---

tags: Monthly Core Unit Updates

---

# Monthly Core Unit Updates: March 2022 (pt 4)

###  [Sidestream Auction Services](https://forum.makerdao.com/c/core-units/sidestream-core-unit)

<details><summary>Unified Auctions UI Release v0.9.0 - March 11th 2022</summary><br>

[Link](https://forum.makerdao.com/t/unified-auctions-ui-release-v0-9-0-march-11th-2022/13850)

Unified Auctions UI Release v0.9.0 - March 11th 2022

====================================================

Version: v0.9.0\

Name: Phillips

### [](https://forum.makerdao.com/t/unified-auctions-ui-release-v0-9-0-march-11th-2022/13850#v090-in-a-nutshell-2)v0.9.0 in a nutshell

Hitting larger milestones always feels good. We had this feeling during the last sprint, watching our keeper take some auctions on goerli and kovan for the first time. Today we are releasing the first version of our collateral keeper. Besides that, we made some good progress to support the Dai bidding flow in our UI. Our plan is to release this feature at the end of the next sprint. And lastly, not having any information on a finished auction was a thorn in our side. We changed it...

Phillips Auction House is considered as a very dynamic and forward-looking auction house, due to its focus on the defining aesthetic movements of the last century. With especially an eye on the next sprint, we also work future-oriented and want to constantly release new features and work out the foundation for upcoming ones, so the name Phillips seems like a fit.

### [](https://forum.makerdao.com/t/unified-auctions-ui-release-v0-9-0-march-11th-2022/13850#a-closer-look-at-changes-3)A closer look at changes

#### [](https://forum.makerdao.com/t/unified-auctions-ui-release-v0-9-0-march-11th-2022/13850#unified-auctions-keeper-implementation-v1-4)Unified Auctions Keeper implementation V1

[

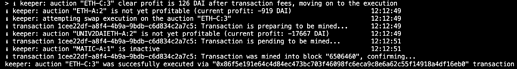

Keeper_logs1918×258 41.1 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/b/7/b7ccd8bc569abebf40839c9d6a3dfdb4864b2955.png "Keeper_logs")

For the first version of our keeper implementation, we were able to rely on a lot of the logic that we have already built for our UI. Our modular and structured approach right from the beginning pays off. With the keeper, we are basically providing a script that fetches collateral auctions and its market values on a regular basis. Once one auction becomes profitable, the script executes the relevant authorizations (if they are not yet executed) and moves on to take the auction via flash landing. The keeper is not optimized in a way to outcompete other market actors, but rather constitutes a backstop solution. Everyone is able to download and run the code themselves after setting the required parameters (more on that in the [readme](https://github.com/sidestream-tech/unified-auctions-ui/blob/main/bot-twitter/README.md))

Despite it's the first release of the keeper, a lot of thought was put in its design already:

- Our keeper implementation is beginner-friendly (you need to create one config file with only a few parameters to get it running)

- The keeper can work in a simulated environment such as a hardhat fork without a problem (since we fetch current maker contracts from the chainlog contract)

- The keeper wouldn't execute any transactions (including auth transactions) until it can yield a net profit specified by the user. Net profit means that it takes estimated transaction fees into consideration

- The keeper executes auctions in parallel, meaning that if there are several auctions running, it will not wait for one transaction to finish executing another one. At the same time, the design prevents it from executing authorisations of the same kind twice, even if they are running in parallel

We're looking forward to your feedback and feature requests for the next Unified Auctions Keeper versions.

#### [](https://forum.makerdao.com/t/unified-auctions-ui-release-v0-9-0-march-11th-2022/13850#info-on-finished-auctions-5)Info on finished auctions

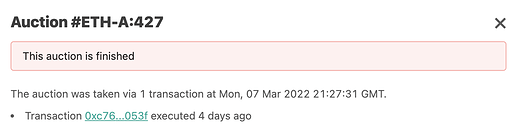

[

Finished_Auction1368×360 28.3 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/8/3/8384fcade69c8a0b8e8e2b5ce3a3911287a2094e.png "Finished_Auction")

When directly navigating to a past auction on the Unified Auctions UI in the past, we only showed the message "This auction was not found". We don't want to keep the user in the dark any longer and now provide some information on what happened to the auction in question.

For that, fetch clipper `Take` events and display the transaction hashes for further investigation. You can try it out with a recent ETH-A auction: [Auctions UI 2](https://auctions.makerdao.network/collateral?network=mainnet&auction=ETH-A%3A427)

As always, we are aiming to provide the best possible experience to the user, and we see past auction data as a means to make more informed decisions. So in the future we will bring more analytical auction data to the UI.

#### [](https://forum.makerdao.com/t/unified-auctions-ui-release-v0-9-0-march-11th-2022/13850#progress-on-the-dai-bidding-flow-6)Progress on the Dai bidding flow

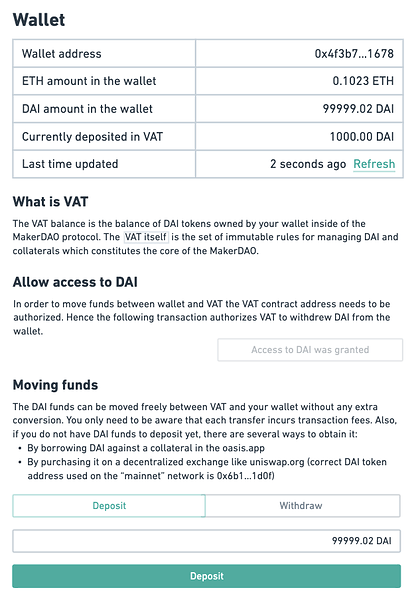

[

WalletPopup624×904 83 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/6/2/625660cfb41b11853eb5f161fdac9daef34e937e.png "WalletPopup")

In our last release notes, we already gave an insight on how we are going to support the flow to bid on an auction with Dai. The first components and some underlying logic was built. The missing part to complete this feature is to provide an interface to the user that allows to deposit and withdraw Dai to and from the VAT. This is what we are tackling in the next sprint.

</details></br>

###  [TechOps]()

<details><summary></summary><br>

[Link]()

</details></br>

##  Others

### Delegate Updates

<details><summary>Recognized Delegate Compensation Breakdown - March 2022</summary><br>

[Link](https://forum.makerdao.com/t/recognized-delegate-compensation-breakdown-march-2022/14427)

### Breakdown - March 2022

| Delegate | Address | Amount (DAI) | Notes |

| --- | --- | --- | --- |

| Flip Flop Flap Delegate LLC | [ 0x688d508f3a6B0a377e266405A1583B3316f9A2B3](https://etherscan.io/address/0x688d508f3a6B0a377e266405A1583B3316f9A2B3) | 12000 | |

| Feedblack Loops LLC | [ 0x80882f2A36d49fC46C3c654F7f9cB9a2Bf0423e1](https://etherscan.io/address/0x80882f2A36d49fC46C3c654F7f9cB9a2Bf0423e1) | 12000 | |

| ultraschuppi | [ 0x89C5d54C979f682F40b73a9FC39F338C88B434c6](https://etherscan.io/address/0x89C5d54C979f682F40b73a9FC39F338C88B434c6) | 12000 | |

| MakerMan | [ 0x9AC6A6B24bCd789Fa59A175c0514f33255e1e6D0](https://etherscan.io/address/0x9AC6A6B24bCd789Fa59A175c0514f33255e1e6D0) | 10761 | |

| ACREInvest | [ 0x5b9C98e8A3D9Db6cd4B4B4C1F92D0A551D06F00D](https://etherscan.io/address/0x5b9C98e8A3D9Db6cd4B4B4C1F92D0A551D06F00D) | 9295 | |

| monetsupply | [ 0x4Bd73eeE3d0568Bb7C52DFCad7AD5d47Fff5E2CF](https://etherscan.io/address/0x4Bd73eeE3d0568Bb7C52DFCad7AD5d47Fff5E2CF) | 7598 | Performance Modifier of 69.56% applied |

| JustinCase | [ 0xE070c2dCfcf6C6409202A8a210f71D51dbAe9473](https://etherscan.io/address/0xE070c2dCfcf6C6409202A8a210f71D51dbAe9473) | 6640 | |

| GFX Labs | [ 0xa6e8772af29b29B9202a073f8E36f447689BEef6](https://etherscan.io/address/0xa6e8772af29b29B9202a073f8E36f447689BEef6) | 6606 | |

| Doo | [ 0x3B91eBDfBC4B78d778f62632a4004804AC5d2DB0](https://etherscan.io/address/0x3B91eBDfBC4B78d778f62632a4004804AC5d2DB0) | 283 | Pro-rata payout - started on 7th of March |

3 Recognized Delegates did not qualify for compensation this month: Gauntlet, Hasu, and Flipside Crypto.

Payout for March 2022: 77,183 DAI

[Summary 1](https://docs.google.com/spreadsheets/d/1q1qy4KwwVW9Uc7rWszQaCOFuDACbP9XTEk0TM3ZGw08/edit#gid=1372802823) - [Calculations](https://docs.google.com/spreadsheets/d/1q1qy4KwwVW9Uc7rWszQaCOFuDACbP9XTEk0TM3ZGw08/edit#gid=1332881127) - [Processed MKR-by-Day](https://docs.google.com/spreadsheets/d/1q1qy4KwwVW9Uc7rWszQaCOFuDACbP9XTEk0TM3ZGw08/edit#gid=1261983691) - [Raw MKR-by-Day](https://docs.google.com/spreadsheets/d/1q1qy4KwwVW9Uc7rWszQaCOFuDACbP9XTEk0TM3ZGw08/edit#gid=1928066296)

*Previous Payouts and Annualized Compensation*

- Payout for February 2022: 57,665 DAI

- Payout for January 2022: 54,752 DAI

- 3-Month Annualized Compensation: 758,400 DAI

Credits\

Huge thanks to [@piotr.klis](https://forum.makerdao.com/u/piotr.klis) from the Data Insights CU for the raw data.

