# Kazakhstan E-commerce Market Analysis: The Emerging Digital Economy Powerhouse of Central Asia

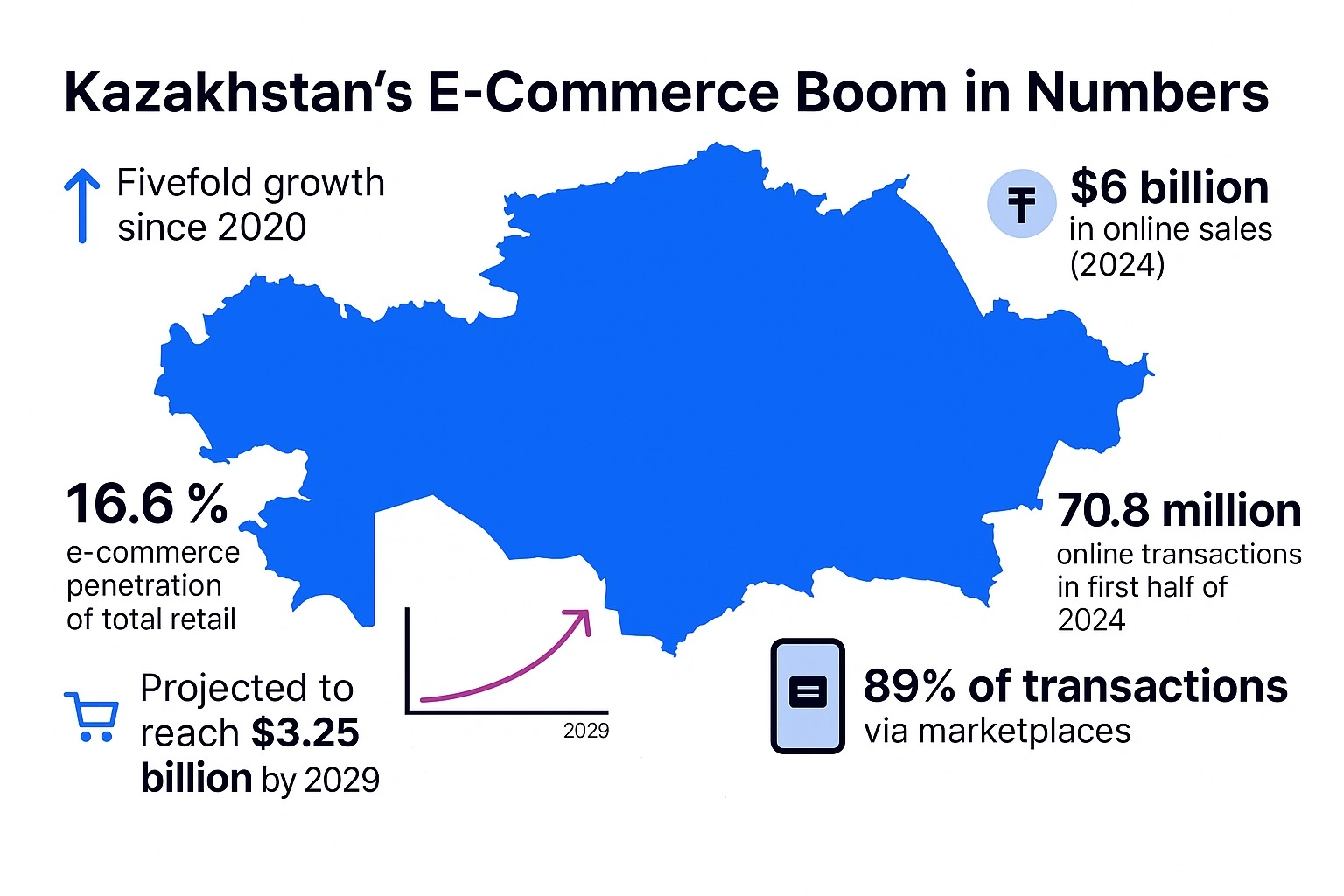

Kazakhstan, as Central Asia's largest economy, is experiencing unprecedented rapid growth in its e-commerce sector. According to the latest data, Kazakhstan's e-commerce market reached 3.44 trillion tenge (approximately \$7.3 billion) in 2024, representing a remarkable 42% growth from 2023 and a seven-fold increase over five years. This extraordinary growth rate not only exceeds the global average but also establishes Kazakhstan's leadership position in Central Asia's digital economy. The government has set ambitious targets to increase e-commerce's share of total retail trade to 20% by 2030, actively implementing digital transformation strategies to promote economic diversification and sustainable development.[^1][^2][^3]

## Market Size and Growth Dynamics

### Explosive Growth Trajectory

Kazakhstan's e-commerce market development has been remarkable. Starting from 476.7 billion tenge in 2020, the market size achieved seven-fold growth in just four years, reaching a historic high of 3.44 trillion tenge in 2024. This growth rate far exceeds the global average of 7.7%, with its share of total retail trade rapidly increasing from 4.3% in 2020 to 15.3% in 2024.[^1][^4]

哈薩克電子商務市場規模與份額增長趨勢,顯示市場在5年內的快速發展

The growth in transaction volume has been even more impressive. Online purchases reached 162 million transactions in 2024, an 87% increase from the previous year, while the average order value decreased to 21,200 tenge (approximately \$45), a 24% decline. This trend reflects e-commerce's deep integration into Kazakhstani daily life, with consumers making more frequent small-value online purchases, indicating the market's evolution toward maturity.[^1][^4]

### Seasonal Patterns and Market Maturity

Market data reveals distinct seasonal patterns, with the second half of the year typically accounting for 58% of annual sales, particularly strong growth in Q4. The third and fourth quarters of 2024 achieved 18% and 33% growth respectively, compensating for relatively slower growth in the first half. This seasonal trend aligns with global e-commerce market development patterns, reflecting the gradual maturation of consumer shopping habits.[^4]

