# The Best Solana Bots to Automate Your Crypto Game

As Solana continues to grow as one of the fastest and most affordable blockchains, more traders are turning to automated tools to get an edge. Trading bots, which can execute trades 24/7 without emotion or hesitation, are becoming a must-have for serious users of Solana’s DeFi ecosystem. Whether you’re looking to snipe new tokens, arbitrage across DEXs, or just automate your strategies, there’s probably a bot out there for you.

In this guide, we’ll walk through what Solana trading bots are, why they matter, and which ones are worth your attention right now.

## What is a Solana Trading Bot?

[A Solana trading bot](https://soltradingbots.io/) is a program that interacts directly with Solana-based decentralized exchanges (DEXs) like Jupiter, Raydium, or Orca to buy and sell tokens automatically. It uses predefined rules or real-time data to make decisions—no manual clicking, no staring at charts for hours.

Solana is a great fit for this kind of automation. Its fast transaction speed and near-zero gas fees make it ideal for bots that need to execute trades quickly and often. Most bots connect through Solana’s RPCs and use tools like Web3.js or Python SDKs, and some also integrate with Jupiter Aggregator to get the best swap routes.

Trading bots on Solana can serve a lot of purposes:

Sniping new token launches

Arbitrage between DEXs

Scalping small price moves

Market making with spread-based strategies

Portfolio rebalancing

Some bots require coding knowledge, while others offer no-code dashboards or Telegram integration for ease of use.

## Which Solana Trading Bot Should You Pick?

There’s no one-size-fits-all bot. The best option depends on what kind of trader you are, how hands-on you want to be, and how much risk you’re comfortable with. Let’s break down five popular bots in the Solana ecosystem right now.

### NOVA

NOVA is an advanced, user-friendly bot designed with snipers in mind. It lets users target new token launches the moment they hit the market. You can customize your slippage, max buy amount, and token filters, and NOVA will do the rest—often faster than any manual trader could ever react.

Key features:

Real-time sniping engine

Telegram-based control panel

Anti-rug protections (like auto-sell on blacklisting)

Wallet management tools

It’s a favorite among degens looking to get into low-cap tokens early. NOVA also offers stealth mode and auto-sell triggers, giving users more control over risk.

If you're the type who tracks presales or is always chasing alpha, NOVA’s probably your best bet.

### GMGN

GMGN Bot is more focused on providing a polished trading experience for casual users. It combines ease of use with a clean dashboard, allowing both beginners and experienced traders to interact with Solana tokens quickly.

What sets GMGN apart is its speed and multi-wallet support. It also integrates well with Jupiter for price aggregation, ensuring better swap prices.

Highlights:

Web-based UI and Telegram bot

Multi-wallet support

Quick token search and swapping

Great for everyday trading, not just sniping

GMGN is a solid all-around tool. If you’re not into the high-stakes sniping game and just want something stable to automate token buys or manage trades, GMGN strikes a good balance.

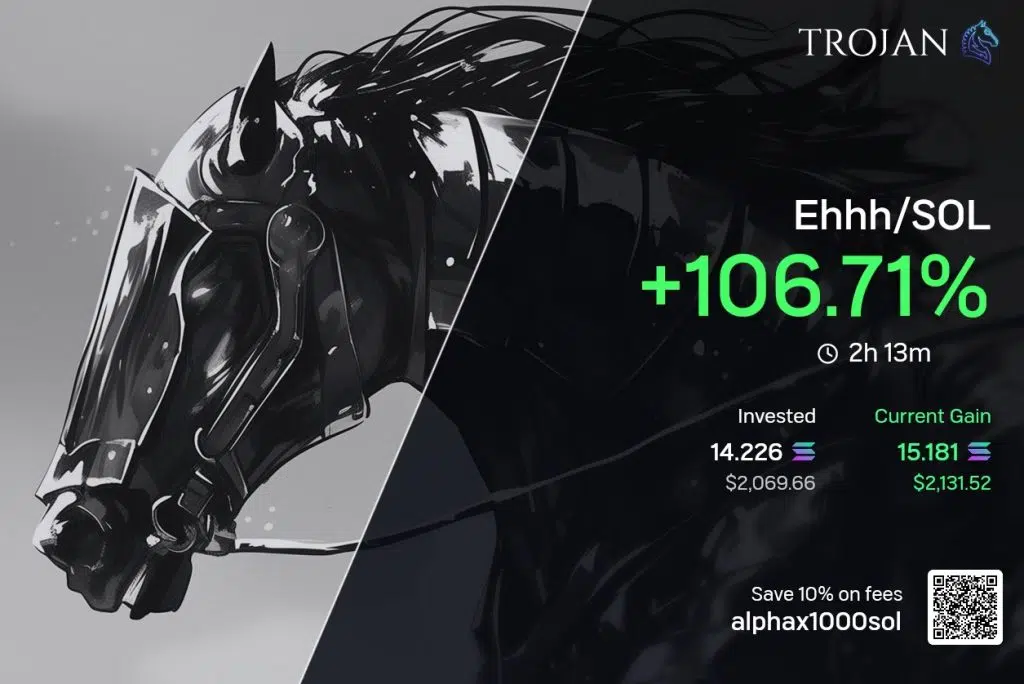

### Trojan

[Trojan Bot](https://soltradingbots.io/trading-bots/trojan-bot/) is a more aggressive tool tailored for hardcore snipers. Built with speed and stealth in mind, Trojan focuses on getting ahead of others during hyper-competitive launches.

Notable features include:

High-speed sniping with customizable presets

Pre-set slippage, gas, and buy/sell logic

Anti-mev and anti-bot detection tactics

Telegram integration

Trojan is also known for offering private RPC routing, which reduces delay during snipes—crucial when milliseconds matter. It’s less beginner-friendly than others, but if you’re comfortable tweaking settings and want raw speed, Trojan delivers.

### Bonkbot

Bonkbot blew up thanks to the BONK meme token craze but has since evolved into a legit trading tool with wide support across the Solana ecosystem. It combines simplicity with some advanced features under the hood.

Bonkbot has a very intuitive Telegram interface, making it super easy to use even for people new to bots. You just connect your wallet, and you’re ready to go.

Why people like it:

Lightning-fast buys/sells

Easy setup and user-friendly design

Real-time token price tracking

Built-in chart previews

Bonkbot is perfect for casual traders who want to act fast without needing to understand Solana’s backend mechanics. It doesn’t try to do too much—it just makes basic trading faster and easier.

### Tradewiz

Tradewiz is geared toward strategy-focused traders. It offers more customizable automation, letting you build complex logic like DCA (dollar-cost averaging), trailing stop losses, or portfolio rebalancing schedules.

Think of it more like a trading assistant than a pure sniper. You set your strategy, and Tradewiz handles execution.

Pros:

Strategy automation

Portfolio management features

Integrated risk control (stop loss, take profit)

Works with multiple DEXs and tokens

If you’re looking to treat your Solana portfolio like a system, Tradewiz is a great pick. It's less flashy than the sniping bots, but more powerful for long-term planning.

## Final Thoughts

Solana trading bots are changing the game for crypto traders. Whether you’re into chasing moonshots or building a smart, steady strategy, there’s a tool for you. NOVA and Trojan are your go-to if speed and sniping are the name of the game. GMGN and Bonkbot shine with simplicity and usability. And Tradewiz gives strategy traders the flexibility they need.

Just remember—bots don’t eliminate risk. They just make it easier to act on your strategy, whether that’s good or bad depends on how you use them.

Do your own research, start small, and always stay one step ahead of the market.