### [](https://forum.makerdao.com/t/recognized-delegate-compensation-breakdown-march-2022/14427#comments-2)Comments

#### [](https://forum.makerdao.com/t/recognized-delegate-compensation-breakdown-march-2022/14427#calculations-around-starting-leaving-delegates-3)Calculations around starting / leaving delegates

- Recognized Delegate's MKR weight is measured once per day, and this is used to generate an average for the month.

- The amount of MKR Recognized Delegates are credited with is an average of the days for which they were active for the month.

- The average referenced in the previous point counts MKR delegated on each day to a maximum of 10,000 MKR in line with the intention to cap the benefit from delegated MKR at the upper threshold of 10,000 MKR.

- We apply pro-rata scaling to compensation for Recognized Delegates that were only active for a part of the month.

#### [](https://forum.makerdao.com/t/recognized-delegate-compensation-breakdown-march-2022/14427#recognized-delegate-compensation-calculations-4)Recognized Delegate Compensation Calculations

[MIP 61 3](https://mips.makerdao.com/mips/details/MIP61) was ratified during the March Governance Cycle. This MIP contains details of the calculations used to determine Recognized Delegate compensation as well as information about the Performance Modifier.

#### [](https://forum.makerdao.com/t/recognized-delegate-compensation-breakdown-march-2022/14427#distribution-5)Distribution

Recognized Delegate compensation will be distributed as part of the Executive Vote scheduled for the 8th of April.

#### [](https://forum.makerdao.com/t/recognized-delegate-compensation-breakdown-march-2022/14427#previous-recognized-delegate-compensation-breakdowns-6)Previous Recognized Delegate Compensation Breakdowns

- [February 2022](https://forum.makerdao.com/t/recognized-delegate-compensation-breakdown-february-2022/13518)

- [January 2022](https://forum.makerdao.com/t/recognized-delegate-compensation-breakdown-january-2022/13001)

- [December 2021](https://forum.makerdao.com/t/delegate-compensation-breakdown-december-2021/12462)

- [November 2021](https://forum.makerdao.com/t/delegate-compensation-breakdown-november-2021/11979)

* * * * *

cc: [@Recognized-Delegates](https://forum.makerdao.com/groups/recognized-delegates)

</details></br>

<details><summary></summary><br>

[Link]()

</details></br>

### Real World Assets (in collab with RWF)

<details><summary>SG Forge: OFH Token Transaction Update - March 2022</summary><br>

[Link](https://forum.makerdao.com/t/sg-forge-ofh-token-transaction-update-march-2022/14334)

Real World Finance, Collateral Engineering Services, Growth and the incubating Legal and Transaction Service core units are pleased to provide the following update on the on-boarding of the SocGen Forge OFH Tokens into a Maker vault. [https://forum.makerdao.com/t/security-tokens-refinancing-mip6-application-for-ofh-tokens/10605 2](https://forum.makerdao.com/t/security-tokens-refinancing-mip6-application-for-ofh-tokens/10605)

We have progressed with SG Forge on nearly all of the commercial, technical and legal workstreams. SG Forge continues to progress on its regulatory and compliance assessment and selection of potential brokers to convert DAI into fiat. This regulatory and compliance assessment and selection remains outstanding. It's currently the key transaction blocker and dependency.

Commercial/Risk/Legal

We have made solid progress on two of the three legal agreements to evidence the transaction. All of the legal agreements will be governed by French law.

Instruction - The instruction is the instrument under which DIIS Group, as representative for the Maker community, acts under the DAI Loan Agreement and the Pledge Agreement. As a commercial and legal matter, we have aligned with SG-Forge that the instruction be an instrument approved by the Maker token holders and DIIS Group. SG-Forge and its counsel have signed off on this approach. The original draft contemplated an agreement signed by DIIS Group and Maker DAO.

The instruction includes a mechanism for DIIS Group to take instructions (as required) from a delegated committee of Maker representatives (the appointment, replacement and authorities of which to be further developed, and proposed in the Risk Assessment). But the intention is for the delegated committee to be an authorized real world communication point for any loan administration related issues and communications.

DAI Loan Agreement - The DAI Loan Agreement outlines the key commercial terms of the transaction. The DAI Loan Agreement also includes the collateral ratio threshold, cure periods, and liquidation triggers if the collateral ratio is breached.

RWF is working with SG-Forge to align on a valuation metric for the OFH Token by referencing a pool of similar covered bonds.

Pledge Agreement - SG-Forge will prepare the pledge agreement after our final alignment on the Instruction and the DAI Loan Agreement.

As a legal matter, the incubating LTS core unit spent some time with external counsel (including SG-Forge's French counsel) to better understand the legal risks and potential mitigants associated with SG-Forge holding the "keys" to the OFH Tokens. This is a novel issue as the "keys" give SG-Forge control over the OFH Tokens in the event of a liquidation. The incubating LTS core unit will provide a more detailed write-up of the risks and mitigants in the Risk Assessment (when published). We consider this issue to be resolved with SG-Forge.

Collateral Engineering Services

CES has continued to work with SG-Forge on the incorporation of the OFH Token into a Maker Vault. CES and SG-Forge have worked collaboratively to evaluate several potential mechanisms to incorporate the OFH Token (which is not ERC-20 compliant) into the Maker Protocol. CES has aligned with SG-Forge to adopt the MIP-21 process for the OFH Token.

Growth

Growth remains abreast and engaged with SG-Forge and the Maker core units in moving the transaction towards a successful on-boarding.

[@SylvFromSG-Forge](https://forum.makerdao.com/u/sylvfromsg-forge)\

[@Growth-Core-Unit](https://forum.makerdao.com/groups/growth-core-unit)\

[@collateral-core-unit](https://forum.makerdao.com/groups/collateral-core-unit)\

[@Real-World-Finance](https://forum.makerdao.com/groups/real-world-finance)\

[@luca_pro](https://forum.makerdao.com/u/luca_pro)

</details></br>

<details><summary>RWA International Ltd. - Update</summary><br>

[Link](https://forum.makerdao.com/t/rwa-international-ltd-update/14478)

Toward the end of 2021, the corporate service provider for RWA International Ltd was transferred from Crestbridge to [Zedra 2](https://www.zedra.com/). Corporate services providers are professional firms with seasoned staff (usually attorneys) in jurisdictions such as the Cayman Islands in this case that provide a corporate domicile as well as directors for an entity. This transfer was initiated by Crestbridge and Zedra agreed to accept the role of Director. Zedra is a world-class service provider and familiar with MakerDAO. Nothing material has changed with this transfer less the Director of record in the Cayman Islands. All interaction (e.g. flow of funds & custody of assets) with WSFS and RWA Senior Lending Trust remains unchanged.

In addition to the above, starting in early January discussions started on acceptable mechanisms that could be put in place that would be acceptable to the Directors as to who could be in this optional administrative (non-decision making) role of an "authorized representative". Further, this role could even be eliminated at this stage. They have agreed to only accept a new authorized representative as part of an established process (on their end) and that the person / entity must ultimately have the "affirmative vote" of MakerDAO. The MakerDAO process will be included in my upcoming MIP that further outlines how this will work (or we could remove this role completely).

For any specifics, please DM me. Thank you.

</details></br>

<details><summary>6s Structure Updates</summary><br>

[Link](https://forum.makerdao.com/t/6s-structure-updates/14528)

All -

A quick note with some updates.

In the interests of transparency, please see the communication I have shared with the RWF team post 6s' recent closing.

* * * * *

03 April 2022

On behalf of the 6s team, I want to thank the RWF team for your initial review. My objective with this communication is to establish the work that has been completed thus far to allow for a constructive engagement going forward. Further, as a professional courtesy, I want to ensure we keep lines of communication open.