Despite some deceleration in growth rates, Kazakhstan's e-commerce market maintains robust development momentum. Analysts believe this gradual slowdown represents a natural progression toward market maturity, consistent with global e-commerce development patterns.[^2][^4]

## Digital Infrastructure and Technology Environment

### Highly Digitalized Social Foundation

Kazakhstan possesses robust digital infrastructure supporting thriving e-commerce development. In 2024, the country achieved a 92.9% internet penetration rate with 19.2 million internet users. Mobile internet users number approximately 18 million, expected to increase by 1.7 million by 2029. Smartphone penetration reached 85%, establishing a solid foundation for mobile commerce development.[^5][^6][^7][^8][^9]

哈薩克數位基礎設施關鍵指標,展示該國在數位化方面的發展水準

The highly developed digital payment system is a key factor in Kazakhstan's e-commerce success. Cashless payments account for 86-89% of all transactions, with mobile banking usage at 82%, significantly exceeding Russia's 70%. This digital payment ecosystem's maturity ranks among global leaders, comparable to the most digitalized countries like Sweden (98%) and Singapore (97%).[^5][^10]

### Rapid Telecommunications Infrastructure Development

The government continues investing in telecommunications infrastructure. Fiber-optic network projects have connected over 1,200 rural settlements and 3,700 state institutions, adding more than 20,000 kilometers of new fiber-optic lines. 5G base stations cover 20 cities with 918 stations operational, achieving 65% 5G coverage in major cities.[^9][^11]

The World Bank approved a \$92.43 million "Digital Acceleration for Inclusive Economy Project" aimed at providing high-quality, climate-resilient broadband access to underserved areas in Kazakhstan, expected to benefit over 1 million people in rural regions.[^12]

