Stability%20Fee%2CDai%20Supply%20-%20Dai%20Supply&start=1606604400&end=1638658799&granularity=Weekly)

The [GUSD-PSM](https://vote.makerdao.com/polling/QmayeEjz?network=mainnet#vote-breakdown) is going to launch soon. As a first step we propose to increase the Stability Fee slightly with the goal to increase motivation to unwind here and move over to PSM.

[](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825#guniv3daiusdc1-a-11)GUNIV3DAIUSDC1-A

- decrease Stability Fee by 0.4% from 0.5% to 0.1%

[](https://www.mkranalytics.com/vaults/USD/GUNIV3DAIUSDC1-A?stats=Fee%20-%20Stability%20Fee%2CDai%20Supply%20-%20Dai%20Supply%2CDai%20Supply%20-%20Debt%20Ceiling&start=1629842400&end=1637881199&granularity=Daily)

The APR on this pool has decreased significantly so the DAI-minting has slowed down a lot. This is related to the new [0.01% UniV3-pool](https://info.uniswap.org/#/pools/0x5777d92f208679db4b9778590fa3cab3ac9e2168) which already has a much higher volume than the underlying [0.05% pool](https://info.uniswap.org/#/pools/0x6c6bc977e13df9b0de53b251522280bb72383700) of this collateral. With the currently set Stability Fee it is not profitable to stay here, we propose to decrease the Stability Fee to reduce the loss for vault users.

Note that there is already a Signal Request in the forum for [onboarding the corresponding Gelato-Token for the new pool](https://forum.makerdao.com/t/g-uni-dai-usdc-0-01-tier-onboard-g-uni-for-univ3s-new-0-01-fee-tier/11738).

The proposed changes will decrease our annualized income by ~0.75 MM - we still think this is a reasonable change as the alternative would be that the vaults will unwind.

[](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825#uniswap-v2-lps-12)Uniswap V2-LPs:

- UNIV2DAIETH-A - increase Stability Fee by 0.5% from 1.5% to 2.0%

- UNIV2WBTCETH-A - increase Stability Fee by 0.5% from 2.5% to 3.0%

- UNIV2USDCETH-A - increase Stability Fee by 0.5% from 2.0% to 2.5%

- UNIV2UNIETH-A - increase Stability Fee by 2.0% from 2.0% to 4.0%

We propose adjusting the Stability Fees to closer align with the rates we have for the underlying collateral types.

#### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825#revenue-effects-13)Revenue Effects

We anticipate the effect on annualized revenue - assuming stable levels of utilization - to be

- ETH-A: increase by ~7.8MM

- ETH-B: increase by ~0.77 MM

- LINK-A: increase by ~0.68 MM

- MANA-A: increase by ~0.16 MM

- UNI-A: increase by ~0.25 MM

- GUNIV3DAIUSDC1-A: decrease by ~0.75 MM

- Uniswap V2-LPs combined: increase by ~0.58 MM

#### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-2021-11-25/11825#final-note-14)Final Note

The proposed changes, if confirmed, should increase yearly revenue by about 9.6 MM or from 153.2 MM to 162.8 MM DAI.

Proposed changes will get included into next week's on-chain poll on November 29, 2021 (Berlin) , and if passed, will be included in an executive vote on December 3, 2021 (Berlin) .

---

### Credits

Credit is owed to all Core Units and teams mentioned in this summary.