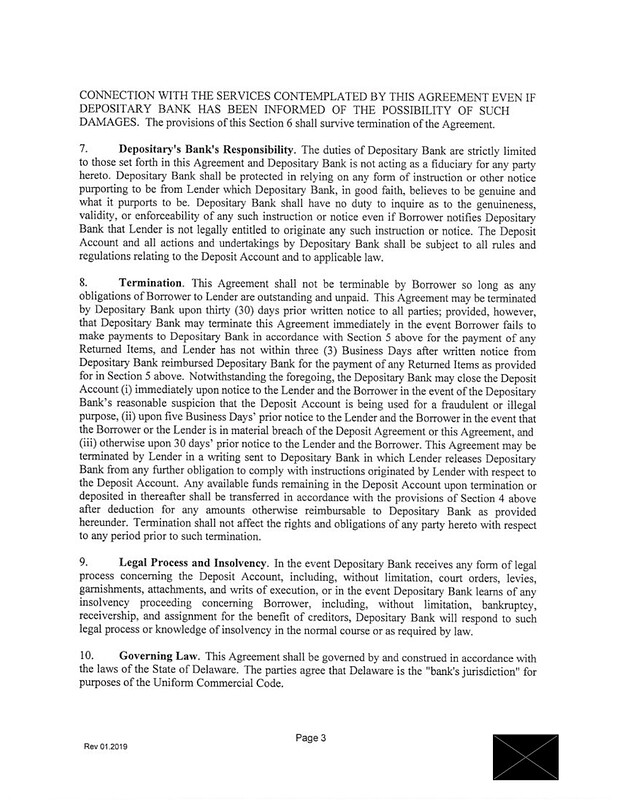

Since our last discussion, 6s has closed and perfected the security interest from the Trust down through 6s Capital Partners down to the underlying projects. Further, as a result of this first usage of the credit facility the lion's share of the concerns that were raised (from our lens) have been addressed as a result. They include:

- the conversion of the protected series to a registered series for Series A;

- implementing the account control agreement;

- removing the ambiguous language surrounding 6.02(a)(iv) with the consent of the Lender;

- filing the UCC-1 to perfect the security interest granted under the Security Agreement; receiving a legal opinion that outlines UCC-1 filing for the security agreement not only includes all historically downstream filed UCC-1s but also including all subsequent filings (e.g. all UCC-1s filing in favor of 6s Capital Partners LLC, Series A as a result of us originating a loan are also perfected to the Trust) - Legal opinions issued by Richards Layton Finger, counsel to WSFS and the Trust;

- built a process to add / remove / replace the Authorized Representative for the CayCo with the Directors of the CayCo;

- built a process to add / remove / replace the members of an advisory committee with the CayCo

Further, Series B has now been registered with the State of Delaware for another creditor to provide isolation from one to the other (Series C, D, and E will be filed soon hereafter).

From our lens, the facility is and was always intended to be a senior secured facility only. The clarifying actions taken above as a result of our first closing reinforce our commitment to this ethos.

We have both completed our 2021 annual audit (clean) and have now closed (perfected liens all the way around) on the first usage of our facility and done so with an institutional counterparty to help our client expand. We want to have a collaborative engagement with RWF and MakerDAO as a whole. Our clients are growing, and 6s is growing to meet their seemingly insatiable needs (now exceeding 100MM of projects allocated to 6s Development, to which 6s Capital can, on a competitive-basis, lend to enable those projects). It is my strong desire to utilize the MakerDAO-capital-sourced Series A of the senior secured structure we have assembled to meet their needs. As you know, the current debt ceiling allocated does not accomplish this objective. My goal here is really simple: for this to be a win (for all of us).

As a result, we will be requesting an increase in our scope in the near future as we want to expand our lending scope to include non-6s related borrowers.

We look forward to engaging with you / the community to allow for the foregoing. Thank you.

* * * * *

To that end and as referenced above and with the consent of the Lender / Trust Sponsor / Counsel to for the Lender / Counsel for the Trust Sponsor, 6s proposed the following to Trustee for the Trust and the CayCo directors:

* * * * *

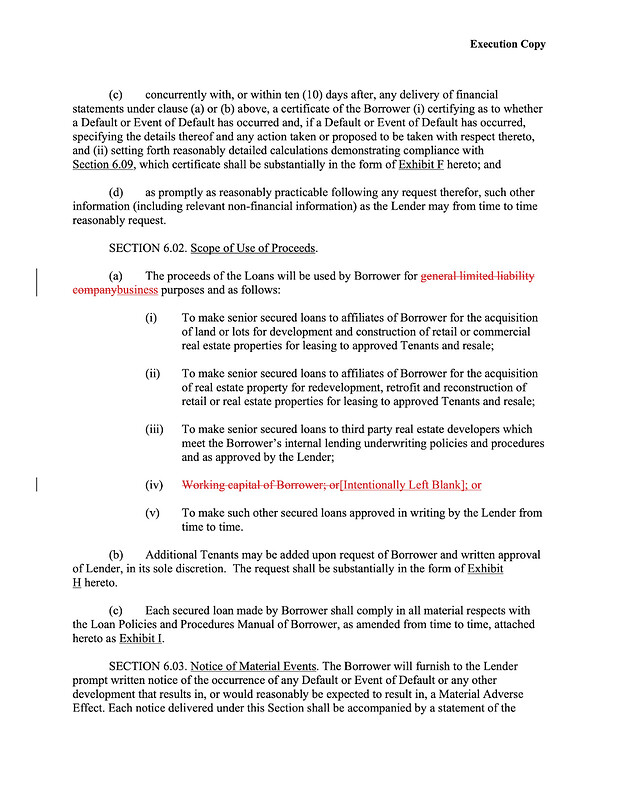

FROM: 6s\

DATE: Feb 27 2022\

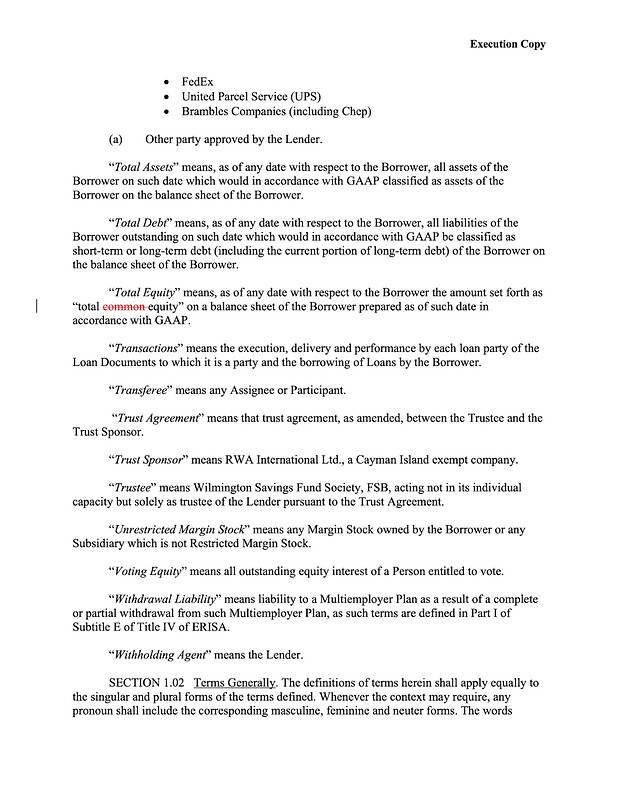

SUBJECT: Credit Agreement - 6S Capital Partners LLC Series A

Since we closed the credit agreement last fall, we have discovered a couple of small nits that we would like to clean up before the first closing. We have attached the 2 marked pages for your consideration.

The first deletion to the definition of Total Equity is to make clear than all equity of the company is included in the ratio calculations. Inclusion of the word "common" was a drafting oversight because we decided to issue both common and preferred equity.

The second deletion relates to an ambiguity concerning unsecured loans. It is not our intention to make unsecured loans with the credit facility proceeds. The words "working capital" could be read to mean this type of loan is permitted and could be unsecured.

Both of these changes benefit the lender and neither change impacts the document pagination. We could execute an amendment to the credit agreement but these changes are not material. If you are comfortable with simply making these 2 changes and inserting the clean revised pages into the existing credit agreement without doing a formal amendment, we would be fine with that.

Please share your thoughts.

* * * * *

Below are the two areas.

[

1237×1600 311 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/3/6/36d3faa91751d747e2d5cad97d81db777782831b.jpeg)

[

1237×1600 358 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/d/e/de9befdd4cb1b9bcdbbd882e6004fa56ffde9f4e.jpeg)

* * * * *

As a result on March 04 2022, Lender / Trust Sponsor / Counsel for the Lender / Counsel for the Trust Sponsor / 6s all agreed to make the above effective as it only benefits the lender and frankly is only for clarifications purposes. The underlying intent has been since DAY ONE to exclusively utilize the credit facility for senior secured transactions only. No other changes have been made.

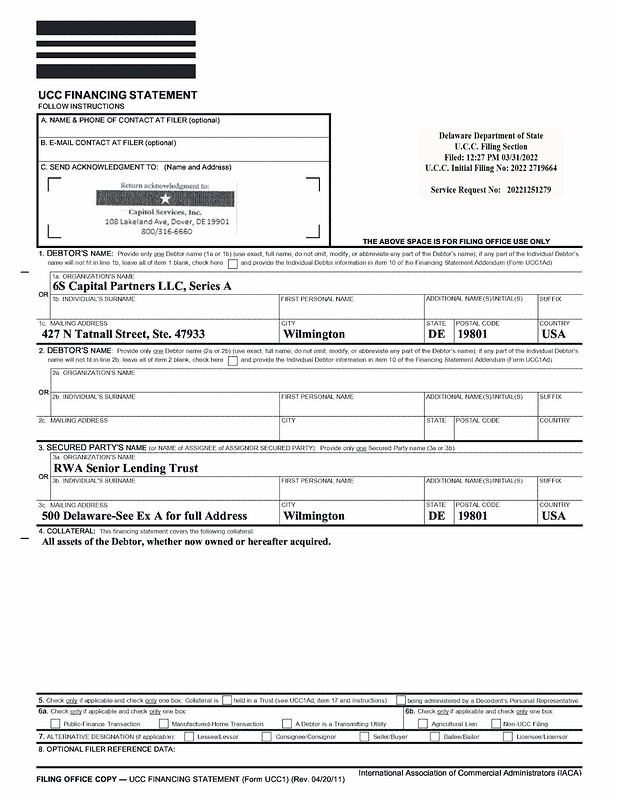

[

1237×1600 343 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/6/e/6e0473d71ae770b412cc84a8860cbaf1424de54c.jpeg)

[

1237×1600 32.7 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/1/9/199ff8f8412aa7a156678dc29d06af2a0ef4406e.png)