## Major E-commerce Platform Landscape

### Local Leader Kaspi.kz's Super App Ecosystem

Kaspi.kz, as Kazakhstan's largest fintech and e-commerce platform, dominates the market with approximately 36% market share. The platform boasts 13.5 million monthly active users, representing roughly two-thirds of Kazakhstan's total population.[^3][^13][^14]

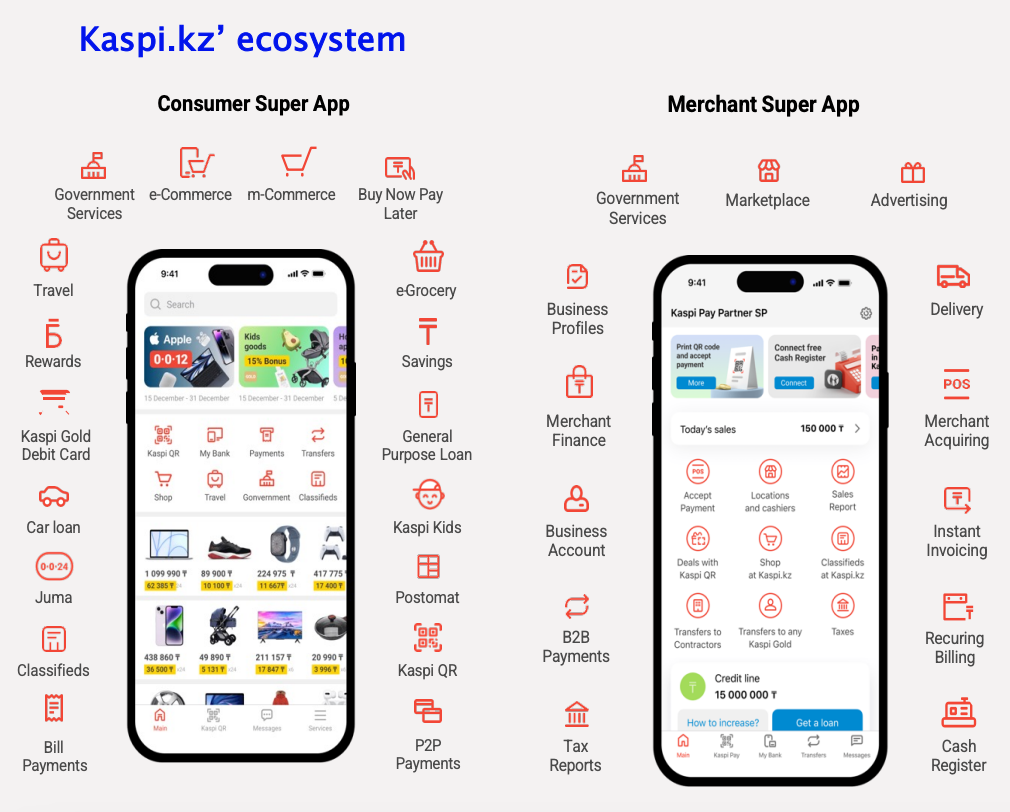

Kaspi.kz ecosystem showing diverse consumer and merchant fintech services including e-commerce and digital payments in Kazakhstan.

Kaspi.kz's success stems from its comprehensive super app ecosystem integrating three core businesses: payments, marketplace, and financial services. In 2024, the company's e-commerce revenue grew 85%, total revenue increased 32%, and net profit surged significantly. Platform users average 73 transactions monthly, demonstrating extremely high user engagement.[^13][^15]

Kaspi.kz mobile app showcasing e-commerce and fintech services in Kazakhstan

The platform also excels in logistics delivery, with Kaspi Delivery order volume growing 128% and capturing 50% of the e-commerce delivery market. Through its Postomat pickup locker network, it provides convenient last-mile delivery services.[^15]

### International Platform Competition

Russian e-commerce platforms hold important positions in Kazakhstan's market. Wildberries ranks second with approximately 17.2% market share, achieving \$614 million in sales in 2023, a 198% increase from the previous year. The platform operates 8 logistics centers in Kazakhstan with a total area of 44,000 square meters, constructing additional 271,000 square meters of warehouse facilities.[^16][^17][^18]

Ozon ranks third with approximately 8.5% market share, operating two sorting centers in Almaty and Astana totaling 42,000 square meters, with another 20,000 square meter distribution hub under construction in Almaty.[^17][^18]

哈薩克電子商務平台市場份額分佈,展示本地與國際平台的競爭格局

Chinese e-commerce platforms are rapidly emerging. Temu, since entering the Kazakhstan market in March 2024, quickly became the most downloaded shopping app on the App Store, capturing approximately 5% market share. Alibaba's AliExpress holds about 4% market share. These Chinese platforms are rapidly gaining market recognition through direct supplier partnerships and aggressive marketing strategies.[^19][^20]

## Consumer Behavior and Market Characteristics

### Evolution of Online Shopping Habits

Kazakhstani consumer online shopping behavior is rapidly maturing. A 2024 survey showed 28.5% of respondents had made online purchases, with the most popular product categories including clothing and footwear (62.1%), food products (49.1%), and cosmetics (32.7%).[^9]

Marketplace platforms continue dominating online sales, accounting for 91% of total retail e-commerce, up 2 percentage points from 2023. In contrast, independent online stores' market share declined to 9%. This trend reflects consumer preference for one-stop shopping platforms.[^4]

### Digital Payment Transformation

Widespread digital payment adoption is a key driver of e-commerce growth. In 2024, payments for goods and services through internet and mobile banking applications reached 62%, up significantly from 47% in 2023. QR code payments are also rapidly expanding, with over 8 million registered QR signatures and more than 18 million identity verifications through the Digital ID system.[^10][^21]

The average Kazakhstani holds 4 bank cards, exceeding Russia's 3 cards, demonstrating a highly developed financial services ecosystem. The instant payment system, launched in June 2022, processed 2.1 billion transactions in the first 8 months of 2024.[^5][^10]

## Policy Environment and Regulatory Framework

### Government Digitalization Strategy

The Kazakhstan government prioritizes e-commerce development, establishing ambitious digital transformation strategies. President Tokayev emphasized in his 2024 State of the Nation address that digitalization and artificial intelligence should be central to the national economic strategy.[^22][^23]

The government plans to increase e-commerce share to 20% by 2030, implementing the "Digital Qazaqstan" strategy to unify all national AI and digital initiatives. The newly established Ministry of AI will oversee new digital strategy implementation and big data usage in strategically important sectors.[^23]

### Legislative Development and Tax Policy

Kazakhstan is actively improving its e-commerce legal framework. The "E-commerce Development Plan" passed in April 2024 aims to improve online sales legislation, introduce e-commerce training courses nationwide, and establish fiscal support measures for entrepreneurs.[^24]

Tax regulation for foreign e-commerce platforms has become increasingly strict. Since 2022, foreign platforms must pay 12% VAT, with 105 foreign companies registered and collectively paying over 83 billion tenge in taxes. Major global platforms including Apple, Amazon, Google, Meta, TikTok, Netflix, Alibaba, and Temu have all completed registration.[^25]

### Consumer Protection

The government is strengthening e-commerce regulation to protect consumer rights. Proposed amendments to the "Consumer Rights Protection Law" will clarify e-commerce entity definitions and require online trading platforms to provide accurate seller and product information. Platforms violating regulations face administrative liability or account suspension.[^26][^27]

## Logistics Infrastructure Development

### Large-scale Warehouse Network Investment

Rapid e-commerce development has driven massive logistics infrastructure investment. National postal service QazPost is constructing modern warehouse complexes totaling 85,000 square meters in Almaty, Aktobe, Almaty region, and Turkestan region.[^18][^28]

Private enterprises are also heavily investing in logistics facilities. Wildberries has built 8 logistics centers totaling 44,000 square meters, constructing additional 271,000 square meters in Astana and Almaty. Ozon operates two sorting centers in Almaty and Astana totaling 42,000 square meters, with another 20,000 square meter facility under construction.[^18]