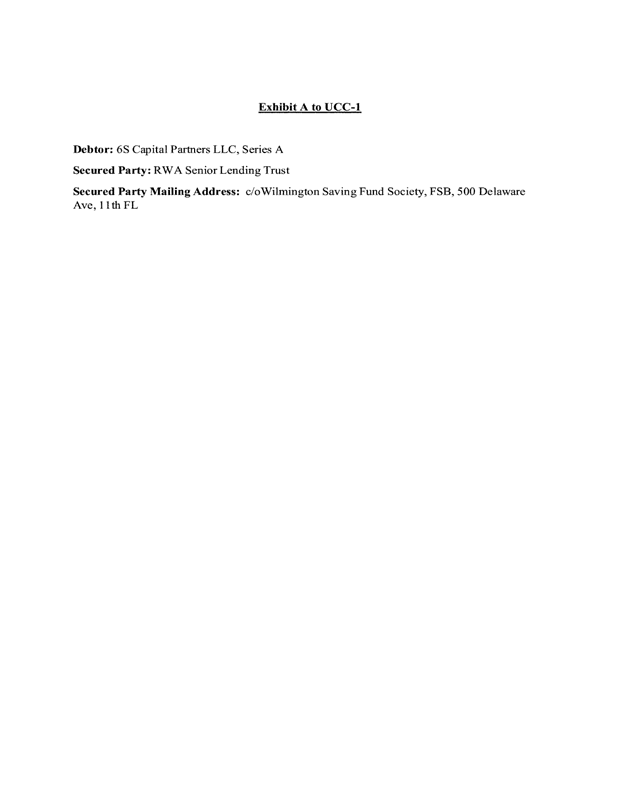

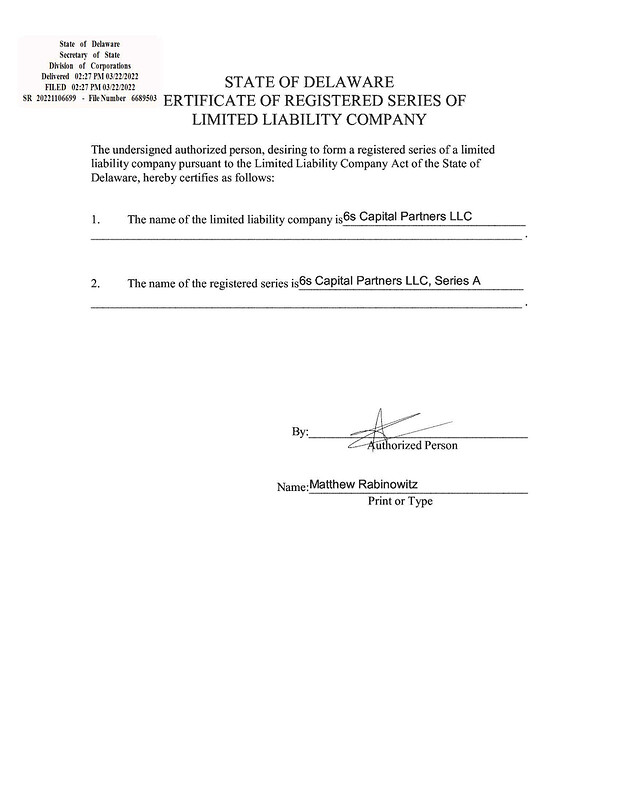

Also, in preparation for multiple series and at the recommendation of the RWF team, 6s converted 6s Capital Partners LLC, Series A from a "Protected" Series to a "Registered" Series.

[

1237×1600 228 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/a/e/aefc945d63635d7c37d43364362ac738370fcc51.jpeg)

[

1237×1600 144 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/0/b/0bfbe6067e3556e69de5e4ca0b19cb688255b285.jpeg)