### Delivery Network Densification

Delivery networks are rapidly expanding to support e-commerce growth. Wildberries operates over 1,230 pickup points in Kazakhstan, concentrated in seven major cities: Almaty, Astana, Karaganda, Uralsk, Pavlodar, Kostanay, and Aktobe. Ozon operates approximately 790 pickup points.[^29]

QazPost serves as an infrastructure platform, collaborating with local and international players to provide nationwide e-commerce access. The company provides full-cycle services from warehousing to last-mile delivery for over 10,000 SMEs and major marketplace platforms.[^28]

## Cross-border E-commerce and International Cooperation

### Thriving China-Kazakhstan Cross-border E-commerce

Cross-border e-commerce has become an important driver of Kazakhstan's e-commerce growth. In the first 10 months of 2024, parcel volume from China increased 67% year-on-year, from 2.7 million to 4.5 million packages. Chinese e-commerce platforms like Temu and Pinduoduo are aggressively entering Kazakhstan through border crossings including Xinjiang's Khorgos and Alashankou.[^19][^30]

Khorgos, as a major border crossing between China and Kazakhstan, has attracted over 40 cross-border e-commerce enterprises to establish operations. From January to July 2024, cross-border e-commerce trade volume at this crossing reached 29.148 billion yuan, a year-on-year increase exceeding 814%. Business covers over 20 Eurasian countries and regions, with products spanning daily necessities, clothing, new energy products, and mechanical parts.[^30]

### Deepening Financial Services Cooperation

China-Kazakhstan cross-border payment cooperation is intensifying. In September 2024, Freedom Bank signed a cooperation memorandum with China UnionPay Business to develop China-Kazakhstan cross-border e-commerce wholesale trade and promote bilateral economic relations. The project will receive support from Xinhua News Agency's Advanced Industry Research Center and funding from subsidiaries of CITIC Industrial Fund.[^31][^32][^33]

This cooperation will establish a China-Kazakhstan e-commerce and digital economy settlement system, facilitating cross-border transactions. Analysts believe this will further promote digital trade development between the two countries.[^32][^33]

## Market Challenges and Development Bottlenecks

### Consumer Trust Requires Enhancement

Despite rapid e-commerce development, consumer trust remains an important factor constraining further growth. Government officials acknowledge that many consumers still prefer offline shopping due to online fraud and digital trust issues. Over 80% of consumers believe there's no necessity for online purchases, with 17% expressing loyalty to traditional physical stores.[^18][^34]

Cybersecurity risks are also significant challenges. Concerns about data breaches and online fraud affect consumer confidence in online transactions, requiring enhanced cybersecurity measures to protect businesses and consumers.[^35]

### Logistics Costs and Delivery Efficiency

High transportation and logistics costs remain major obstacles to e-commerce development. Due to Kazakhstan's landlocked geography, elevated logistics costs affect online product price competitiveness. Inefficient customs procedures also increase cross-border e-commerce costs and timeframes.[^35]

Currency exchange rate fluctuations create uncertainty and risks for cross-border e-commerce transactions, with businesses and consumers facing challenges in pricing and payments. This requires developing appropriate strategies to reduce currency-related risks.[^35]

### Urban-Rural Digital Divide

Despite high overall internet penetration, regions outside major cities show relatively limited e-commerce interest. Expanding e-commerce awareness and infrastructure coverage to rural and underdeveloped areas is crucial for achieving broader market coverage.[^35]

Professional talent shortage also constrains industry development. The lack of e-commerce specialists affects industry innovation and ability to adapt to market trends, requiring the establishment of a skilled workforce to support sustainable development.[^35]

## Future Development Prospects and Opportunities

### 2030 Development Goals

Kazakhstan has established ambitious e-commerce development goals. The government plans to increase e-commerce share of total retail trade to 20% by 2030, targeting a market size of 9.3 trillion tenge (approximately \$18.5 billion), nearly triple current levels.[^36][^37][^38]

Forecasts indicate that by 2029, each person will receive 27 packages annually, reaching developed country levels. This will promote growth in local businesses and cross-border trade, with international marketplace platforms' share reaching 19%.[^28]

### Technology Innovation's Driving Role

Applications of advanced technologies like AI and blockchain will further drive e-commerce development. The government has established an AI Development Committee and approved the 2024-2029 AI Development Concept. The newly established Alem.AI center will focus on cultivating specialists and developing AI startups.[^11][^21]

Generative AI applications in payments show broad prospects. Visa and Mastercard are utilizing AI to enhance fraud detection capabilities, while Stripe is integrating AI to optimize payment processing and improve transaction speeds. These innovations will further enhance e-commerce security and efficiency.[^39]

### Establishing Regional Hub Status

Kazakhstan is actively building itself as Central Asia's digital economy hub. Through the Caspian fiber-optic cable project, East-West superhighway construction, and data center development, Kazakhstan is strengthening its position in the global digital economy. Partnerships with international partners like Amazon Kuiper and Shanghai Aerospace Communications Satellite Technology will further enhance its technological capabilities.[^40]

Araltau city, as a future Singapore-style city, plans to attract foreign investment for digital projects and infrastructure construction, creating cryptocurrency investment and AI centers. Special economic zones have launched, planning to attract approximately 170 major projects related to cryptocurrency markets.[^23]

Key statistics illustrating Kazakhstan's booming e-commerce market and its future growth potential.

## Conclusions and Recommendations

Kazakhstan's e-commerce market demonstrates tremendous development potential and bright future prospects. Seven-fold growth in five years, highly developed digital payment infrastructure, strong government policy support, and strategic geographical location make Kazakhstan one of Central Asia's most attractive e-commerce markets.

Despite challenges including consumer trust, logistics costs, and the urban-rural digital divide, these issues are gradually being addressed through continued infrastructure improvements, regulatory framework refinement, and deepening international cooperation. Particularly, cooperation with China in cross-border e-commerce brings new growth momentum and development opportunities to the market.

For enterprises hoping to enter the Kazakhstan market, now is an excellent opportunity. We recommend focusing on mobile commerce applications, digital payment integration, localized services, and partnerships with major marketplace platforms. Companies should also closely monitor government policy developments and regulatory requirements to ensure compliant operations.

Looking ahead, with further proliferation of AI and 5G technologies, and advancement of the government's 2030 development goals, Kazakhstan's e-commerce market is poised to maintain strong growth, becoming an important digital trade hub connecting the Eurasian continent.

Modern skyline of Astana, Kazakhstan, emphasizing technological advancement and urban development.

<div align="center">⁂</div>

[^1]: https://qazinform.com/news/kazakhstans-e-commerce-market-hits-34-billion-tenge-in-2024-study-shows-c494d2

[^2]: https://www.pwc.com/kz/en/publications/e-commerce/pdf/e-commerce-6M2024-eng.pdf

[^3]: https://image.mfa.go.th/mfa/0/iyOJNVBddx/E-book/The_rise_of_e-commerce_in_Central_Asia.pdf

[^4]: https://www.pwc.com/kz/en/publications/e-commerce/pdf/e-commerce-12m2024-eng.pdf

[^5]: https://astanatimes.com/2025/08/kazakhstan-becomes-regional-fintech-leader-as-startups-quadruple/

[^6]: https://datareportal.com/reports/digital-2024-kazakhstan

[^7]: https://datareportal.com/reports/digital-2025-kazakhstan

[^8]: https://www.statista.com/topics/11604/internet-usage-in-kazakhstan/

[^9]: https://astanatimes.com/2025/04/kazakhstan-reports-high-digital-literacy-and-internet-usage/