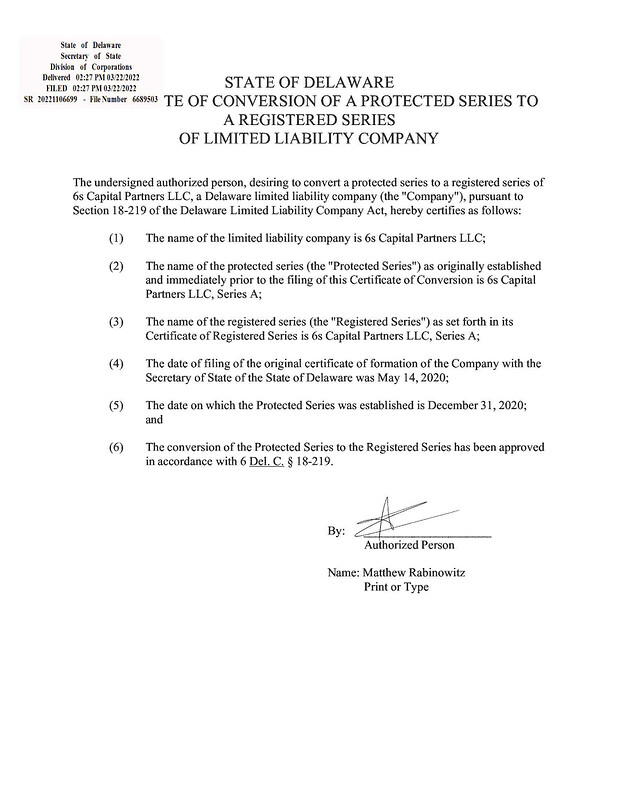

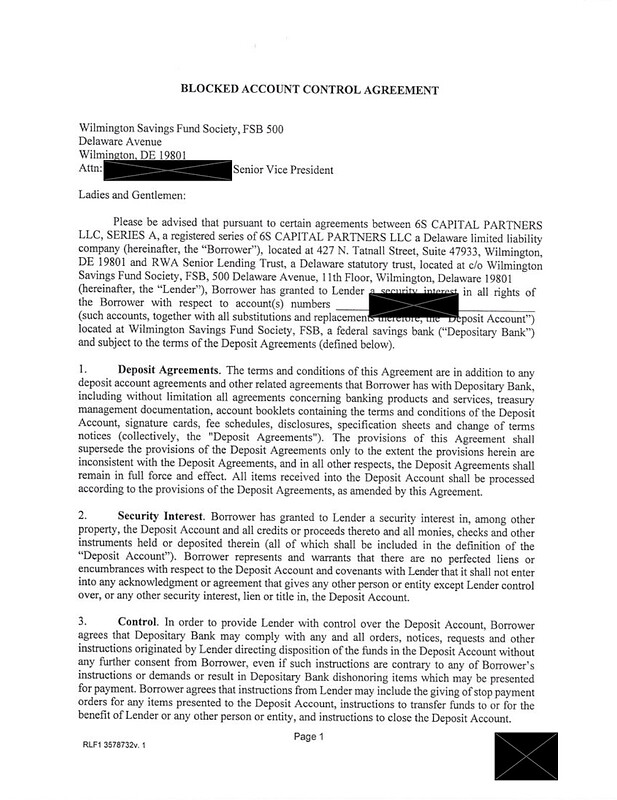

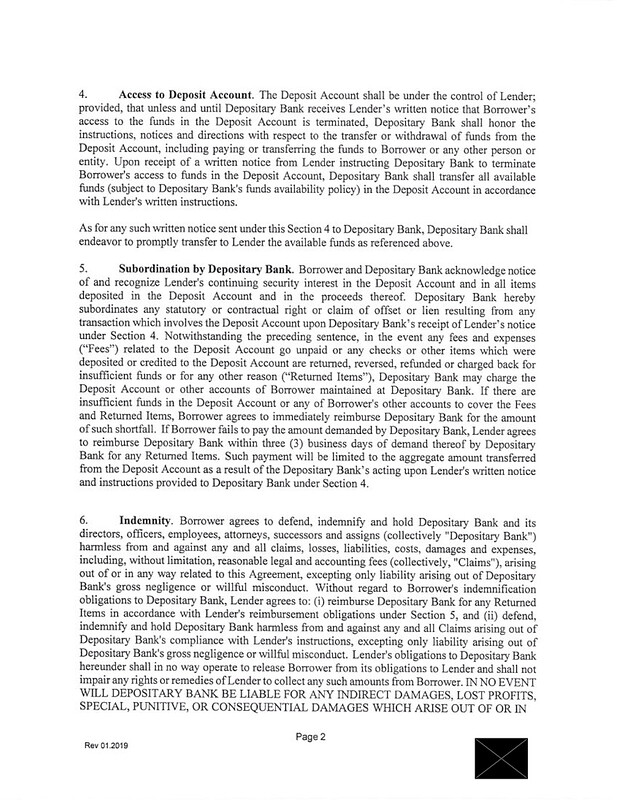

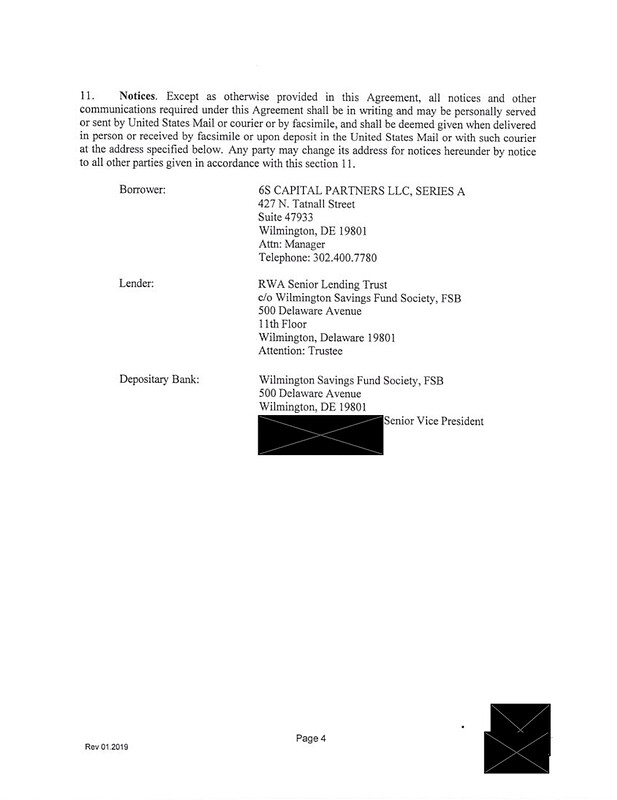

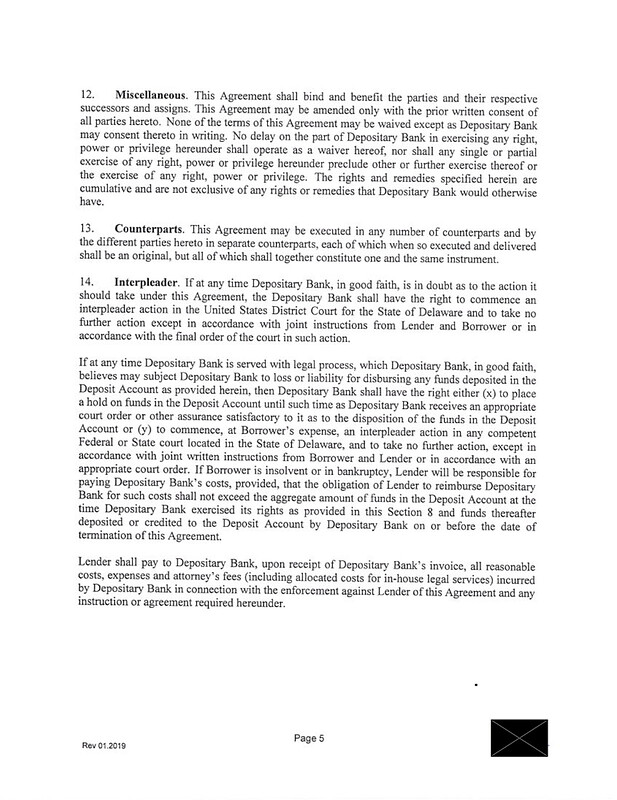

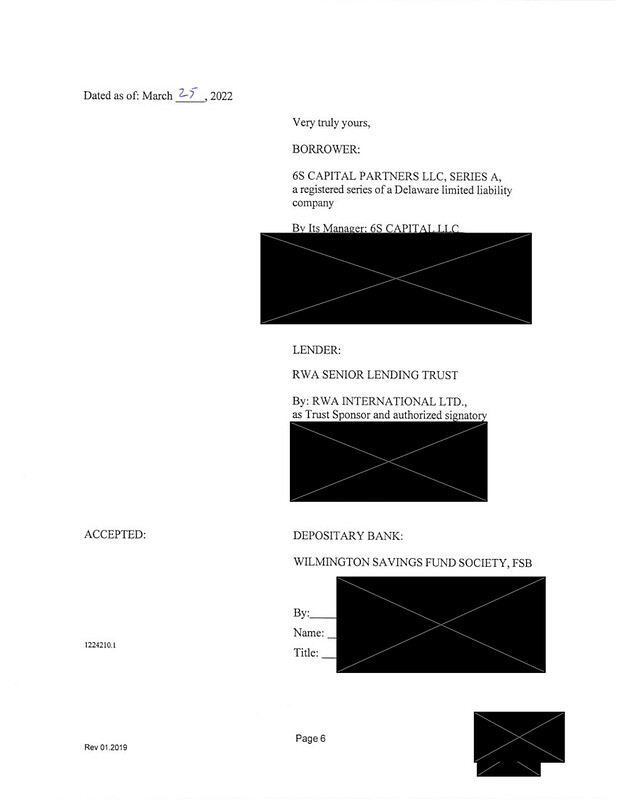

In addition, 6s completed the needed account control agreement as referenced below.

[

1236×1600 397 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/7/f/7febcd842857f72192b31218e961331a1c3d5727.jpeg)

[

1236×1600 454 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/4/5/45016dcbf5eada571d187a269f2947af60539fe4.jpeg)

[

1236×1600 429 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/f/c/fc08465d8732acd08548430c822304aef2b13851.jpeg)

[

1236×1600 144 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/2/9/29d141ddc1873f947caf87f5a2fb12892e9b77d6.jpeg)

[

1236×1600 358 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/a/e/aeceb95534005c52a8aaddcc20b113b9efe2b730.jpeg)

[

1236×1600 104 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/9/1/916029b116129c949a9b92a36c5c801126255b03.jpeg)

* * * * *

As I outlined above and restate for clarity, from our lens, the facility is and was always intended to be a senior secured facility only. The clarifying actions taken above as a result of our first closing reinforce our commitment to this ethos.

</details></br>

### [MakerDAO Open Market Committee](https://forum.makerdao.com/t/parameter-proposal-group-makerdao-open-market-committee/7355)

<details><summary>Parameter Changes Proposal - PPG-OMC-001 - 31 March 2022</summary><br>

[Link](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-31-march-2022/14347)

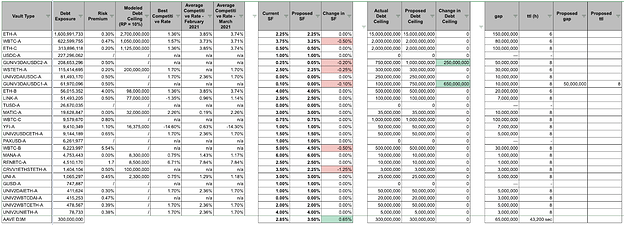

Parameter Proposal Group: [MakerDAO Open Market Committee 4](https://forum.makerdao.com/t/parameter-proposal-group-makerdao-open-market-committee/7355)

Authors: [@Primoz](https://forum.makerdao.com/u/primoz) [@LongForWisdom](https://forum.makerdao.com/u/longforwisdom), [@Monet-supply](https://forum.makerdao.com/u/monet-supply), [@SebVentures](https://forum.makerdao.com/u/sebventures), [@hexonaut](https://forum.makerdao.com/u/hexonaut), [@ultraschuppi](https://forum.makerdao.com/u/ultraschuppi)

[

1600×579 333 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/1/7/17edc2085b5e9176a9e7c6e92160587b928e6dc6.png)

Source: [Risk Premiums & Competitive Rates - Updates for April 2022 1](https://docs.google.com/spreadsheets/d/19ut6QHmvqSjZyfi5fcUNMFp0n0X6ExxM3PtwyiZR1Fg/edit?usp=sharing)

### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-31-march-2022/14347#lending-market-overview-1)Lending Market Overview

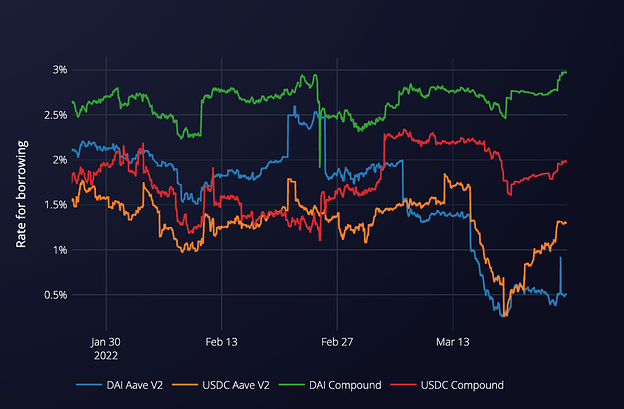

Average defi borrowing costs have declined slightly from the previous month, but are trending up in the past week with improving market sentiment. Rates have diverged somewhat between Aave and Compound, with effective rates on Aave trending lower while Compound rates stayed relatively stable. On Aave, USDC borrowing costs have mostly rebounded while DAI rates remain low, driven by large deposits from the D3M.

[

1140×748 129 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/2/0/201d405d2796a6f3c3618a68e98466571188c5ae.png)

Source: [Blockanalitica dashboard 2](https://maker.blockanalitica.com/defi/)

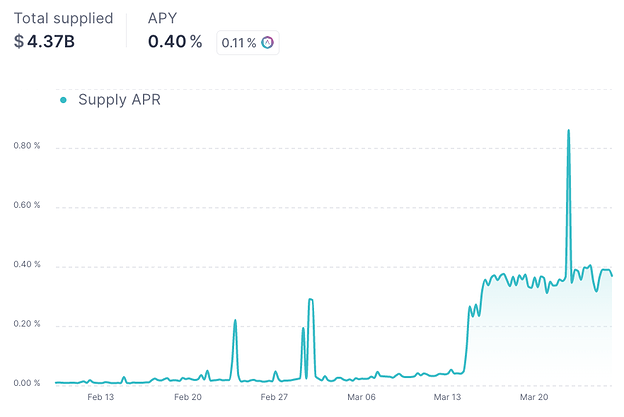

Specifically looking at Aave, the introduction of stETH as a collateral asset has significantly boosted demand for borrowing ETH (driven by users recursively leveraging their stETH position to increase yield). This has increased ETH deposit rates from near 0% to around 0.4%, which reduces the effective cost of borrowing stablecoins against ETH. We may see this effect increase if Aave adopts a [proposed change to the ETH interest rate model 2](https://app.aave.com/governance/proposal/?proposalId=68), which would potentially see ETH deposit rates increase to around 1.9% before liquidity incentives. This would make Aave much more competitive on a simple cost assessment, but would also increase risk of Aave users losing their collateral if Lido experienced issues (eg slashing or , so impact on Maker's competitive position is somewhat unclear (Maker does not rehypothecate collateral so users face lower risk of loss).