[^10]: https://www.csis.org/analysis/building-digital-public-infrastructure-lessons-learned-kazakhstan

[^11]: https://astanatimes.com/2024/08/kazakhstan-reviews-progress-in-digitization-and-innovation-development-in-six-months/

[^12]: https://www.worldbank.org/en/news/press-release/2024/02/22/world-bank-to-help-expand-digital-infrastructure-for-underserved-areas-in-kazakhstan

[^13]: https://dcfmodeling.com/blogs/history/kspi-history-mission-ownership

[^14]: https://www.statista.com/statistics/1422756/top-e-commerce-platforms-by-traffic-kazakhstan/

[^15]: https://www.ainvest.com/news/kaspi-kz-digital-titan-path-dominance-central-asia-2505/

[^16]: https://www.statista.com/topics/10841/wildberries/

[^17]: https://english.news.cn/20250626/4c7a404ddef14013a913e8f5750c3f38/c.html

[^18]: https://astanatimes.com/2025/06/kazakhstan-sees-rapid-expansion-in-e-commerce-sector/

[^19]: https://kz.kursiv.media/en/2024-11-05/engk-yeri-chinese-e-commerce-giants-temu-and-pinduoduo-are-expanding-partnerships-with-kazakhstan/

[^20]: https://kz.kursiv.media/en/2024-12-19/engk-yeri-alibaba-to-be-taxed-in-kazakhstan/

[^21]: https://timesca.com/digital-kazakhstan-pioneering-e-government-innovation-amid-new-challenges/

[^22]: https://astanatimes.com/2025/09/kazakhstan-accelerates-digital-transformation-with-ai-blockchain-and-global-tech-ambitions/

[^23]: https://jamestown.org/program/kazakhstan-prioritizes-development-of-technological-innovation/

[^24]: https://primeminister.kz/en/news/marketplaces-from-abroad-to-be-regulated-in-kazakhstan-29575

[^25]: https://qazinform.com/news/foreign-marketplaces-paid-over-83-billion-tenge-to-kazakhstan-since-2022-163f97

[^26]: https://english.news.cn/asiapacific/20250531/7397048c567746b6a901ee875f2fec83/c.html

[^27]: https://vatabout.com/kazakhstan-vat-rules-for-foreign-e-commerce-firms-2026

[^28]: https://primeminister.kz/en/news/e-commerce-market-infrastructure-being-actively-developed-in-kazakhstan-29576

[^29]: https://kz.kursiv.media/en/2024-10-21/engk-tank-wildberries-continues-expanding-its-market-share-in-kazakhstan-despite-problems-in-russia-its-home-country/

[^30]: https://eng.yidaiyilu.gov.cn/p/087I8PQ3.html

[^31]: https://www.trend.az/business/finance/4086355.html

[^32]: https://finance.yahoo.com/news/china-kazakhstan-economic-cross-border-093000205.html

[^33]: https://www.freedomholdingcorp.com/news-media/press-releases/detail/84/freedom-bank-and-unionpay-business-forge-partnership-to

[^34]: https://www.statista.com/topics/11776/e-commerce-in-kazakhstan/

[^35]: https://www.cipeafrica.org/wp-content/uploads/2024/03/Market-Assessment_E-Commerce-in-Central-Asia_FULL-REPORT.pdf

[^36]: https://timesca.com/kazakhstan-targets-20-e-commerce-share-by-2030/

[^37]: https://astanatimes.com/2024/01/kazakhstan-plans-to-increase-e-commerce-share-to-20-by-2030/

[^38]: https://primeminister.kz/en/news/kazakhstan-plans-to-increase-share-of-e-commerce-to-20-by-2030-26975

[^39]: https://www.pwc.com/kz/en/publications/publication_assets/strategy-payments-july-2024-eng.pdf

[^40]: https://primeminister.kz/en/news/presidential-address-2024-how-kazakhstan-is-building-a-digital-ecosystem-30474