[

882×590 29.8 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/8/2/8275810419573b0129acb9b674eaae82d6a52c29.png)

Source: [Aave markets dashboard](https://app.aave.com/reserve-overview/?underlyingAsset=0xc02aaa39b223fe8d0a0e5c4f27ead9083c756cc2&marketName=proto_mainnet)

Compound recently passed [proposal 92 1](https://www.tally.xyz/governance/eip155:1:0xc0Da02939E1441F497fd74F78cE7Decb17B66529/proposal/92), which reduces existing COMP liquidity incentives by 50% across the board. This is likely to be followed in the coming weeks by another proposal to fully remove existing rewards and only offer incentives for newly added assets to help bootstrap liquidity.

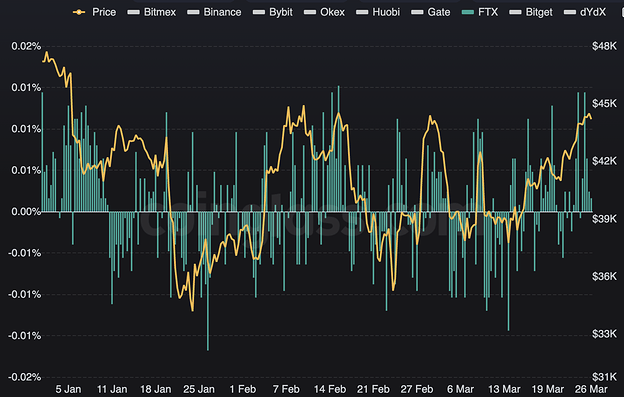

Perpetual futures funding rates are fairly even vs last month, but have increased slightly in the past week.

[

1434×914 124 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/b/7/b7687ba47ab228f26d514ad80e1d0e8aaf5a61f3.png)

Source: [Coinglass](https://www.coinglass.com/funding/BTC)

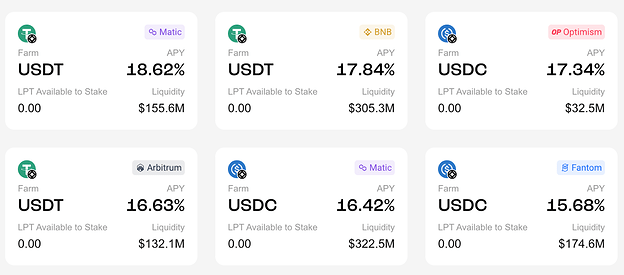

Bridge protocol Stargate Finance recently launched, and is offering high liquidity mining rewards on various stablecoins (no DAI pools offered for now). This may lead to additional borrowing demand at Maker as well as outflows from the USDC PSM. The USDC PSM peaked at 5,465,000,000 DAI on March 19 (shortly after farming began) before falling to the current level of 5,090,000,000 DAI (a decline of nearly 7%).

[

1600×704 155 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/6/0/606addd78a23b5d846001303ee0dbddd67c12033.png)

Source: [Stargate 1](https://stargate.finance/farm)

### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-31-march-2022/14347#proposed-changes-2)Proposed Changes

#### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-31-march-2022/14347#wbtc-a-reduce-stability-fee-to-325-3)WBTC-A: Reduce stability fee to 3.25%

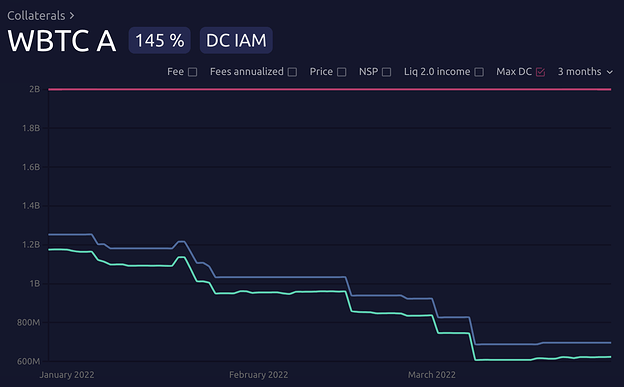

[

1492×924 51 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/2/b/2b5515fbbad051f22c81ad37c2d17ae9eda15dd9.png)

WBTC-A has seen significant outflows over the past months, likely due to the large borrowing cost difference vs ETH-A and WBTC collateralized borrowing costs on Aave. This stability fee reduction should help reverse this trend and make Maker vaults a more competitive option for WBTC backed leverage.

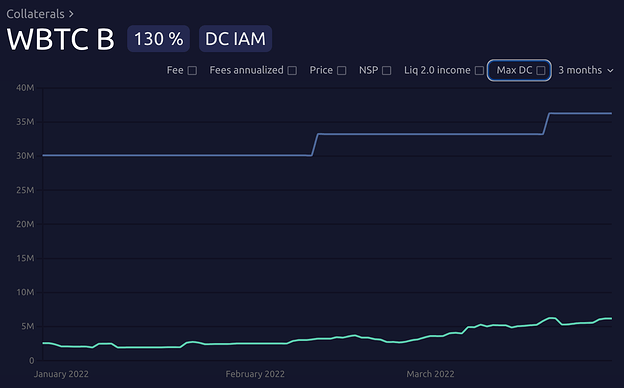

#### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-31-march-2022/14347#wbtc-b-reduce-stability-fee-to-45-4)WBTC-B: Reduce stability fee to 4.5%

[

1486×924 47.5 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/7/c/7c69ab89d4b439a1fedfc89c9fc2f0bf9c2a3e00.png)

This stability fee reduction is correlated with WBTC-A reduction, and will help grow usage of this vault type (which has remained relatively low since launch).

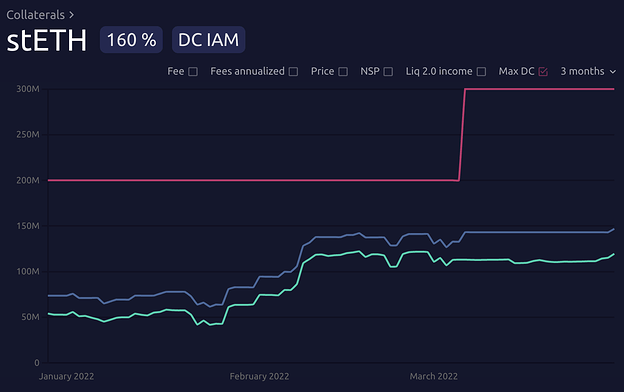

#### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-31-march-2022/14347#wsteth-a-reduce-stability-fee-to-225-5)WSTETH-A: Reduce stability fee to 2.25%

[

1480×930 51.3 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/2/1/21d05d8b685e04668c6cffd1c4346076a0e72db0.png)

Reducing WSTETH-A stability fee should help us maintain competitiveness with Aave (which has recently seen a large amount of stETH deposits) and attract new users as stETH total supply continues to increase.

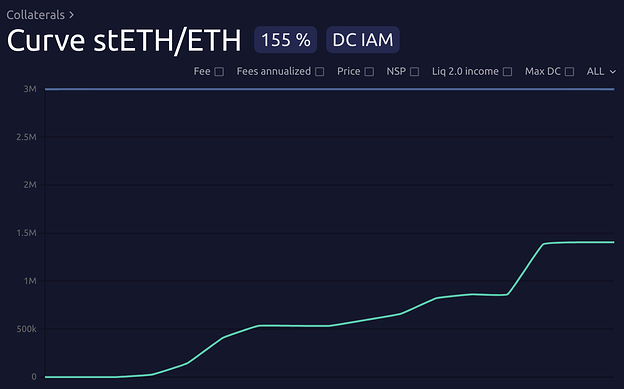

#### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-31-march-2022/14347#crvv1ethsteth-a-reduce-stability-fee-to-225-6)CRVV1ETHSTETH-A: Reduce stability fee to 2.25%

[

1480×922 40.8 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/a/9/a9fe5db40deff049f12cc97786e8bf0f0a628139.png)

This collateral type has similar risk profile to WSTETH-A (potentially even slightly less risky because roughly ½ of value is held in ETH), and earns slightly higher yield due to LDO and CRV rewards. Reducing borrowing costs could help us take market share on this collateral type from Abracadabra (the only other lender accepting this asset as collateral) without exposing Maker to excessive risk.

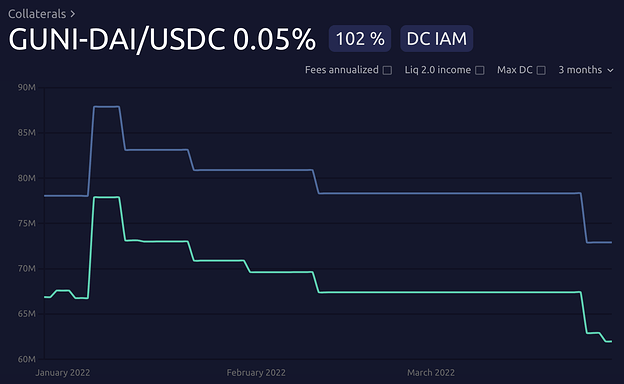

#### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-31-march-2022/14347#guniv3daiusdc1-a-reduce-stability-fee-to-0-increase-debt-ceiling-to-750m-and-increase-gap-to-50m-7)GUNIV3DAIUSDC1-A: Reduce stability fee to 0%, increase debt ceiling to 750M, and increase gap to 50M

[

1490×918 60.5 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/d/a/da177e7672544fa0b51577b869eed85ff7628b65.png)

This stability fee reduction only marginally impacts Maker's revenue, but should help significantly reduce exposure to USDC through the PSM. This improves Maker's centralization risk profile at very low cost. Gap and debt ceiling are increased in expectation of growing demand.

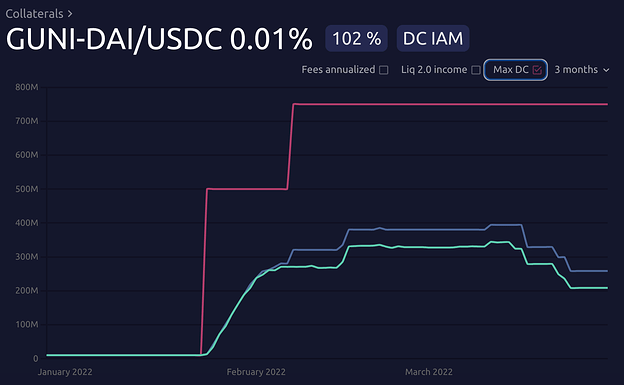

#### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-31-march-2022/14347#guniv2daiusdc2-a-reduce-stability-fee-to-005-and-increase-debt-ceiling-to-1b-8)GUNIV2DAIUSDC2-A: Reduce stability fee to 0.05% and increase debt ceiling to 1B

[

1494×924 68.5 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/2/0/2045f53a08e66b760c3a86aca4c10602cd27a969.png)

Similar to above, this stability fee reduction only marginally impacts revenue while improving centralization risk profile. Debt ceiling is being increased to accommodate potential increase in demand above the existing 750 million DAI debt ceiling.

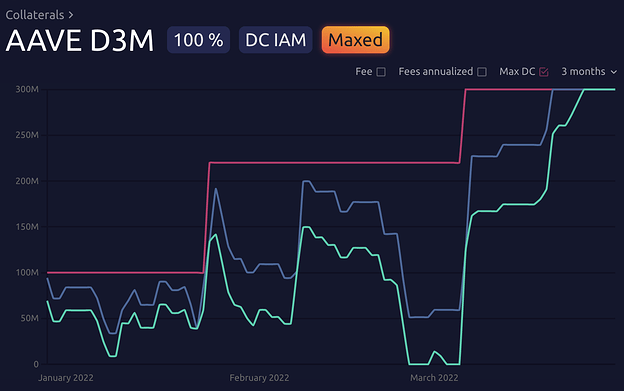

#### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-31-march-2022/14347#aave-d3m-increase-bar-to-35-9)AAVE D3M: Increase bar to 3.5%

[

1478×924 83.7 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/d/5/d551e92418defc8868028335afd93b9b81d2171e.png)

At the current bar of 2.85%, Maker's debt ceiling of 300M is being fully utilized which means we can't provide the benefit of borrowing rate stability (one of the benefits of D3M integration). This is also forcing down competitive borrowing rates and potentially reducing Maker's market share - this effect could increase due to previously mentioned changes in the Aave market which will increase ETH collateral deposit rates. Increasing the bar will help address these concerns, while also ensuring Maker adheres to the voter approved mandate of making up only 30% of real dai supplied and 0.5% maximum effective spread between Maker and Aave rates.

### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-31-march-2022/14347#proposal-impact-and-next-steps-10)Proposal Impact and Next Steps

The proposed changes, if confirmed, should reduce yearly revenue by about 6 million DAI (~8%), due to roughly 100M reduction in expected debt exposure to the Aave D3M as well as stability fee reductions on stETH and WBTC collateral types.

Proposed changes will be submitted for on chain voting next week.

### [](https://forum.makerdao.com/t/parameter-changes-proposal-ppg-omc-001-31-march-2022/14347#notes-11)Notes:

- Risk premiums and maximum debt ceilings are calculated based on recent market conditions

- Negative competitive rates are mostly due to liquidity mining rewards on Compound and Aave, as well as interest and rewards earned on deposited collateral

- Lending products are not standardized across defi and cefi lenders, and therefore rates can not be strictly compared on a like for like basis

</details></br>

### SourceCred

<details><summary>Delay in SourceCred Payments</summary><br>

[Link](https://forum.makerdao.com/t/delay-in-sourcecred-payments/13656)

SourceCred Distribution Delayed to Monday 2022-03-07 (at the earliest)

----------------------------------------------------------------------

This post is to update the community on the delay in SourceCred distributions. This is the first time GovAlpha is taking on the distributions and while we had the ability to send out payments today, we opted to delay until next week so that we can verify all 77 transactions properly.

Values displayed on [makerdao.sourcecred.io 22](http://makerdao.sourcecred.io/) should be accurate for this upcoming distribution, as our hold up is in verifying that the dispersement app we are using has compiled the data correctly.

Luckily we have our resident technical wizard [@hernandoagf](https://forum.makerdao.com/u/hernandoagf) working on creating a custom solution to check expected values from Gnosis Safe's transaction API.

#### [](https://forum.makerdao.com/t/delay-in-sourcecred-payments/13656#please-contact-me-prose11-if-this-payment-delay-is-causing-a-hardship-2)Please Contact me ([@prose11](https://forum.makerdao.com/u/prose11)) if this payment delay is causing a hardship.

It was not our intention to delay these payments, but we decided it was better to be safe than sorry during our inaugural run at owning SourceCred distributions. If there are reasonable mitigating actions we can take to make up for this inconvenience I am happy to do so.

</details></br>

<details><summary>SourceCred Bi-Weekly Happenings #2</summary><br>

[Link](https://forum.makerdao.com/t/sourcecred-bi-weekly-happenings-2/14201)

Hey, community! This is the short report on SourceCred's bi-weekly happenings with the latest news about what's been going on with SourceCred these last weeks!.

If you want to check our instance you can find it [here 3](https://makerdao.sourcecred.io/#/explorer). Navigate to the [DAI Accounts tab 6](http://makerdao.sourcecred.io/#/accounts) to see your current DAI balance and total DAI earned.

Haven't you signed up yet? For details on opting in, see [Opting in to Sourcecred/Wth is SourceCred?](https://forum.makerdao.com/t/opting-in-to-sourcecred-wth-is-sourcecred/3913/1).

If there is anything else you would like to see added please leave your comments below.

[](https://forum.makerdao.com/t/sourcecred-bi-weekly-happenings-2/14201#cred-stats-1)Cred Stats

-----------------------------------------------------------------------------------------------

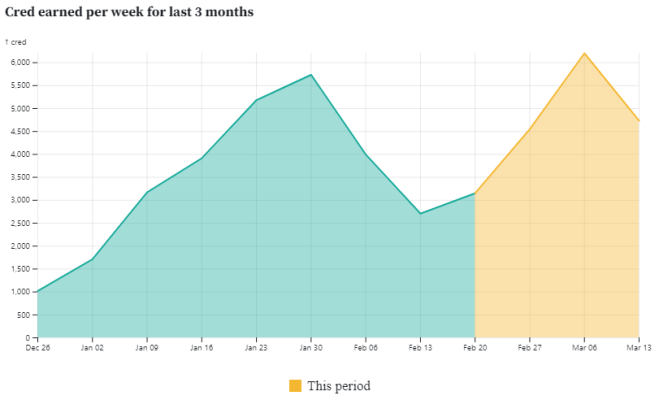

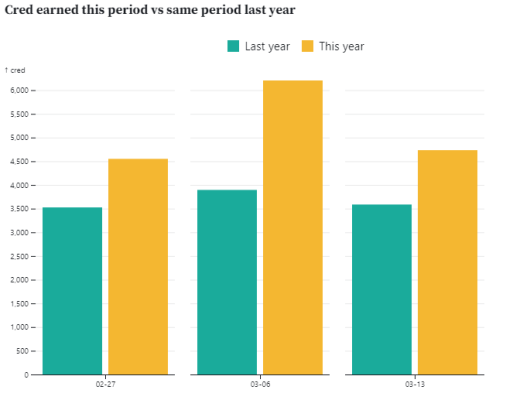

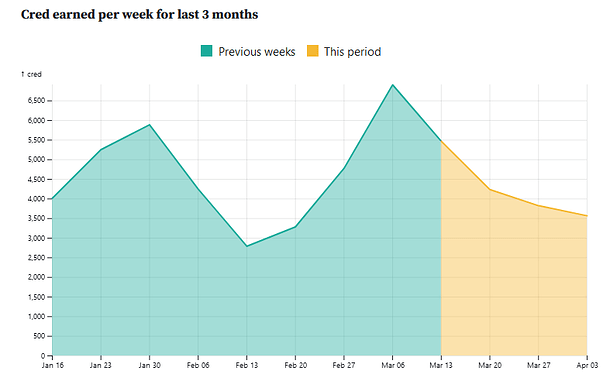

In the last few weeks, from March 1 to March 19, a total of 15,491 Cred have been generated with 131 topics and 1,275 publications created. As we can see in the two graphs below, the activity of these first weeks of March has been particularly intense. In the first graph we see how, after stabilizing in February, activity reaches its peak in early March, even higher than that observed during January after the December holidays. The second graph shows how the Cred accumulated in the period has been considerably higher than that accumulated in the same period last year.

Top 5 Categories

Below are the top 5 categories of the period, ranked by Cred generated.

| Cred | Categorie |

| --- | --- |

| 6478 | Governance |

| 4678 | MIPS - RFC |

| 2094 | Signal Requests |

| 1989 | Core Units - Sustainable Ecosystem Scaling |

| 1892 | Signal Archive |

Top Contributions

Below are the top 10 topics created, ranked by Cred generated. The cred minted in these top 10 topics was 14,196, that is, 91% of the total Cred for the period in the forum.

| Cred | Contribution | Author |

| --- | --- | --- |

| 1892 | [[Signal Request] Real World Asset Fast-Tracking](https://forum.makerdao.com/t/13563) | [@LongForWisdom](https://forum.makerdao.com/u/longforwisdom) |

| 1777 | [Aggressive Growth Strategy](https://forum.makerdao.com/t/13958) | [@hexonaut](https://forum.makerdao.com/u/hexonaut) |

| 1546 | [Ukraine Vault/Loan/War Bond Purchase Proposal](https://forum.makerdao.com/t/13529) | [@Allan_Pedersen](https://forum.makerdao.com/u/allan_pedersen) |

| 1497 | [What Core Units does the DAO need next](https://forum.makerdao.com/t/13594) | [@synesthesia](https://forum.makerdao.com/u/synesthesia) |

| 1495 | [Call for Responsible Budget and Process](https://forum.makerdao.com/t/13816) | [@Doo_Nam](https://forum.makerdao.com/u/doo_nam) |

| 1463 | [[Signal Request] Onboard D3M For Notional Finance](https://forum.makerdao.com/t/13782) | [@GFXlabs](https://forum.makerdao.com/u/gfxlabs) |

| 1433 | [stkMKR: Maker Staking and Tokenomics Revision](https://forum.makerdao.com/t/13890) | [@monet-supply](https://forum.makerdao.com/u/monet-supply) |

| 1109 | [MIP40c3-SP67: Modify Core Unit Budget - Strategic Happiness (SH-001)](https://forum.makerdao.com/t/13805) | [@aburban90](https://forum.makerdao.com/u/aburban90) |

| 1103 | [Hilo Oficial de Bienvenida](https://forum.makerdao.com/t/13566) | [@kat](https://forum.makerdao.com/u/kat) |

| 881 | [MIP39c2-SP32: Adding Events Core Unit (EVENTS-001)](https://forum.makerdao.com/t/13780) | [@PonJerry](https://forum.makerdao.com/u/ponjerry) |

Top Contributors

Below are the top 10 contributors of the period, ranked by Cred generated.

| Cred | Contributor |

| --- | --- |

| 610.8 | Doo-Nam |

| 535.2 | ElProgreso |

| 514.8 | luca-pro |

| 364.1 | psychonaut |

| 259.3 | ACREinvest |

| 239.7 | MadShills |

| 233.4 | Allan-Pedersen |

| 214.3 | aburban90 |

| 205.6 | MakerMan |

| 205.5 | Traster-Tray |

</details></br>

<details><summary>SourceCred Bi-Weekly Happenings #3</summary><br>

[Link](https://forum.makerdao.com/t/sourcecred-bi-weekly-happenings-3/14549)

Hey, community! This is a new report on SourceCred's bi-weekly happenings with the latest news about what's been going on with SourceCred!.In this opportunity, we want to summarize the last two weeks of March and the first week of April.

If you want to check our instance you can find it [here 4](https://makerdao.sourcecred.io/#/explorer).

Haven't you signed up yet? For details on opting in, see [Opting in to Sourcecred/Wth is SourceCred?](https://forum.makerdao.com/t/opting-in-to-sourcecred-wth-is-sourcecred/3913/1).

If there is anything else you would like to see added please leave your comments below.

[](https://forum.makerdao.com/t/sourcecred-bi-weekly-happenings-3/14549#announcements-1)Announcements

-----------------------------------------------------------------------------------------------------

March payouts are out! Please check your wallets and keep posting! This month 25.000 DAI was distributed based on Cred scores. Navigate to the [DAI Accounts tab 7](http://makerdao.sourcecred.io/#/accounts) of the Maker instance to see your current DAI balance and total DAI earned.

[](https://forum.makerdao.com/t/sourcecred-bi-weekly-happenings-3/14549#newcomers-2)Newcomers

---------------------------------------------------------------------------------------------

Please welcome [@FuchoCrypto](https://forum.makerdao.com/u/fuchocrypto) [@AliceinMKRland](https://forum.makerdao.com/u/aliceinmkrland) [@Muzza](https://forum.makerdao.com/u/muzza) [@Valen_Gayone](https://forum.makerdao.com/u/valen_gayone) and [@Piratical](https://forum.makerdao.com/u/piratical). They are our newest members within the program so if you see them out there don't forget to say hi!

[](https://forum.makerdao.com/t/sourcecred-bi-weekly-happenings-3/14549#cred-stats-3)Cred Stats

-----------------------------------------------------------------------------------------------

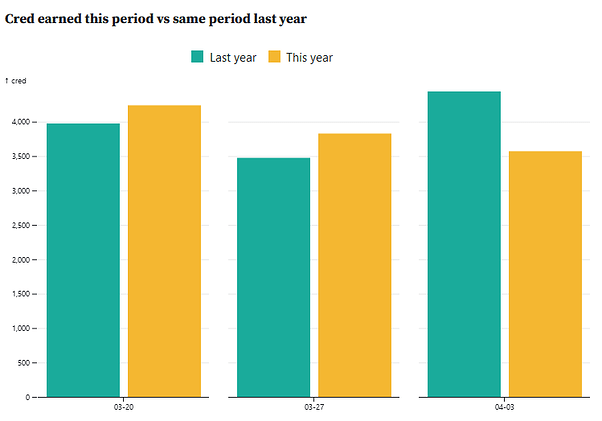

A total of 11.637 Cred have been generated in these three weeks, with 120 topics and 1217 posts created. As we can see in the first graph below, the activity has been steadily declining, approaching the values of mid-February, the lowest recorded so far this year. However, the second graph shows the similarities in production compared to the previous year, suggesting a certain seasonality in the levels of Cred generated.

[

778×501 24.3 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/1/9/19ac325beb09950f3ff5cac68c7ebc0fde6615b6.png)

[

749×525 11.5 KB

](https://makerdao-forum-backup.s3.dualstack.us-east-1.amazonaws.com/original/3X/8/5/8530acaa052ff2c9ef5fa5788160c69a2f0e68cb.png)

Top Contributions

Below are the top 10 topics created in the period, ranked by Cred generated. The Cred minted in these top 10 topics was 4,628, that is, 40% of the total cred for the period selected.

| Cred | Contribution | Author |

| --- | --- | --- |

| 693.41 | [The Maker Brand Team 1](https://forum.makerdao.com/t/the-maker-brand-team/14442) | [@MarianoDP](https://forum.makerdao.com/u/marianodp) |

| 619.45 | [MIP73: Pando Investment Grade Climate Assets Collateral Onboarding 1](https://forum.makerdao.com/t/mip73-pando-investment-grade-climate-assets-collateral-onboarding/14484) | [@Dori](https://forum.makerdao.com/u/dori) |

| 518 | [[Informal poll] Actions to increase competitiveness of ETH & stETH collateral 1](https://forum.makerdao.com/t/informal-poll-actions-to-increase-competitiveness-of-eth-steth-collateral/14090) | [@Frank_Brinkkemper](https://forum.makerdao.com/u/frank_brinkkemper) |

| 510.02 | [Ust update (Terra)](https://forum.makerdao.com/t/ust-update-terra/14230) | [@cryptenthusiastic](https://forum.makerdao.com/u/cryptenthusiastic) |

| 432.38 | [Moderating "Suspicious" Accounts 1](https://forum.makerdao.com/t/moderating-suspicious-accounts/14173) | [@prose11](https://forum.makerdao.com/u/prose11) |

| 392.2 | [Black Thursday It's still not too late 1](https://forum.makerdao.com/t/black-thursday-its-still-not-too-late/14231) | [@aburban90](https://forum.makerdao.com/u/aburban90) |

| 386.73 | [MIP4c2-SP19: MIP40 Budget Process Amendment 1](https://forum.makerdao.com/t/mip4c2-sp19-mip40-budget-process-amendment/14250) | [@adcv](https://forum.makerdao.com/u/adcv) |

| 385.87 | [MIP6: Huntingdon Valley Bank Loan Syndication Collateral Onboarding Application](https://forum.makerdao.com/t/mip6-huntingdon-valley-bank-loan-syndication-collateral-onboarding-application/14219) | [@maxglass](https://forum.makerdao.com/u/maxglass) |

| 379.47 | [Towards taking asset risks - A primer](https://forum.makerdao.com/t/towards-taking-asset-risks-a-primer/14265) | [@SebVentures](https://forum.makerdao.com/u/sebventures) |

| 310.57 | [Request for Definitive Description of Collateral Onboarding Process 1](https://forum.makerdao.com/t/request-for-definitive-description-of-collateral-onboarding-process/14330) | [@Katie](https://forum.makerdao.com/u/katie) |

Top Contributors

Below are the top 10 contributors of the period, ranked by Cred generated.

| Cred | Contributor |

| --- | --- |

| 423.85 | Doo-Nam |

| 333.67 | christiancdpetersen |

| 270.16 | ElProgreso |

| 260.34 | lollike |

| 225.17 | luca-pro |

| 222.12 | ACREinvesti |

| 217.37 | MakerMan |

| 160.77 | ultraschuppi |

| 148.94 | blimpa |

| 119.61 | mrabino1 |

</details></br>

---